Question: please answer b and c if possible EPS and Debt to Equity Your corporation is cumenty a equity financed with 500,000 shares of common stock

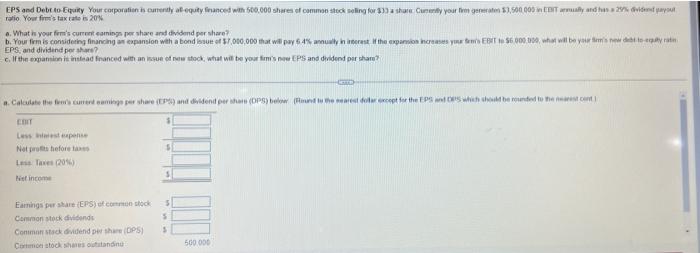

EPS and Debt to Equity Your corporation is cumenty a equity financed with 500,000 shares of common stock selling for $33 a share: Cumenty your firm generates $3,500,000 in EBIT annually and has a 25% dividend payou ratio Your firm's tax 20% e. What is your fem's current eamings per share and dividend per share? b. Your firm is considering financing an expansion with a bond issue of $7,000,000 that will pay 6.4% annually in interest. If the expansion increases your fe's EBIT to $6.000.000, what will be your f EPS, and dividend per share? c. If the expansion is instead financed with an issue of new stock, what will be your firm's now EPS and dividend per share? CONC a. Calculate the fer's current eaminge per share (EPS) and dividend per shars (DPS) below (Round to the nearest dollar except for the EPS and OPS which should be rounded to the nearest cont EDIT Less interest expense Not profits before taxes Less Taxes (20%) Net income Earnings per share (EPS) of common stock Common stock dividends Common stack dividend per share (DPS) Common stock shares outstanding S 5 S S 500.000 egy rat EPS and Debt to Equity Your corporation is cumenty a equity financed with 500,000 shares of common stock selling for $33 a share: Cumenty your firm generates $3,500,000 in EBIT annually and has a 25% dividend payou ratio Your firm's tax 20% e. What is your fem's current eamings per share and dividend per share? b. Your firm is considering financing an expansion with a bond issue of $7,000,000 that will pay 6.4% annually in interest. If the expansion increases your fe's EBIT to $6.000.000, what will be your f EPS, and dividend per share? c. If the expansion is instead financed with an issue of new stock, what will be your firm's now EPS and dividend per share? CONC a. Calculate the fer's current eaminge per share (EPS) and dividend per shars (DPS) below (Round to the nearest dollar except for the EPS and OPS which should be rounded to the nearest cont EDIT Less interest expense Not profits before taxes Less Taxes (20%) Net income Earnings per share (EPS) of common stock Common stock dividends Common stack dividend per share (DPS) Common stock shares outstanding S 5 S S 500.000 egy rat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts