Question: please answer asap will give thumbs up 3. BigAl Corporation estimates that there is a 1/3 of a recession economy next year, a 1/3 chance

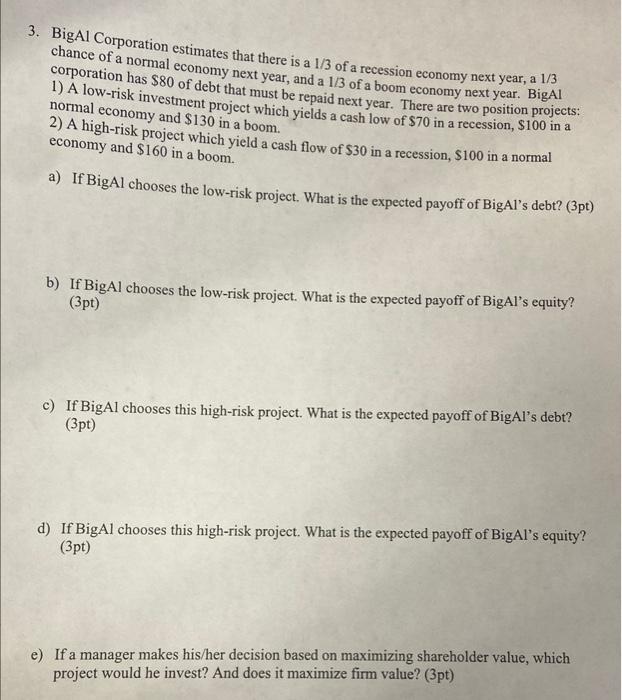

3. BigAl Corporation estimates that there is a 1/3 of a recession economy next year, a 1/3 chance of a normal economy next year, and a 1/3 of a boom economy next year. BigAl 1) A low-risk investment debt must be repaid next year. There are two position projects: normal economy and $130 in a which yields a cash low of $70 in a recession, $100 in a 2) A high-risk project which a boom. economy and $160 in a boom. yield a cash flow of $30 in a recession, $100 in a normal a) If BigAl chooses the low-risk project. What is the expected payoff of BigAl's debt? (3pt) b) If BigAl chooses the low-risk project. What is the expected payoff of BigAl's equity? (3pt) c) If BigAl chooses this high-risk project. What is the expected payoff of BigAl's debt? (3pt) d) If BigAl chooses this high-risk project. What is the expected payoff of BigAl's equity? (3pt) e) If a manager makes his/her decision based on maximizing shareholder value, which project would he invest? And does it maximize firm value? (3pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts