Question: Please answer Assume that Fed Ex is planning to issue $100,000,000 of 270-day commercial paper for an effective yield of 4.75 percent. Trough Credit Enhancement,

Please answer

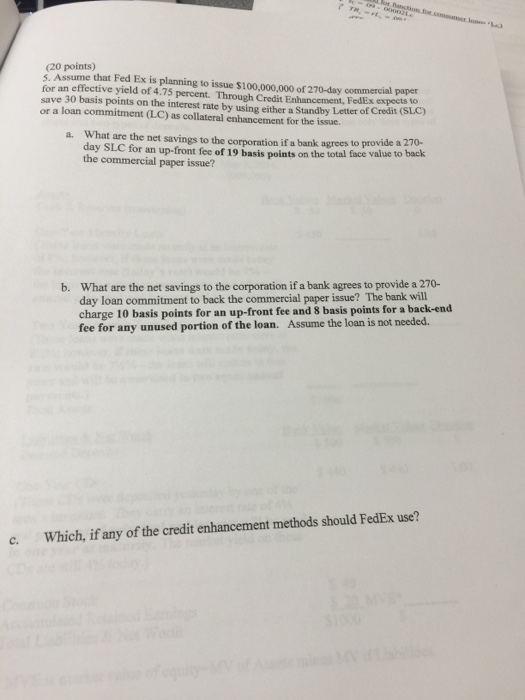

Please answerAssume that Fed Ex is planning to issue $100,000,000 of 270-day commercial paper for an effective yield of 4.75 percent. Trough Credit Enhancement, FedEx expects to save 30 basis on the interest rate by using either a Standby Letter of Credit (SLC) or a loan commitment (LC) as collateral enhancement for the issue. What are the net savings to the corporation if a bank agrees to provide a 270-day SLC for an up-front of 19 basis points on the total value to back the commercial paper issue? What are the net savings to the corporation if a bank agrees to provide a 270-day loan commitment to back the commercial paper issue? The bank will charge 10 basis points for an up-front fee and 8 basis points for a back-end fee for any unused portion of the loan. Assume the loan is not needed. Which, if any of the credit enhancement methods should FedEx use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts