Question: please answer and provide explanation for both questions, its part of the same problem.Thank you in advance. Quattro Technologies, a hydraulic manufacturer in the aeronautics

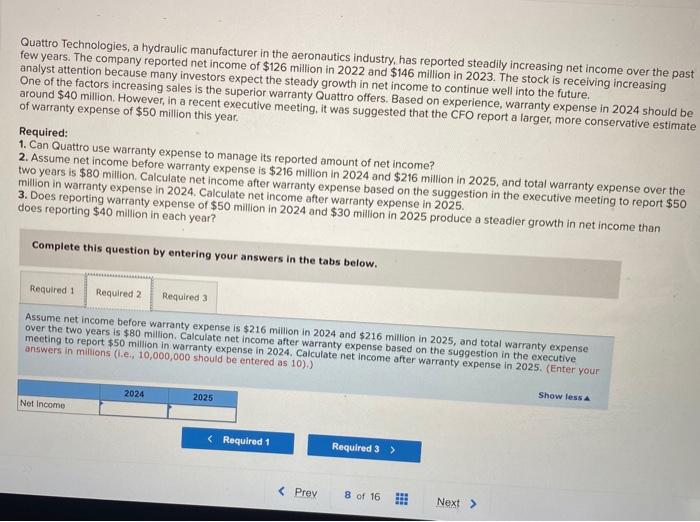

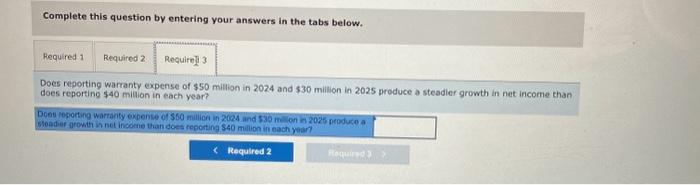

Quattro Technologies, a hydraulic manufacturer in the aeronautics industry, has reported steadily increasing net income over the past few years. The company reported net income of $126 million in 2022 and $146 million in 2023 . The stock is receiving increasing analyst attention because many investors expect the steady growth in net income to continue well into the future. One of the factors increasing sales is the superior warranty Quattro offers. Based on experience, warranty expense in 2024 should be of warranty expense of $50 million this year. Required: 1. Can Quattro use warranty expense to manage its reported amount of net income? 2. Assume net income before warranty expense is $216 million in 2024 and $216 million in 2025, and total warranty expense over the two years is $80 million. Calculate net income after warranty expense based on the suggestion in the executive meeting to report $50 3. Does reporting warranty expense of $50 million in 2024 anter warranty expense in 2025. does reporting $40 million in each year? Complete this question by entering your answers in the tabs below. Assume net income before warranty expense is $216 million in 2024 and $216 million in 2025 , and total warranty expense over the two years is $80 milion. Calculate net income after warranty expense based on the suggestion in the executive answers in millions (i.e., 10,000,000 should be entered as 10).) Complete this question by entering your answers in the tabs below. Does reporting warranty expense of $50 milion in 2024 and $30 milion in 2025 produce a steadier growth in net income than does reporting $40 milion in each year? Shoadiar arowth ir net incone than does reporting $40 mallion in each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts