Question: PLEASE ANSWER ASAP Why are special allocations permitted or required for the partners in a partnership but not for the shareholders in a Cor is

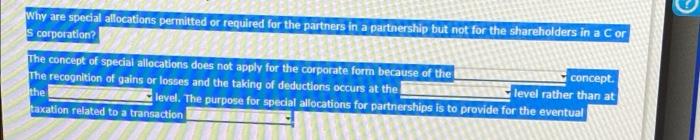

Why are special allocations permitted or required for the partners in a partnership but not for the shareholders in a Cor is corporation? The concept of special allocations does not apply for the corporate form because of the concept. The recognition of gains or losses and the taking of deductions occurs at the level rather than at level. The purpose for special allocations for partnerships is to provide for the eventual taxation related to a transaction the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts