Question: please answer asap will give thumbs up 1. At the end of the year a firm will have $100M of earnings for equity holders and

please answer asap will give thumbs up

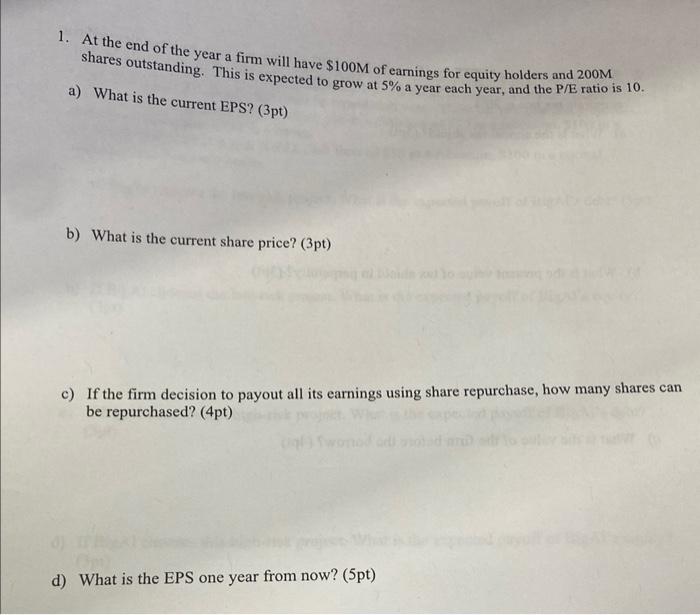

1. At the end of the year a firm will have $100M of earnings for equity holders and 200M shares outstanding. This is expected to grow at 5% a year each year, and the P/E ratio is 10 . a) What is the current EPS? (3pt) b) What is the current share price? (3pt) c) If the firm decision to payout all its earnings using share repurchase, how many shares can be repurchased? (4pt) d) What is the EPS one year from now? (5pt)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock