Question: please answer ASAP within 3 hrs 7. (a) Derive the Capital Market Line (CML) by using the two-fund separation theorem. Explain the concepts of the

please answer ASAP within 3 hrs

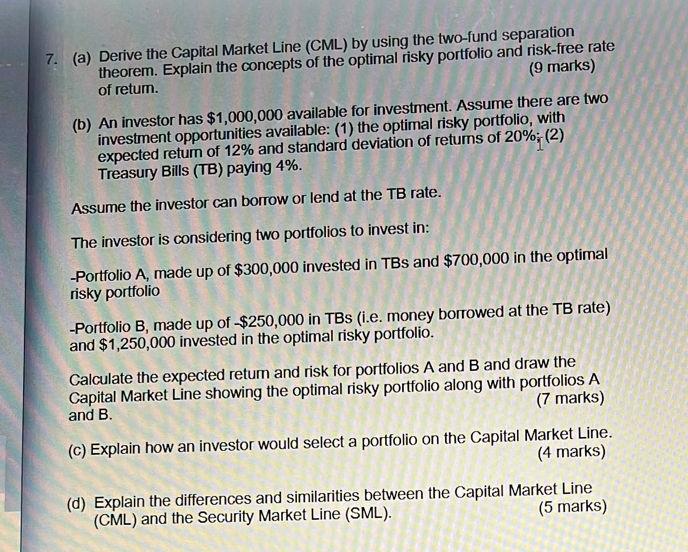

7. (a) Derive the Capital Market Line (CML) by using the two-fund separation theorem. Explain the concepts of the optimal risky portfolio and risk-free rate (9 marks) of retum. (b) An investor has $1,000,000 available for investment. Assume there are two investment opportunities available: (1) the optimal risky portfolio, with expected return of 12% and standard deviation of returns of 20%; (2) Treasury Bills (TB) paying 4%. Assume the investor can borrow or lend at the TB rate. The investor is considering two portfolios to invest in: -Portfolio A, made up of $300,000 invested in TBS and $700,000 in the optimal risky portfolio -Portfolio B, made up of $250,000 in TBS (i.e. money borrowed at the TB rate) and $1,250,000 invested in the optimal risky portfolio. Calculate the expected return and risk for portfolios A and B and draw the Capital Market Line showing the optimal risky portfolio along with portfolios A (7 marks) and B. (c) Explain how an investor would select a portfolio on the Capital Market Line. (4 marks) (d) Explain the differences and similarities between the Capital Market Line (5 marks) (CML) and the Security Market Line (SML)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts