Question: please answer all, will upvote assp Fool Proof Software is considering a new project whose data are shown below. The equipment that. would be used

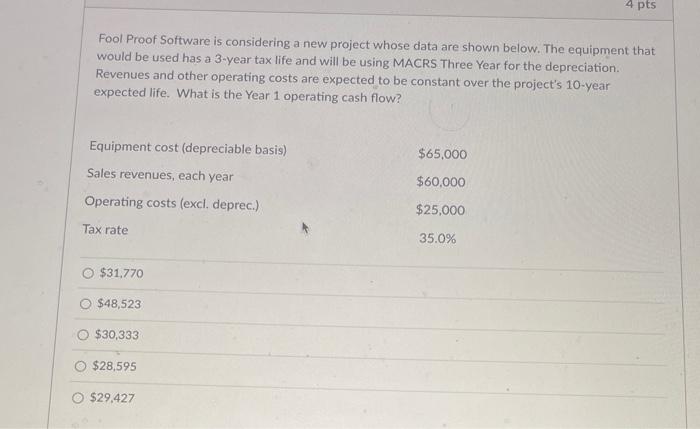

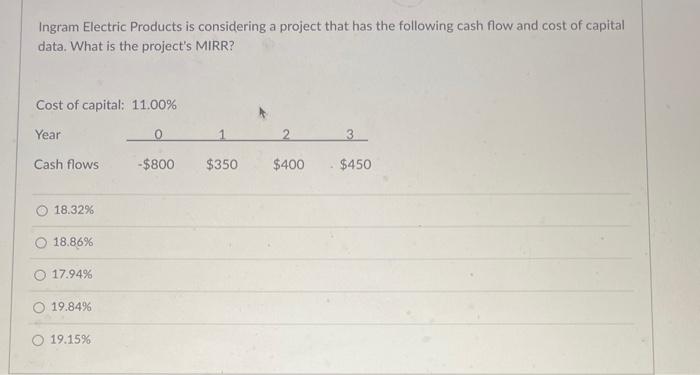

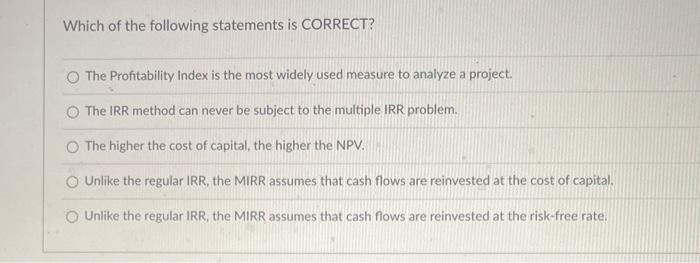

Fool Proof Software is considering a new project whose data are shown below. The equipment that. would be used has a 3-year tax life and will be using MACRS Three Year for the depreciation. Revenues and other operating costs are expected to be constant over the project's 10 -year expected life. What is the Year 1 operating cash flow? $31,770 $48,523 $30,333 $28,595 $29.427 Ingram Electric Products is considering a project that has the following cash flow and cost of capital data. What is the project's MIRR? Cost of capital: 11.00% 18.32% 18.86% 17.94% 19.84% 19.15% Which of the following statements is CORRECT? The Profitability Index is the most widely used measure to analyze a project. The IRR method can never be subject to the multiple IRR problem. The higher the cost of capital, the higher the NPV. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the cost of capital. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts