Question: please answer asap 4) A married couple has an adjusted gross income of $180,000, they file jointly, do not itemize deductions and are entitled to

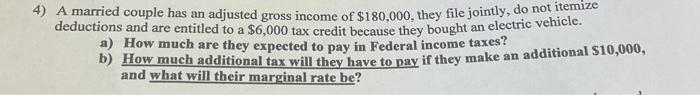

4) A married couple has an adjusted gross income of $180,000, they file jointly, do not itemize deductions and are entitled to a $6,000 tax credit because they bought an electric vehicle. a) How much are they expected to pay in Federal income taxes? b) How much additional tax will they have to pay if they make an additional $10,000, and what will their marginal rate be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts