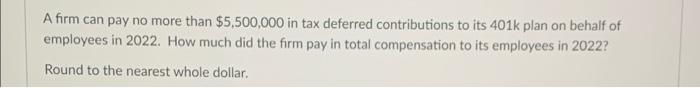

Question: please answer and explain thanks A firm can pay no more than $5,500,000 in tax deferred contributions to its 401k plan on behalf of employees

please answer and explain thanks

A firm can pay no more than $5,500,000 in tax deferred contributions to its 401k plan on behalf of employees in 2022. How much did the firm pay in total compensation to its employees in 2022? Round to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

It seems the image youve provided contains details that may help in answering the question regarding ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock