Question: Please help me to solve this question. Please answer in details.I will upvote u Question 1 (a) WIM Bhd. is a construction company in Malaysia

Please help me to solve this question. Please answer in details.I will upvote u

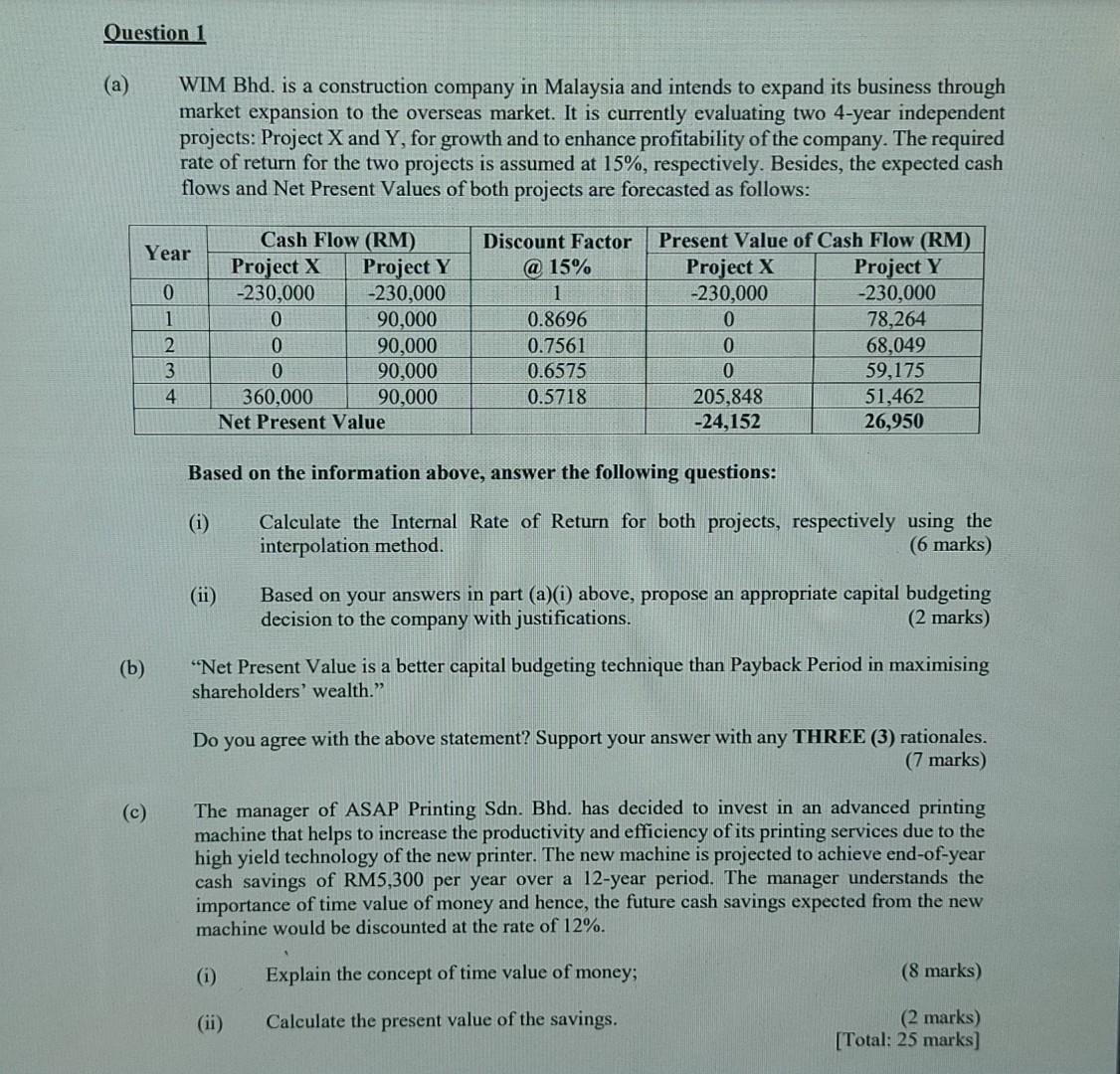

Question 1 (a) WIM Bhd. is a construction company in Malaysia and intends to expand its business through market expansion to the overseas market. It is currently evaluating two 4-year independent projects: Project X and Y, for growth and to enhance profitability of the company. The required rate of return for the two projects is assumed at 15%, respectively. Besides, the expected cash flows and Net Present Values of both projects are forecasted as follows: Year 0 1 2 3 4 Cash Flow (RM) Project X Project Y -230,000 -230,000 0 90,000 0 90,000 0 90,000 360,000 90,000 Net Present Value Discount Factor @ 15% 1 0.8696 0.7561 0.6575 0.5718 Present Value of Cash Flow (RM) Project X Project Y -230,000 -230,000 0 78,264 0 68,049 0 59,175 205,848 51,462 -24,152 26,950 Based on the information above, answer the following questions: (i) Calculate the Internal Rate of Return for both projects, respectively using the interpolation method. (6 marks) (ii) Based on your answers in part (a)(i) above, propose an appropriate capital budgeting decision to the company with justifications. (2 marks) (b) Net Present Value is a better capital budgeting technique than Payback Period in maximising shareholders' wealth. Do you agree with the above statement? Support your answer with any THREE (3) rationales. (7 marks) (c) The manager of ASAP Printing Sdn. Bhd. has decided to invest in an advanced printing machine that helps to increase the productivity and efficiency of its printing services due to the high yield technology of the new printer. The new machine is projected to achieve end-of-year cash savings of RM5,300 per year over a 12-year period. The manager understands the importance of time value of money and hence, the future cash savings expected from the new machine would be discounted at the rate of 12%. (i) Explain the concept of time value of money; (8 marks) (ii) Calculate the present value of the savings. (2 marks) [Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts