Question: please answer all wuestions , ty ! Review the attached financial statements and calculate the business financial ratios for 2007 only. ote: the company had

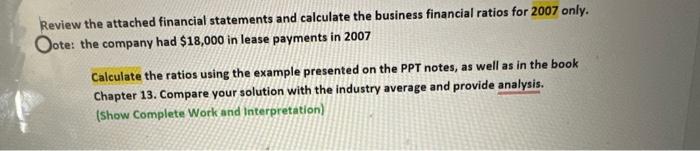

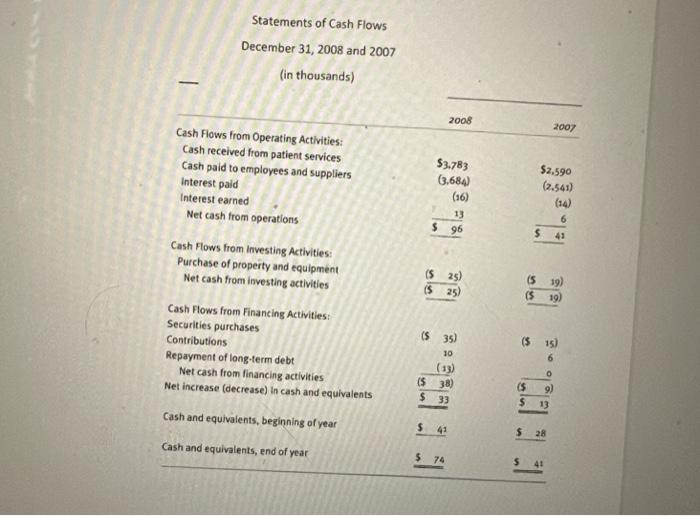

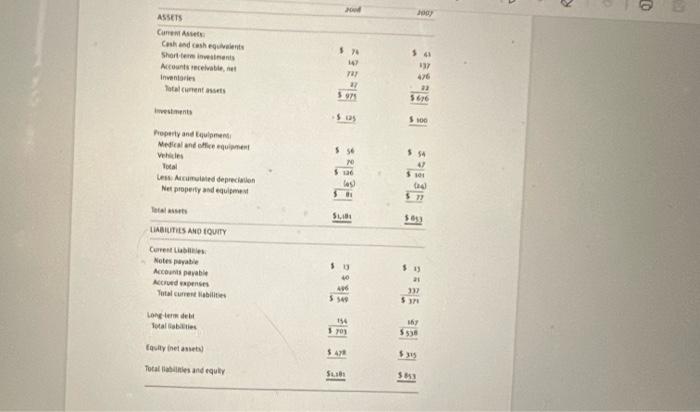

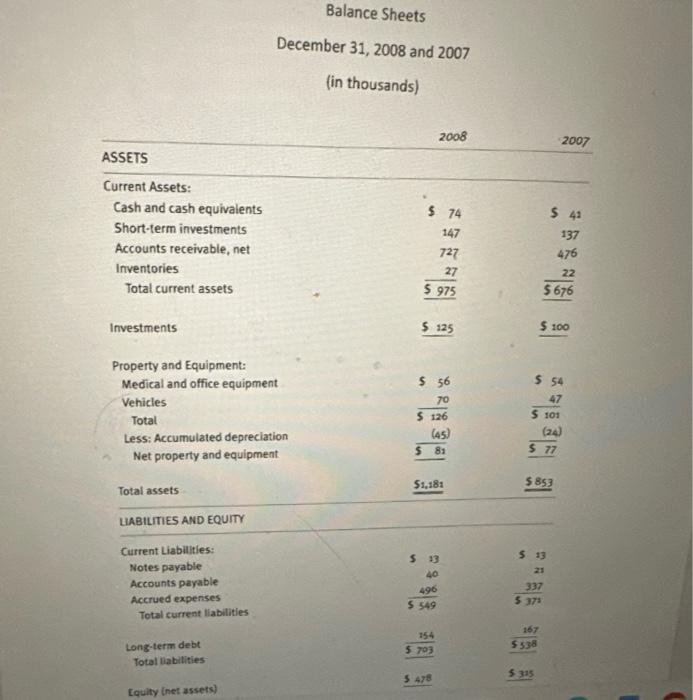

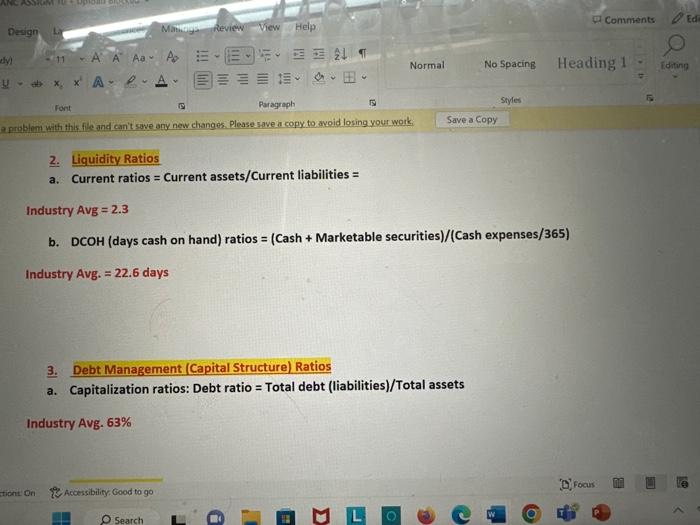

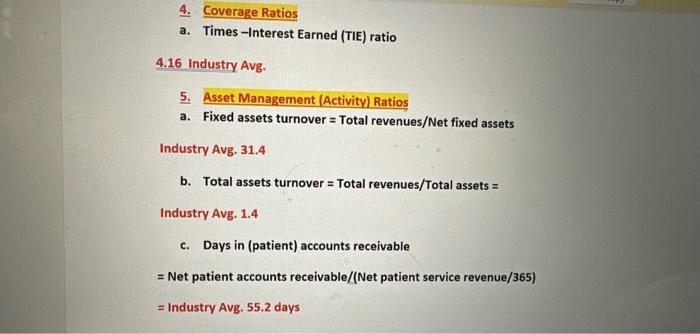

Review the attached financial statements and calculate the business financial ratios for 2007 only. ote: the company had $18,000 in lease payments in 2007 Calculate the ratios using the example presented on the PPT notes, as well as in the book Chapter 13. Compare your solution with the industry average and provide analysis. (Show Complete Work and Interpretation) Statements of Cash Flows December 31, 2008 and 2007 (in thousands) Balance Sheets December 31, 2008 and 2007 (in thousands) \begin{tabular}{lrr} & 2008 & 2007 \\ \hline ASSETS & & \\ \hline Current Assets: & 574 & 542 \\ Cash and cash equivalents & 147 & 137 \\ Short-term investments & 727 & 476 \\ Accounts receivable, net & 297527 & 5676 \\ Inventories & 5975 & 5100 \\ Total current assets & 525 & \end{tabular} Property and Equipment: Medical and office equipment 556554 VehiclesTotal56705126510147(24) Less: Accumulated depreciation Net property and equipment. Total assets 51,181 UABILITIES AND EQUITY Current Liabilities: Notes payable Accounts payable Accrued expenses Total current liabilities Long-term debt Total babilities Equity (net assets) 543405549496523235378397 AvB=2.3 4.16 Industry Avg. 5. Asset Management (Activity) Ratios a. Fixed assets turnover = Total revenues/Net fixed assets Industry Avg. 31.4 b. Total assets turnover = Total revenues/Total assets = Industry Avg. 1.4 c. Days in (patient) accounts receivable = Net patient accounts receivable/(Net patient service revenue/365) = Industry Avg. 55.2 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts