Question: PLEASE ANSWER ALL!! WILL UPVOTE!! What is the IRR for a project with an initial investment of $180,000 that provides an annual cash inflow of

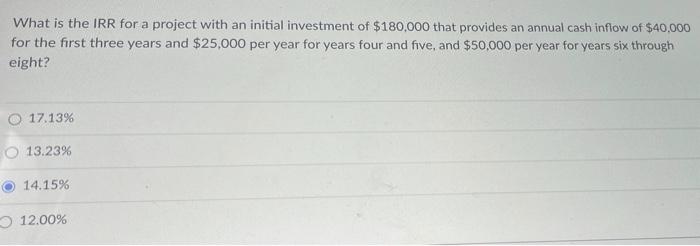

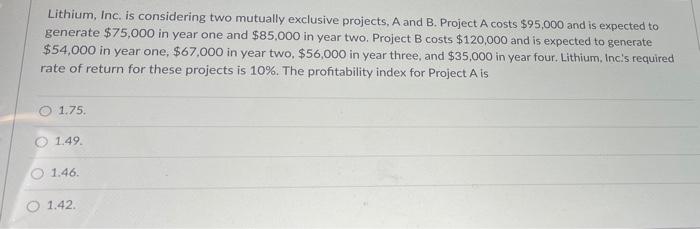

What is the IRR for a project with an initial investment of $180,000 that provides an annual cash inflow of $40,000 for the first three years and $25,000 per year for years four and five, and $50,000 per year for years six through eight? O 17.13% 13.23% 14.15% 12.00% Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95,000 and is expected to generate $75,000 in year one and $85,000 in year two. Project B costs $120,000 and is expected to generate $54,000 in year one, $67,000 in year two, $56,000 in year three, and $35,000 in year four. Lithium, Incs required rate of return for these projects is 10%. The profitability index for Project Ais O 1.75 @ 1.49. 1.46. O 1.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts