Question: please answer asap will give thumbs up!!! 1. At the end of the year a firm will have $100M of earnings for equity holders and

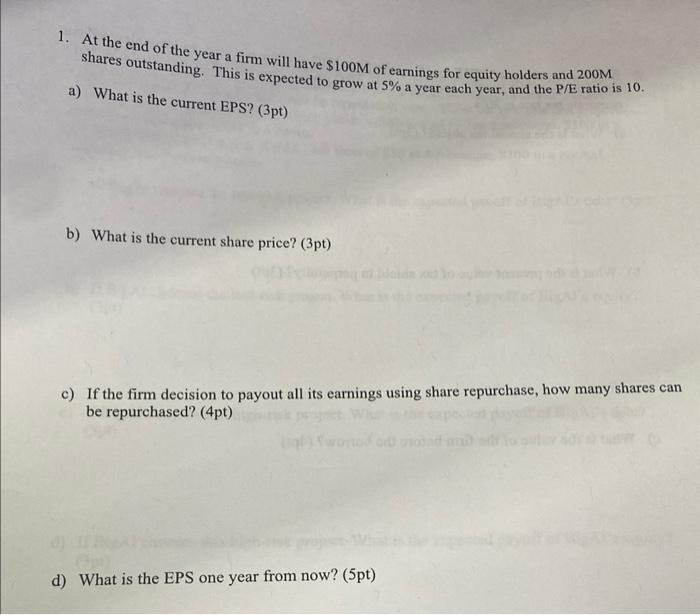

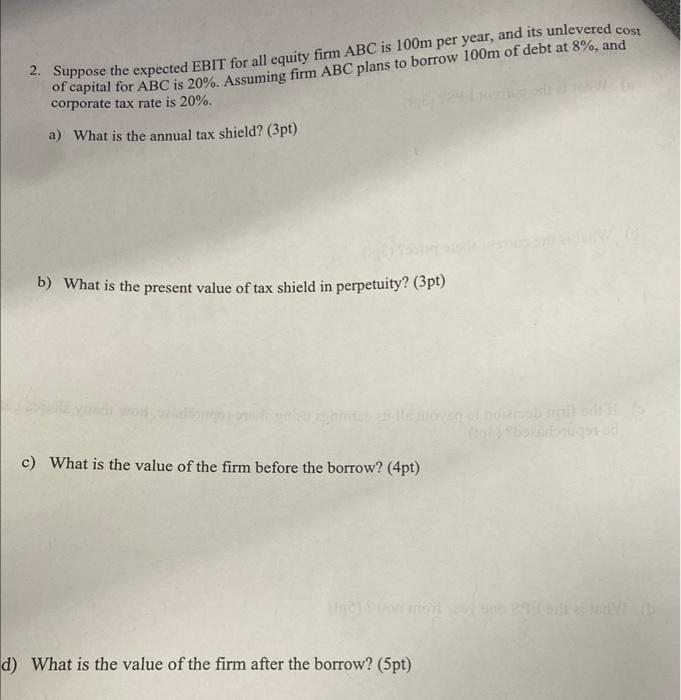

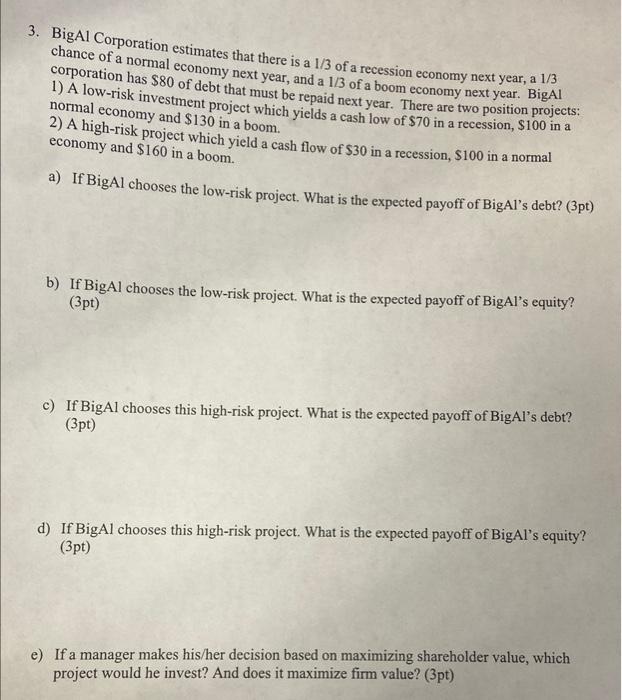

1. At the end of the year a firm will have $100M of earnings for equity holders and 200M shares outstanding. This is expected to grow at 5% a year each year, and the P/E ratio is 10 . a) What is the current EPS? (3pt) b) What is the current share price? ( 3pt) c) If the firm decision to payout all its earnings using share repurchase, how many shares can be repurchased? (4pt) d) What is the EPS one year from now? (5pt) b) What is the present value of tax shield in perpetuity? (3pt) c) What is the value of the firm before the borrow? (4pt) d) What is the value of the firm after the borrow? (5pt) 3. BigAl Corporation estimates that there is a 1/3 of a recession economy next year, a 1/3 chance of a normal economy next year, and a 1/3 of a boom economy next year. BigAl 1) A low-risk investion debt that must be repaid next year. There are two position projects: normal economy and $130 in a which yields a cash low of $70 in a recession, $100 in a 2) A high-risk project which a boom. economy and $160 in a boom. a) If BigAl chooses the low-risk project. What is the expected payoff of BigAl's debt? (3pt) b) If BigAl chooses the low-risk project. What is the expected payoff of BigAl's equity? (3pt) c) If BigAl chooses this high-risk project. What is the expected payoff of BigAl's debt? (3pt) d) If BigAl chooses this high-risk project. What is the expected payoff of BigAl's equity? (3pt) e) If a manager makes his/her decision based on maximizing shareholder value, which project would he invest? And does it maximize firm value? (3pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts