Question: Please answer ASAP and i will leave a thumbs up!!! - Download 10 Portfolios Formed on REVERSAL from Kenneth French website - Download the Fama

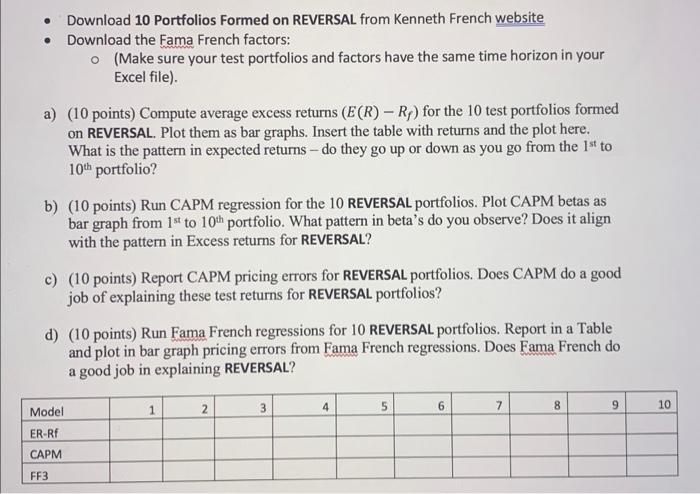

- Download 10 Portfolios Formed on REVERSAL from Kenneth French website - Download the Fama French factors: - (Make sure your test portfolios and factors have the same time horizon in your Excel file). a) (10 points) Compute average excess returns (E(R)Rf) for the 10 test portfolios formed on REVERSAL. Plot them as bar graphs. Insert the table with returns and the plot here. What is the pattern in expected returns - do they go up or down as you go from the 1st to 10th portfolio? b) (10 points) Run CAPM regression for the 10 REVERSAL portfolios. Plot CAPM betas as bar graph from 1st to 10th portfolio. What pattern in beta's do you observe? Does it align with the pattern in Excess returns for REVERSAL? c) (10 points) Report CAPM pricing errors for REVERSAL portfolios. Does CAPM do a good job of explaining these test returns for REVERSAL portfolios? d) (10 points) Run Fama French regressions for 10 REVERSAL portfolios. Report in a Table and plot in bar graph pricing errors from Fama French regressions. Does Fama French do a good job in explaining REVERSAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts