Question: please answer as fast as possible 3. A company purchased a $60,000 asset with an estimated life of 4 years and expected salvage value of

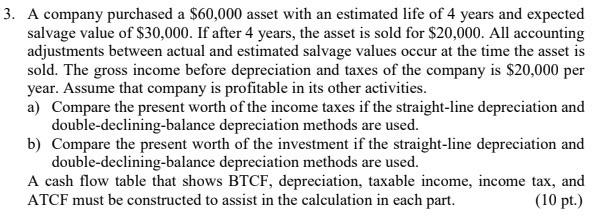

3. A company purchased a $60,000 asset with an estimated life of 4 years and expected salvage value of $30,000. If after 4 years, the asset is sold for $20,000. All accounting adjustments between actual and estimated salvage values occur at the time the asset is sold. The gross income before depreciation and taxes of the company is $20,000 per year. Assume that company is profitable in its other activities. a) Compare the present worth of the income taxes if the straight-line depreciation and double-declining-balance depreciation methods are used. b) Compare the present worth of the investment if the straight-line depreciation and double-declining-balance depreciation methods are used. A cash flow table that shows BTCF, depreciation, taxable income, income tax, and ATCF must be constructed to assist in the calculation in each part. (10 pt.) 3. A company purchased a $60,000 asset with an estimated life of 4 years and expected salvage value of $30,000. If after 4 years, the asset is sold for $20,000. All accounting adjustments between actual and estimated salvage values occur at the time the asset is sold. The gross income before depreciation and taxes of the company is $20,000 per year. Assume that company is profitable in its other activities. a) Compare the present worth of the income taxes if the straight-line depreciation and double-declining-balance depreciation methods are used. b) Compare the present worth of the investment if the straight-line depreciation and double-declining-balance depreciation methods are used. A cash flow table that shows BTCF, depreciation, taxable income, income tax, and ATCF must be constructed to assist in the calculation in each part. (10 pt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts