Question: Please answer as much as possible or let me know if more information is needed. I have attached the prompt, thank you. Congratulations! You've decided

Please answer as much as possible or let me know if more information is needed. I have attached the prompt, thank you.

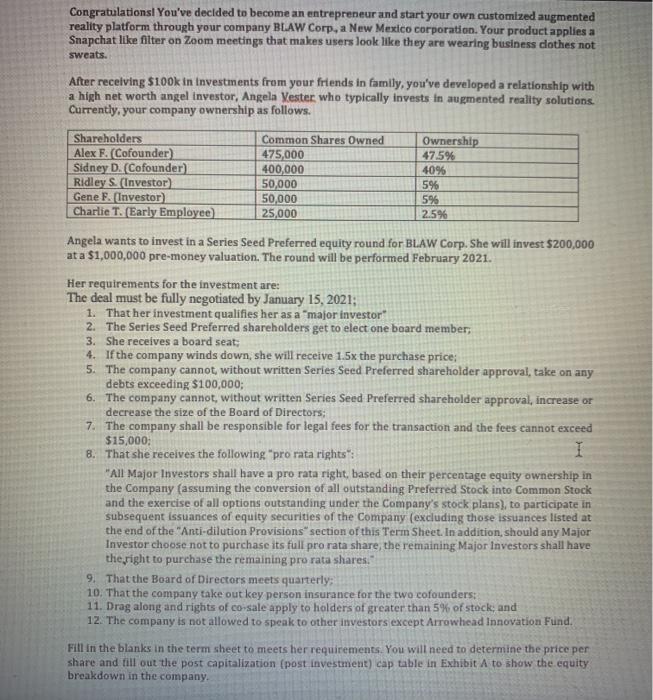

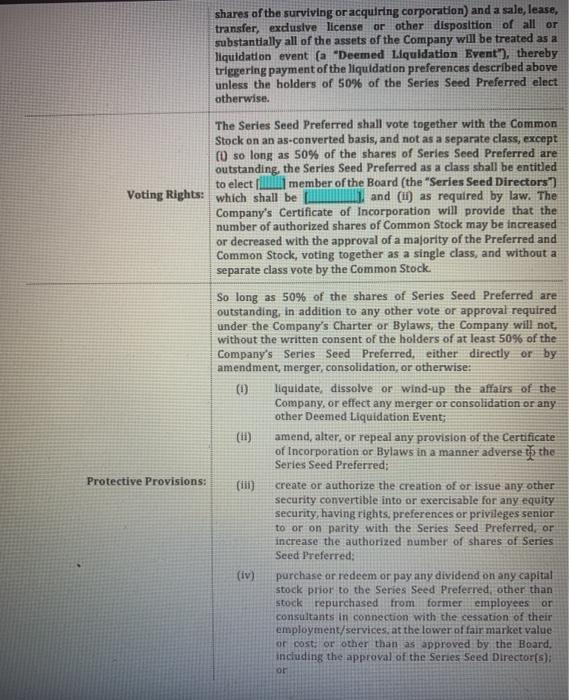

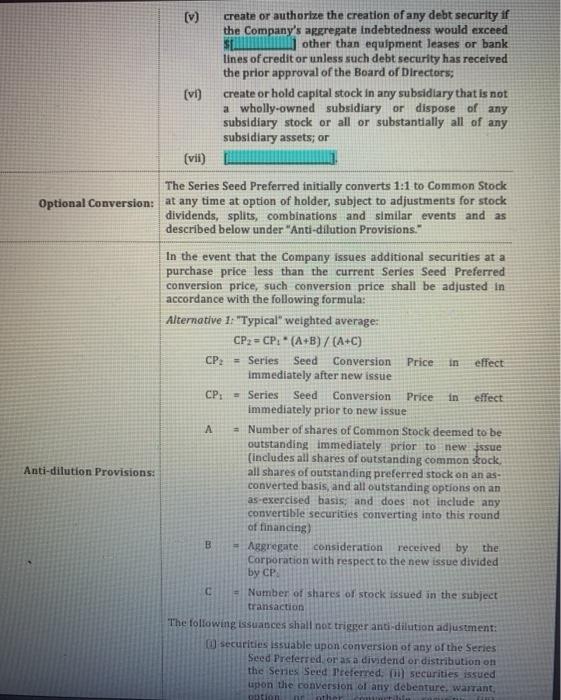

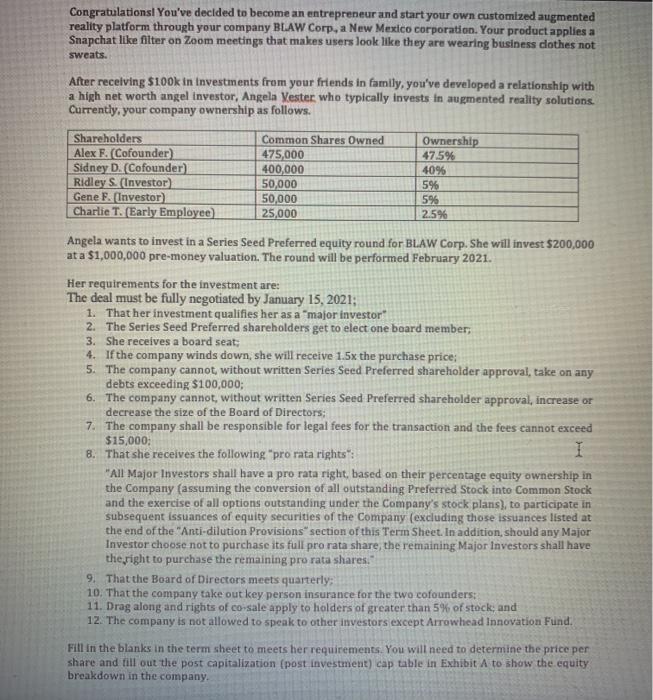

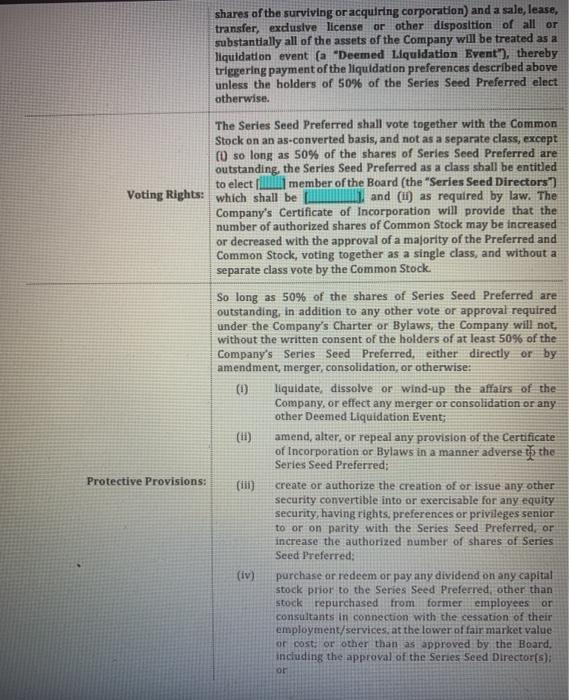

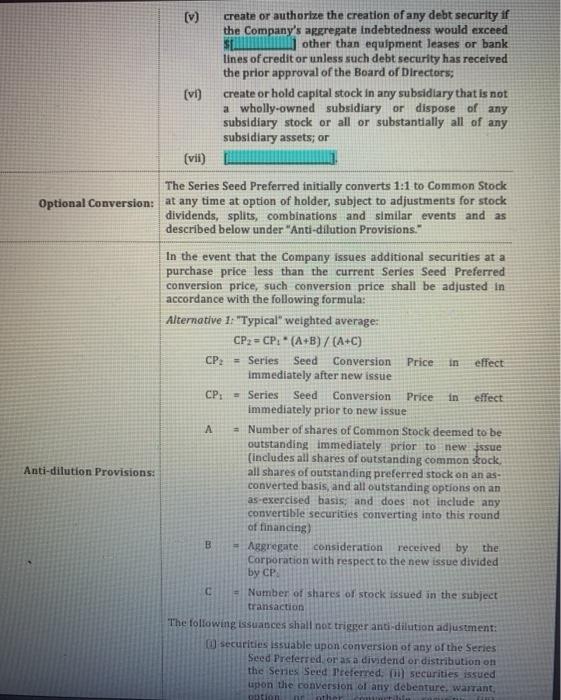

Congratulations! You've decided to become an entrepreneur and start your own customized augmented reality platform through your company BLAW Corp, a New Mexico corporation. Your product applies a Snapchat like filter on Zoom meetings that makes users look like they are wearing business clothes not sweats. After receiving $100k in Investments from your friends in family, you've developed a relationship with a high net worth angel investor, Angela Vester who typically invests in augmented reality solutions Currently, your company ownership as follows. Shareholders Alex F. Cofounder) Sidney D. (Cofounder) Ridley S. (Investor) Gene F. (Investor Charlie T. (Early Employee Common Shares Owned 475,000 400,000 50,000 50,000 25,000 Ownership 47.5% 40% 5% 596 2.5% Angela wants to invest in a Series Seed Preferred equity round for BLAW Corp. She will invest $200,000 at a $1,000,000 pre-money valuation. The round will be performed February 2021. Her requirements for the investment are: The deal must be fully negotiated by January 15, 2021; 1. That her investment qualifies her as a major investor 2. The Series Seed Preferred shareholders get to elect one board member; 3. She receives a board seat; 4. If the company winds down, she will receive 1.5x the purchase price; 5. The company cannot, without written Series Seed Preferred shareholder approval, take on any debts exceeding $100,000; 6. The company cannot, without written Series Seed Preferred shareholder approval, increase or decrease the size of the Board of Directors: 7. The company shall be responsible for legal fees for the transaction and the fees cannot exceed $15,000 8. That she receives the following "pro rata rights": 1 "All Major Investors shall have a pro rata right, based on their percentage equity ownership in the Company (assuming the conversion of all outstanding Preferred Stock into Common Stock and the exercise of all options outstanding under the Company's stock plans), to participate in subsequent issuances of equity securities of the Company (excluding those issuances listed at the end of the "Anti-dilution Provisions' section of this Term Sheet. In addition, should any Major Investor choose not to purchase its full pro rata share the remaining Major investors shall have the right to purchase the remaining pro rata shares." 9. That the Board of Directors meets quarterly: 10. That the company take out key person insurance for the two cofounders: 11. Drag along and rights of co-sale apply to holders of greater than 5% of stock and 12. The company is not allowed to speak to other investors except Arrowhead Innovation Fund. Fill in the blanks in the term sheet to meets her requirements. You will need to determine the price per share and fill out the post capitalization (post investment) cap table in Exhibit A to show the equity breakdown in the company. shares of the surviving or acquiring corporation) and a sale, lease, transfer, exdusive license or other disposition of all or substantially all of the assets of the Company will be treated as a liquidation event (a "Deemed Liquidation Event"), thereby triggering payment of the liquidation preferences described above unless the holders of 50% of the Series Seed Preferred elect otherwise. The Series Seed Preferred shall vote together with the Common Stock on an as-converted basis, and not as a separate class, except (0 so long as 50% of the shares of Series Seed Preferred are outstanding, the Series Seed Preferred as a class shall be entitled to electia member of the Board (the "Series Seed Directors) Voting Rights: which shall be and (Las required by law. The Company's Certificate of Incorporation will provide that the number of authorized shares of Common Stock may be increased or decreased with the approval of a majority of the Preferred and Common Stock, voting together as a single class, and without a separate class vote by the Common Stock. So long as 50% of the shares of Series Seed Preferred are outstanding, in addition to any other vote or approval required under the Company's Charter or Bylaws, the Company will not without the written consent of the holders of at least 50% of the Company's Series Seed Preferred, either directly or by amendment, merger, consolidation, or otherwise: (1) liquidate, dissolve or wind-up the affairs of the Company, or effect any merger or consolidation or any other Deemed Liquidation Event; amend, alter, or repeal any provision of Certificate of Incorporation or Bylaws in a manner adverse to the Series Seed Preferred; Protective Provisions: (111) create or authorize the creation of or issue any other security convertible into or exercisable for any equity security, having rights, preferences or privileges senior to or on parity with the Series Seed Preferred or increase the authorized number of shares of Series Seed Preferred: purchase or redeem or pay any dividend on any capital stock prior to the Series Seed Preferred other than stock repurchased from former employees or consultants in connection with the cessation of their employment/services at the lower of fair market value or cost: or other than as approved by the Board, including the approval of the Series Seed Director(s): (iv) or (v) create or authorize the creation of any debt security if the Company's aggregate indebtedness would exceed other than equipment leases or bank lines of credit or unless such debt security has received the prior approval of the Board of Directors; create or hold capital stock in any subsidiary that is not a wholly-owned subsidiary or dispose of any subsidiary stock or all or substantially all of any subsidiary assets; or (v1) (vii) In The Series Seed Preferred initially converts 1:1 to Common Stock Optional Conversion: at any time at option of holder, subject to adjustments for stock dividends, splits, combinations and similar events and as described below under "Anti-dilution Provisions." In the event that the Company issues additional securities at a purchase price less than the current Series Seed Preferred conversion price, such conversion price shall be adjusted in accordance with the following formula: Alternative 1. Typical weighted average: CP2 = CP. * (A+B)/(A+C) CP = Series Seed Conversion Price effect immediately after new issue CP; - Series Seed Conversion Price in effect immediately prior to new issue - Number of shares of Common Stock deemed to be outstanding immediately prior to new issue (includes all shares of outstanding common stock Anti-dilution Provisions: all shares of outstanding preferred stock on an as- converted basis, and all outstanding options on an as-exercised basis, and does not include any convertible securities converting into this round of financing) B Aggregate consideration received by the Corporation with respect to the new issue divided by CP = Number of shares of stock issued in the subject transaction The following issuances shall not trigger anti-dilution adjustment: securities issuable upon conversion of any of the Series Seed Preferred, or as a dividend or distribution on the Series Seed Preferred, ii) securities issued upon the conversion of atiy debenture, warrant option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock