Question: PLEASE ANSWER ASAP. (a) WIM Bhd. is a construction company in Malaysia and intends to expand its business through market expansion to the overseas market.

PLEASE ANSWER ASAP.

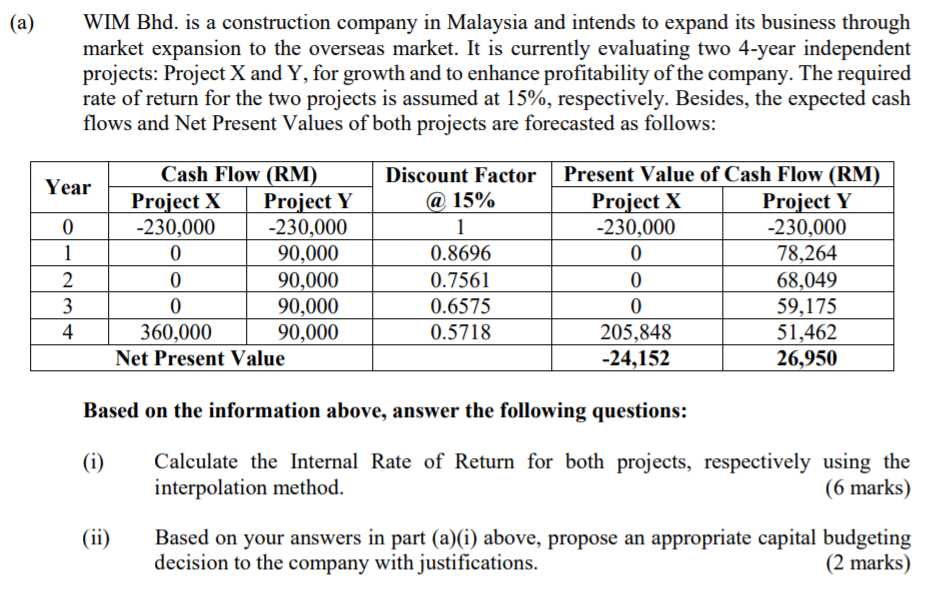

(a) WIM Bhd. is a construction company in Malaysia and intends to expand its business through market expansion to the overseas market. It is currently evaluating two 4-year independent projects: Project X and Y, for growth and to enhance profitability of the company. The required rate of return for the two projects is assumed at 15%, respectively. Besides, the expected cash flows and Net Present Values of both projects are forecasted as follows: Year 0 1 2 3 4 Cash Flow (RM) Project X Project Y -230,000 -230,000 0 90,000 0 90,000 0 90,000 360,000 90,000 Net Present Value Discount Factor Present Value of Cash Flow (RM) @ 15% Project X Project Y 1 -230,000 -230,000 0.8696 0 78,264 0.7561 0 68,049 0.6575 0 59,175 0.5718 205,848 51,462 -24,152 26,950 Based on the information above, answer the following questions: (i) Calculate the Internal Rate of Return for both projects, respectively using the interpolation method. (6 marks) (ii) Based on your answers in part (a)(i) above, propose an appropriate capital budgeting decision to the company with justifications. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts