Question: Congratulations! You've decided to become an entrepreneur and start your own customized augmented reality platform through your company BLAW Corp, a New Mexico corporation.

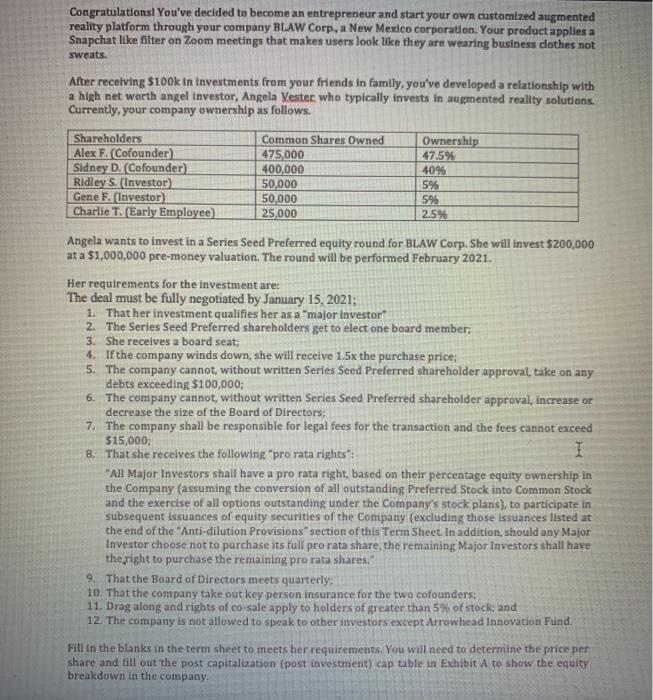

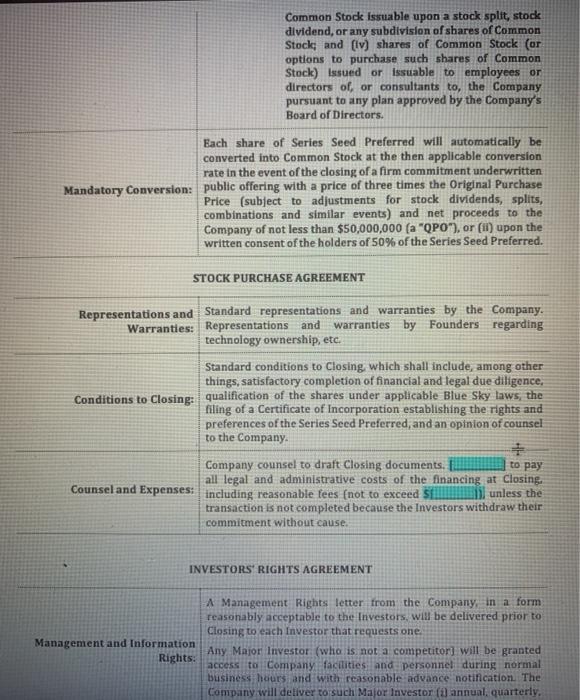

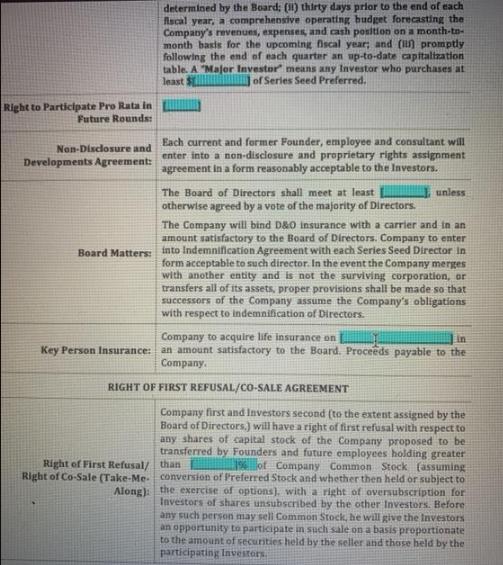

Congratulations! You've decided to become an entrepreneur and start your own customized augmented reality platform through your company BLAW Corp, a New Mexico corporation. Your product applies a Snapchat like filter on Zoom meetings that makes users look like they are wearing business clothes not sweats. After receiving $100k in investments from your friends in family, you've developed a relationship with a high net worth angel investor, Angela Vester who typically invests in augmented reality solutions. Currently, your company ownership as follows. Shareholders Alex F. (Cofounder) Sidney D. (Cofounder) Ridley S. (Investor) Gene F. (Investor) Charlie T. (Early Employee) Common Shares Owned 475,000 400,000 50,000 50,000 25,000 Ownership 47.5% 40% 5% 5% 2.5% Angela wants to invest in a Series Seed Preferred equity round for BLAW Corp. She will invest $200,000 at a $1,000,000 pre-money valuation. The round will be performed February 2021. Her requirements for the investment are: The deal must be fully negotiated by January 15, 2021; 1. That her investment qualifies her as a "major investor 2. The Series Seed Preferred shareholders get to elect one board member, 3. She receives a board seat; 4. If the company winds down, she will receive 1.5x the purchase price; 5. The company cannot, without written Series Seed Preferred shareholder approval, take on any debts exceeding $100,000; 6. The company cannot, without written Series Seed Preferred shareholder approval, increase or decrease the size of the Board of Directors; 7. The company shall be responsible for legal fees for the transaction and the fees cannot exceed $15,000; 8. That she receives the following "pro rata rights": I "All Major Investors shall have a pro rata right, based on their percentage equity ownership in the Company (assuming the conversion of all outstanding Preferred Stock into Common Stock and the exercise of all options outstanding under the Company's stock plans), to participate in subsequent issuances of equity securities of the Company (excluding those issuances listed at the end of the "Anti-dilution Provisions" section of this Term Sheet. In addition, should any Major Investor choose not to purchase its full pro rata share, the remaining Major Investors shall have the right to purchase the remaining pro rata shares." 9. That the Board of Directors meets quarterly; 10. That the company take out key person insurance for the two cofounders: 11. Drag along and rights of co-sale apply to holders of greater than 5% of stock; and 12. The company is not allowed to speak to other investors except Arrowhead Innovation Fund. Fill in the blanks in the term sheet to meets her requirements. You will need to determine the price per share and fill out the post capitalization (post investment) cap table in Exhibit A to show the equity breakdown in the company. Each share of Series Seed Preferred will automatically be converted into Common Stock at the then applicable conversion rate in the event of the closing of a firm commitment underwritten Mandatory Conversion: public offering with a price of three times the Original Purchase Price (subject to adjustments for stock dividends, splits, combinations and similar events) and net proceeds to the Company of not less than $50,000,000 (a "QPO"), or (ii) upon the written consent of the holders of 50% of the Series Seed Preferred. Representations and Warranties: Common Stock Issuable upon a stock split, stock dividend, or any subdivision of shares of Common Stock; and (iv) shares of Common Stock (or options to purchase such shares of Common Stock) Issued or issuable to employees or directors of, or consultants to, the Company pursuant to any plan approved by the Company's Board of Directors. STOCK PURCHASE AGREEMENT Management Standard conditions to Closing, which shall include, among other things, satisfactory completion of financial and legal due diligence, Conditions to Closing: qualification of the shares under applicable Blue Sky laws, the filing of a Certificate of Incorporation establishing the rights and preferences of the Series Seed Preferred, and an opinion of counsel to the Company. Standard representations and warranties by the Company. Representations and warranties by Founders regarding technology ownership, etc.. # to pay Company counsel to draft Closing documents. all legal and administrative costs of the financing at Closing. Counsel and Expenses: including reasonable fees (not to exceed S unless the transaction is not completed because the Investors withdraw their commitment without cause. nation Rights: INVESTORS RIGHTS AGREEMENT A Management Rights letter from the Company, in a form reasonably acceptable to the Investors, will be delivered prior to Closing to each Investor that requests one. Any Major Investor (who is not a competitor] will be granted access to Company facilities and personnel during normal business hours and with reasonable advance notification. The Company will deliver to such Major Investor (1) annual, quarterly, Right to Participate Pro Rata in Future Rounds: Non-Disclosure and Developments Agreement: determined by the Board; (i) thirty days prior to the end of each fiscal year, a comprehensive operating budget forecasting the Company's revenues, expenses, and cash position on a month-to- month basis for the upcoming fiscal year; and (ii) promptly following the end of each quarter an up-to-date capitalization table. A "Major Investor means any Investor who purchases at least $ of Series Seed Preferred. Each current and former Founder, employee and consultant will enter into a non-disclosure and proprietary rights assignment agreement in a form reasonably acceptable to the Investors. Right of First Refusal/ Right of Co-Sale (Take-Me- Along): The Board of Directors shall meet at least otherwise agreed by a vote of the majority of Directors. unless The Company will bind D&O insurance with a carrier and in an amount satisfactory to the Board of Directors. Company to enter Board Matters: into Indemnification Agreement with each Series Seed Director in form acceptable to such director. In the event the Company merges with another entity and is not the surviving corporation, or transfers all of its assets, proper provisions shall be made so that successors of the Company assume the Company's obligations with respect to indemnification of Directors. Company to acquire life insurance on in Key Person Insurance: an amount satisfactory to the Board. Proceeds payable to the Company. RIGHT OF FIRST REFUSAL/CO-SALE AGREEMENT Company first and Investors second (to the extent assigned by the Board of Directors.) will have a right of first refusal with respect to any shares of capital stock of the Company proposed to be transferred by Founders and future employees holding greater than 1% of Company Common Stock (assuming conversion of Preferred Stock and whether then held or subject to the exercise of options), with a right of oversubscription for Investors of shares unsubscribed by the other Investors. Before any such person may sell Common Stock, he will give the Investors an opportunity to participate in such sale on a basis proportionate to the amount of securities held by the seller and those held by the participating Investors.

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Answer 1 company name BLAW CORP Feb 2021 2 BLAW Corp New Mexico 3 New Mexico 4Investors Arr... View full answer

Get step-by-step solutions from verified subject matter experts