Question: please answer asap Julio is single with 1 withholding allowance. He earned $1,165.00 during the most recent semimonthly pay period. He needs to decide between

please answer asap

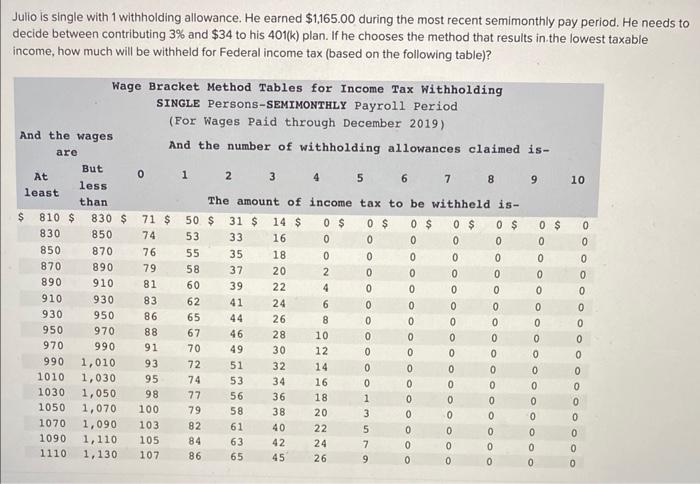

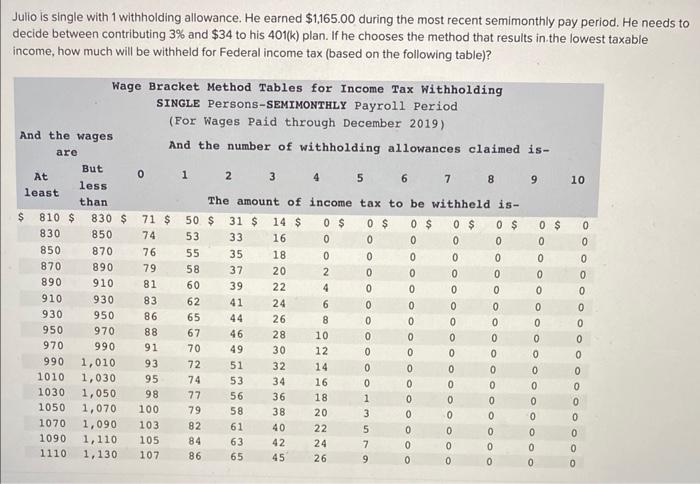

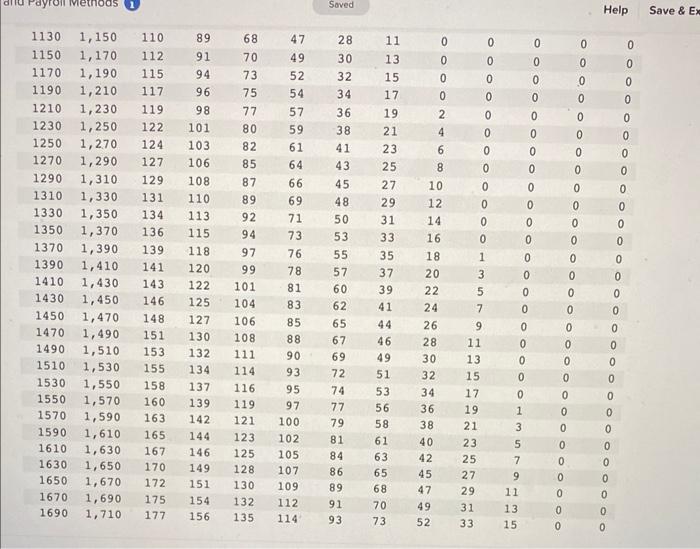

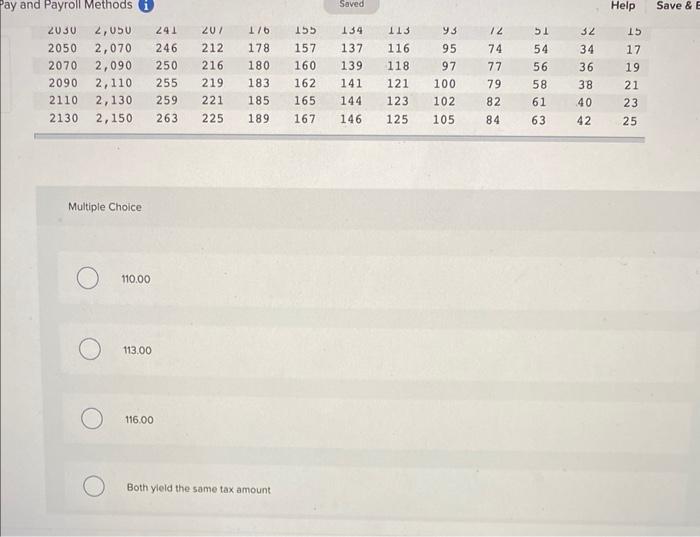

Julio is single with 1 withholding allowance. He earned $1,165.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $34 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)? Multiple Choice 110.00 113.00 116.00 Both yleld the same tax amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock