Question: please answer ASAP for a good rating Permian Partners (PP) produces from aging oli flelds in west Texas. Production is 1.81 million barrels per year

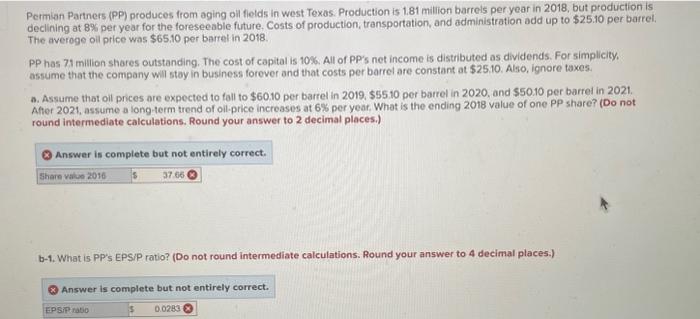

Permian Partners (PP) produces from aging oli flelds in west Texas. Production is 1.81 million barrels per year in 2018, but production is declining at 8% per year for the foreseeable future. Costs of production, transportation, and administration add up to $25.10 per barrel: The averoge oll price was $65.10 per bartef in 2018. PP has 71 million shares outstanding. The cost of capital is 10\%. All of PP's net income is distributed as dividends. For simplicity. assume that the company will stay in business forever and that costs per barret are constant at $25.10. Also, ignore taxes. a. Assume that oil prices are expected to fall to $60.10 per barrel in 2019. $55.10 per barrel in 2020, and $5010 per barret in 2021 . After 2021, assume a long-term trend of oil-price increases at 6% per year. What is the ending 2018 value of one PP share? (Do not. round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. b-1. What is PP's EPSIP ratio? (Do not round intermediate calculations. Round your answer to 4 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts