Question: please answer and explane , thank you in advance , 39) When a taxpayer contacts a tax advisor requesting advice as to the most advantageous

please answer and explane , thank you in advance ,

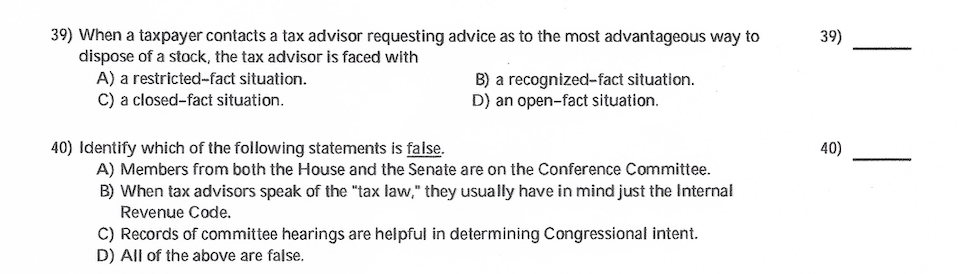

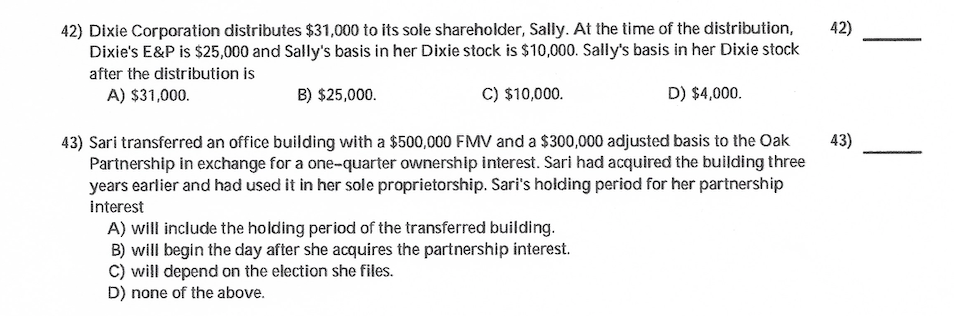

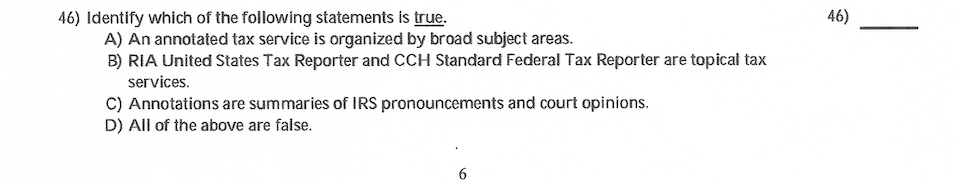

39) When a taxpayer contacts a tax advisor requesting advice as to the most advantageous way to dispoae of a stock. the tax advisor Is faced with A) a rammedfact situation. B) a recognizedfact sttuatlon. C) a closed-fact situation. D) an openfact situation. :10) Identify which of the foltowing statements Is false. A) Members from both the House and the Senate are on the Conference Committee. B} when tax advisers speak of the "tax law,' they usually have in mind just the Internal Retienue Code. C} Records of committee hearings are hetpful in determining Congressional intent. D) All of the above are false. 39) 40) 42) Dixie Corporation distributes $31,000 to Its sole shareholder. Sally. At the time of the distribution. Dixie's E&P is $25000 and Sally's basis in her Dixie stock is $10,000. Sally's basis In her Dixie stock after the distribution Is A) $31,000. B) $25,000. C) $10,000. D) $4,000. 43} Sari transferred an office building with 3 3500.000 FMV and a $300,000 adiustecl basis to the Oak Partnership In exchange for a onequarter ownership interest. Sari had acquired the hulldlng three years earlier and had used It in her sole proprietorship. Sari's holding period for her partnership Interest A) will include the holding period of the transferred building. B) will begin the day after she acquires the partnership interest. C} will depend on the election she files. D) none of the above. 42} 43) 46) Identify which of the following statements is true. 46) A) An annotated tax service is organized by broad subject areas. B) RIA United States Tax Reporter and CCH Standard Federal Tax Reporter are topical tax services. C) Annotations are summaries of IRS pronouncements and court opinions. D) All of the above are false. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts