Question: Please answer asap. Do what you can, if nothing else at least help with the flowchart part of it. Thanks! (70 points) Draw a flowchart

Please answer asap. Do what you can, if nothing else at least help with the flowchart part of it. Thanks!

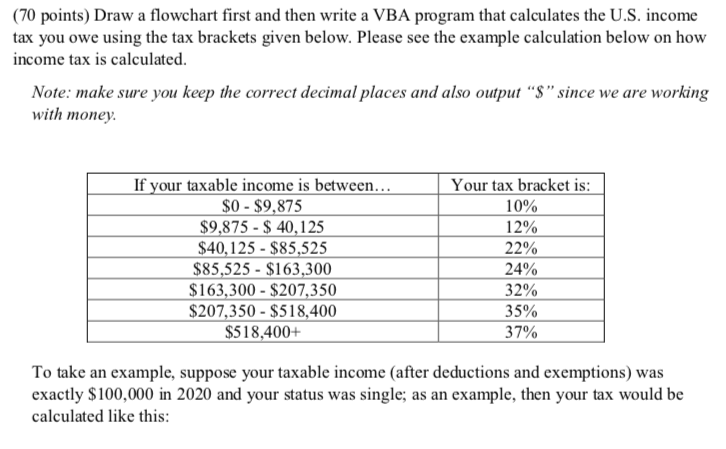

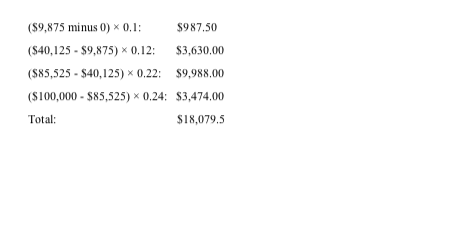

(70 points) Draw a flowchart first and then write a VBA program that calculates the U.S. income tax you owe using the tax brackets given below. Please see the example calculation below on how income tax is calculated. Note: make sure you keep the correct decimal places and also output S since we are working with money. If your taxable income is between... $0 - $9,875 $9,875 - $ 40,125 $40,125 - $85,525 $85,525 - $163,300 $163,300 - $207,350 $207,350 - $518,400 $518,400+ Your tax bracket is: 10% 12% 22% 24% 32% 35% 37% To take an example, suppose your taxable income (after deductions and exemptions) was exactly $100,000 in 2020 and your status was single; as an example, then your tax would be calculated like this: ($9,875 minus 0) x 0.1: $987.50 ($40,125 - $9,875) * 0.12: $3,630,00 ($85,525 - $40,125) * 0.22: $9,988,00 ($100,000 - $85,525) * 0.24: $3,474,00 Total: : $18,079.5 (70 points) Draw a flowchart first and then write a VBA program that calculates the U.S. income tax you owe using the tax brackets given below. Please see the example calculation below on how income tax is calculated. Note: make sure you keep the correct decimal places and also output S since we are working with money. If your taxable income is between... $0 - $9,875 $9,875 - $ 40,125 $40,125 - $85,525 $85,525 - $163,300 $163,300 - $207,350 $207,350 - $518,400 $518,400+ Your tax bracket is: 10% 12% 22% 24% 32% 35% 37% To take an example, suppose your taxable income (after deductions and exemptions) was exactly $100,000 in 2020 and your status was single; as an example, then your tax would be calculated like this: ($9,875 minus 0) x 0.1: $987.50 ($40,125 - $9,875) * 0.12: $3,630,00 ($85,525 - $40,125) * 0.22: $9,988,00 ($100,000 - $85,525) * 0.24: $3,474,00 Total: : $18,079.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts