Question: PLEASE ANSWER AS PER THE TABLE GIVEN 22 10 points Return to question Oldham Inc. conducts business in State M and State N, which both

PLEASE ANSWER AS PER THE TABLE GIVEN

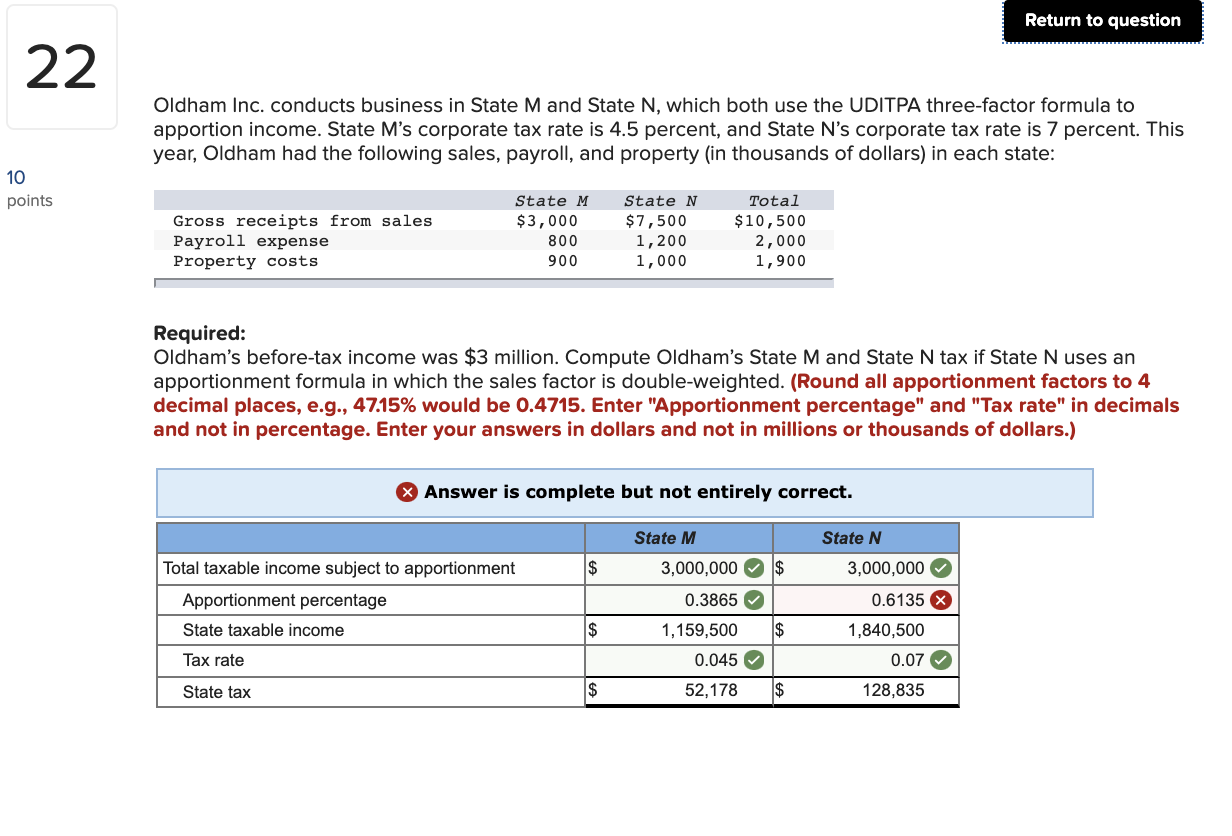

22 10 points Return to question Oldham Inc. conducts business in State M and State N, which both use the UDITPA three-factor formula to apportion income. State M's corporate tax rate is 4.5 percent, and State N's corporate tax rate is 7 percent. This year, Oldham had the following sales, payroll, and property (in thousands of dollars) in each state: State N State N Total Gross receipts from sales $3,000 $7,500 $10,500 Payroll expense 800 1 , 200 2, 000 Property costs 900 1,000 1,900 Required: Oldham's before-tax income was $3 million. Compute Oldham's State M and State N tax ifState N uses an apportionment formula in which the sales factor is double-weighted. (Round all apportionment factors to 4 decimal places. e.g., 47.15% would be 0.4715. Enter "Apportionment percentage\" and \"Tax rate" in decimals and not in percentage. Enter your answers in dollars and not in millions or thousands of dollars.) 9 Answer Is complete but not entirely correct. Total taxable income subject to apportionment $ 3.000.000 o $ 3.000.000 o Apportionment percentage 0.3865 0 0.6135 6 State taxable income $ 1 ,159.500 $ 1,840,500 0-e we

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts