Question: please answer asap Regarding the Statements on Standards for Tax Services that apply to CPAS, complete the following: 1. Assign the correct number to the

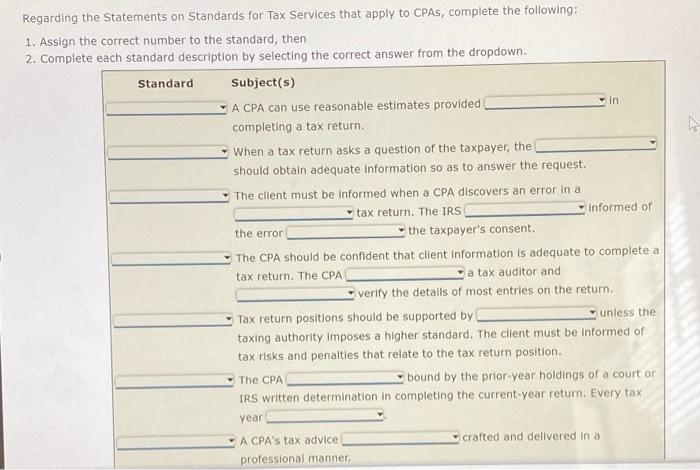

Regarding the Statements on Standards for Tax Services that apply to CPAS, complete the following: 1. Assign the correct number to the standard, then 2. Complete each standard description by selecting the correct answer from the dropdown. Standard Subject(s) A CPA can use reasonable estimates provided in completing a tax return When a tax return asks a question of the taxpayer, the should obtain adequate information so as to answer the request. The client must be informed when a CPA discovers an error in a tax return. The IRS Informed of the error the taxpayer's consent. The CPA should be confident that client Information is adequate to complete a tax return. The CPA va tax auditor and verify the details of most entries on the return. Tax return positions should be supported by unless the taxing authority imposes a higher standard. The client must be informed of tax risks and penalties that relate to the tax return position. The CPA bound by the prior year holdings of a court or IRS written determination in completing the current-year return. Every tax year VA CPA's tax advice crafted and delivered in a professional manner a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts