Question: please answer asap!! will give you a thumbs up! and Live Text . Use cell references and formulas when possible Step 1: Type the labels

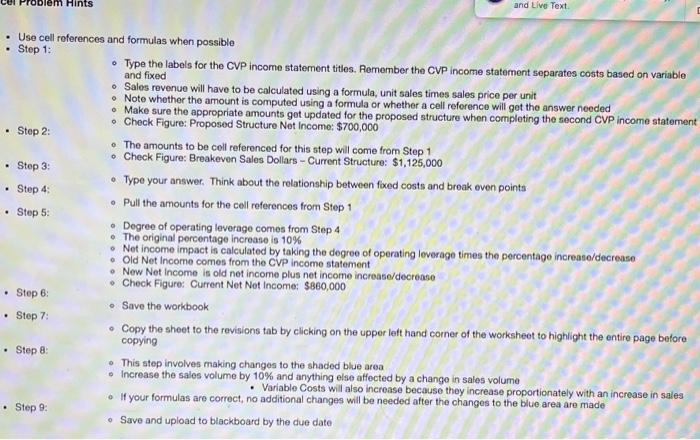

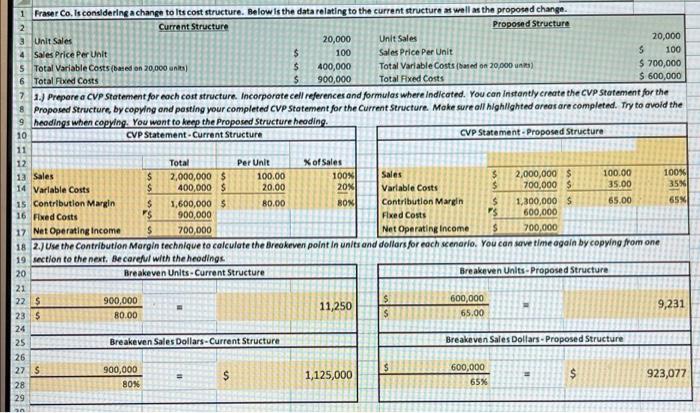

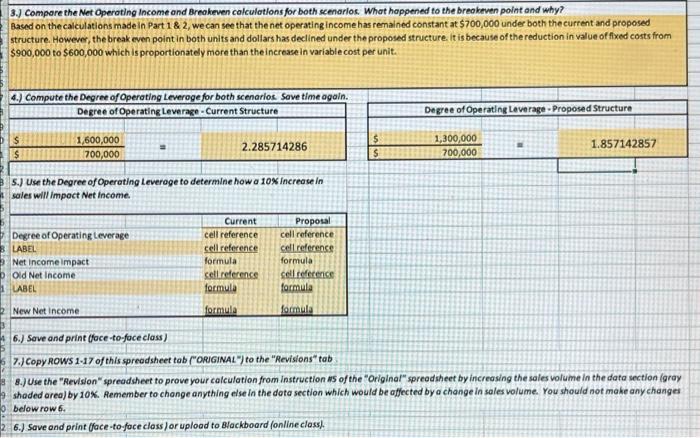

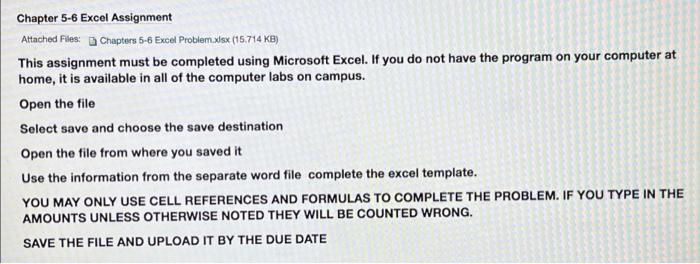

and Live Text . Use cell references and formulas when possible Step 1: Type the labels for the CVP income statement titles. Remember the CVP Income statement separates costs based on variable and fixed Sales revenue will have to be calculated using a formula, unit sales times sales price per unit Note whether the amount is computed using a formula or whether a cell reference will get the answer needed Make sure the appropriate amounts get updated for the proposed structure when completing the second CVP income statement Check Figure: Proposed Structure Net Income: $700,000 Step 2: The amounts to be coll referenced for this step will come from Step 1 Check Figure: Breakeven Sales Dollars - Current Structure: $1,125,000 Step 3: Type your answer. Think about the relationship between fixed costs and broak oven points Step 4: Pull the amounts for the cell references from Stop 1 Step 5: Degree of operating leverage comes from Stop 4 The original percentage increase is 10% Net income impact is calculated by taking the degree of operating leverage times the percentage increase/decrease . Old Net Income comes from the CVP Income statement New Net Income is old net income plus net income increase/decrease Check Figure: Current Net Net Income: $860,000 Step 6: Save the workbook Step 7: Copy the sheet to the revisions tab by clicking on the upper left hand corner of the worksheet to highlight the entire page before copying Step 8 This step involves making changes to the shaded blue area Increase the sales volume by 10% and anything else affected by a change in sales volume Variable Costs will also increase because they increase proportionately with an increase in sales . If your formulas are correct, no additional changes will be needed after the changes to the blue area are made Step 9: Save and upload to blackboard by the due date 1 Fraser Co, Is considering a change to its cost structure. Below is the data relating to the current structure as well as the proposed change. 2 Current Structure Proposed Structure 3 Unit Sales 20,000 Unit Sales 20,000 4 Sales Price Per Unit 100 Sales Price Per Unit $ 100 5 Total Variable Costs (based on 20,000 units) $ 400,000 Total Variable Costed on 20,000) $ 700,000 6 Total Fixed Costs $ 900,000 Total Fixed Costs $ 600,000 7 1.) Prepare a CVP Statement for each cost structure. Incorporate cell references and formulas where indicated. You can instantly create the CVP Statement for the 8 Proposed Structure, by copying and posting your completed CVP Statement for the Current Structure. Make sure all highlighted areas are completed. Try to avoid the 9 headings when copying. You want to keep the Proposed Structure heading 10 CVP Statement-Current Structure CVP Statement Proposed Structure 11 12 Total Per Unit Xof Sales 13 Sales $ 2,000,000 100.00 100% Sales 5 2,000,000 $ 100.00 100% 14 Variable costs $ 400,000 20.00 20 Variable Costs $ 700,000 $ 35.00 35% 15 Contribution Margin $ 1,600,000 $ 80.00 BON Contribution Margin $ 1,300,000 $ 65.00 65% 16 Fixed Costs $ 900,000 Fixed Costs PS 600,000 17 Net Operating income $ 700.000 Net Operating Income 700,000 18 2. Use the Contribution Margin technique to calculate the Breakeven point in units and dollars for each scenario. You can save time again by copying from one 19 section to the next. Be careful with the headings 20 Breakeven Units. Current Structure Breakeven Units. Proposed Structure 21 22 $ 900,000 $ 600,000 11,250 9,231 235 80.00 $ 65.00 24 25 Breakeven Sales Dollars-Current Structure Breakeven Sales Dollars - Proposed Structure 26 275 900,000 600,000 $ 1,125,000 $ 923,077 28 80% 65% 29 3. Compare the Net Operating Income and Breakeven calculations for both scenarios What happened to the breakeven point and why? Based on the calculations made in Part 1 & 2, we can see that the net operating income has remained constant at $700,000 under both the current and proposed structure. However, the break even point in both units and dollars has declined under the proposed structure. It is because of the reduction in value of fixed costs from $900,000 to $600,000 which is proportionately more than the increase in variable cost per unit. 4.) Compute the Degree of Operating Leverage for both scenariot Save time again. Degree of Operating Leverage - Current Structure Degree of Operating Laverage - Proposed Structure $ $ 1,600,000 700,000 2.285714286 $ $ 1,300,000 700,000 1.857142857 5. Use the Degree of Operating Leverage to determine how a 10% Increase in sales will impact Net Income. Degree of Operating Leverage 3 LABEL Net Income Impact Old Net Income 1 LABEL Current cell reference cell reference formula cell reference formula Proposal cell reference cell reference formula cellreference formula New Net Income formula formula 6.) Save and print (face-to-face class) 7.) Copy ROWS 1.17 of this spreadsheet to "ORIGINAL") to the "Revisions" tab 8.) Use the "Revision spreadsheet to prove your calculation from instruction as of the original" spreadsheet by increasing the sales volume in the data section (gray shaded area) by 10%. Remember to change anything else in the data section which would be affected by a change in sales volume. You should not make any changes below row 6. 6.) Save and print (face-to-face class) or upload to Blackboard (online class). Chapter 5-6 Excel Assignment Attached Files: 3 Chapters 5-6 Excel Problem.xlsx (15.714 KB) This assignment must be completed using Microsoft Excel. If you do not have the program on your computer at home, it is available in all of the computer labs on campus. Open the file Select save and choose the save destination Open the file from where you saved it Use the information from the separate word file complete the excel template. YOU MAY ONLY USE CELL REFERENCES AND FORMULAS TO COMPLETE THE PROBLEM. IF YOU TYPE IN THE AMOUNTS UNLESS OTHERWISE NOTED THEY WILL BE COUNTED WRONG. SAVE THE FILE AND UPLOAD IT BY THE DUE DATE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts