Question: PLEASE ANSWER ALL. WILL UPVOTE Suppose you are bearish (pessimistic) on GameLab stock and its market price is $84 per share. You sell short 500

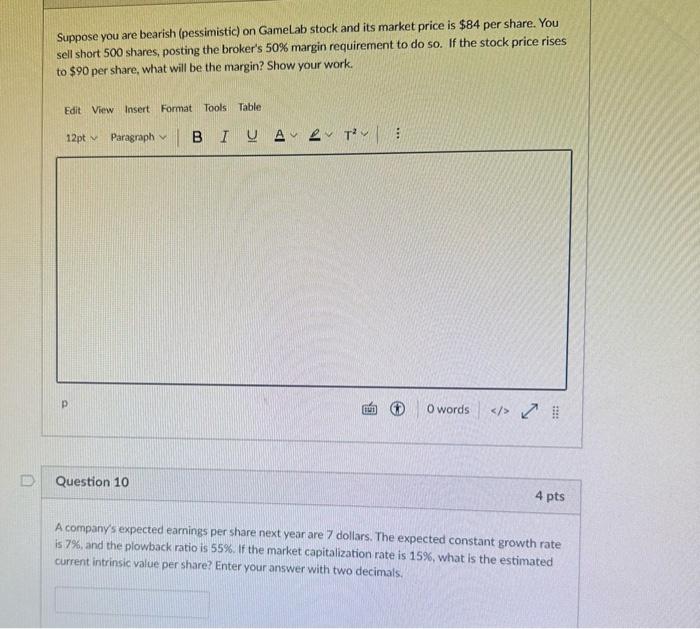

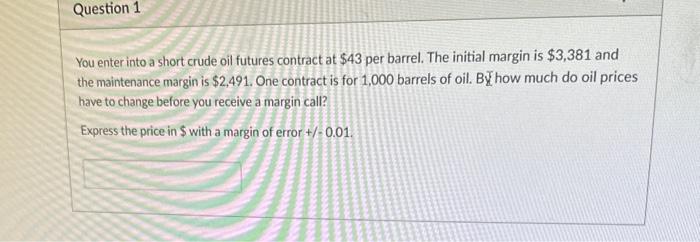

Suppose you are bearish (pessimistic) on GameLab stock and its market price is $84 per share. You sell short 500 shares, posting the broker's 50% margin requirement to do so. If the stock price rises to $90 per share, what will be the margin? Show your work. Question 10 4 pts A companys expected earnings per share next year are 7 dollars. The expected constant growth rate is 7%, and the plowback ratio is 55%. If the market capitalization rate is 15%, what is the estimated Current intrinsic value per share? Enter your answer with two decimals. You enter into a short crude oil futures contract at $43 per barrel. The initial margin is $3,381 and the maintenance margin is $2,491. One contract is for 1,000 barrels of oil. By. how much do oil prices have to change before you receive a margin call? Express the price in $ with a margin of error +/=0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts