Question: please answer as soon as possible, i will really appreciate it. thank you so much Bob exchanged a building for another bullding on April 3,

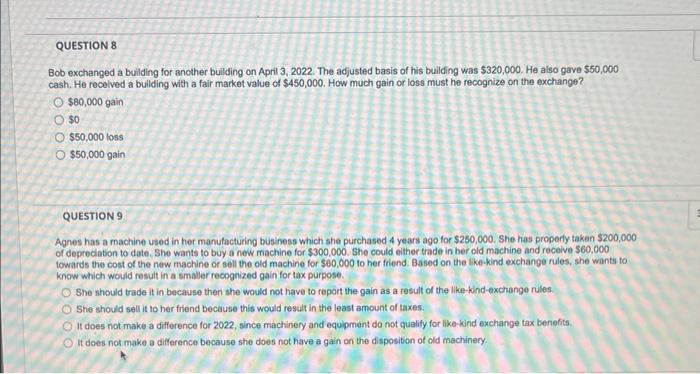

Bob exchanged a building for another bullding on April 3, 2022. The adjusted basis of his building was $320,000. He also gave $50,000 cash. He recelved a building with a fair market value of $450,000. How much gain or loss must he recognize on the exchange? $80,000 gain $0 $50,000 loss $50,000 gain QUESTION 9 Agnes has a machine used in her manufacturing business which she purchased 4 years ago for $250,000. She has properly taken $200,000 of depreciation to date. She wants to buy a new machine for $300,000. She could either trade in ber old machine and receive $60,000 towards the cost of the new machine or sell the old machine for $60,000 to her friend. Based on the like-kind exchange rules, she wants to know which would result in a smaller recognized gain for tax purpose. She should trade it in because then she would not have to report the gain as a result of the like-kind-exchange rules. She should sell it to her friend because this would result in the least amount of taxes. It does not make a difference for 2022 , since machinery and equipment do not qualify for like-kind exchange tax benefits. It does not make a difference because she does not have a gain on the disposition of old machinery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts