Question: Please answer b and d. Morley Properties is planning to build a condominium development on St. Simons Island, Georgia. The company is trying to decide

Please answer b and d.

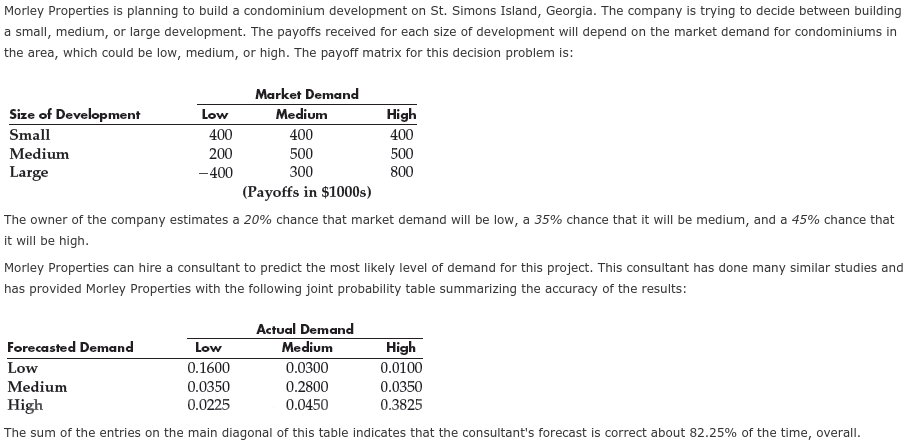

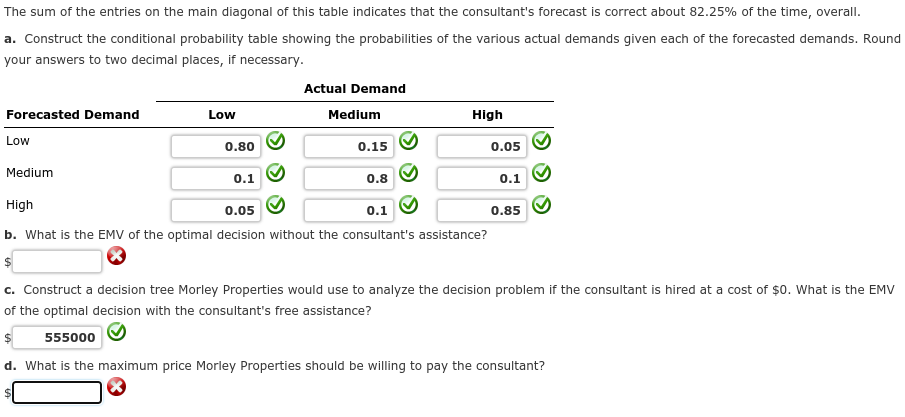

Morley Properties is planning to build a condominium development on St. Simons Island, Georgia. The company is trying to decide between building a small, medium, or large development. The payoffs received for each size of development will depend on the market demand for condominiums in the area, which could be low, medium, or high. The payoff matrix for this decision problem is: Market Demand Size of Development Low Medium High Small 400 400 400 Medium 200 500 500 Large -400 300 800 (Payoffs in $1000s) The owner of the company estimates a 20% chance that market demand will be low, a 35% chance that it will be medium, and a 45% chance that it will be high. Morley Properties can hire a consultant to predict the most likely level of demand for this project. This consultant has done many similar studies and has provided Morley Properties with the following joint probability table summarizing the accuracy of the results: Actual Demand Forecasted Demand Low Medium High Low 0.1600 0.0300 0.0100 Medium 0.0350 0.2800 0.0350 High 0.0225 0.0450 0.3825 The sum of the entries on the main diagonal of this table indicates that the consultant's forecast is correct about 82.25% of the time, overall. Low The sum of the entries on the main diagonal of this table indicates that the consultant's forecast is correct about 82.25% of the time, overall. a. Construct the conditional probability table showing the probabilities of the various actual demands given each of the forecasted demands. Round your answers to two decimal places, if necessary. Actual Demand Forecasted Demand Medium High Low 0.80 0.15 0.05 Medium 0.1 0.8 0.1 High 0.05 0.1 0.85 b. What is the EMV of the optimal decision without the consultant's assistance? $ c. Construct a decision tree Morley Properties would use to analyze the decision problem if the consultant is hired at a cost of $0. What is the EMV of the optimal decision with the consultant's free assistance? 555000 d. What is the maximum price Morley Properties should be willing to pay the consultantStep by Step Solution

There are 3 Steps involved in it

To solve parts b and d we need to follow these steps b EMV of the Optimal Decision Without Consultan... View full answer

Get step-by-step solutions from verified subject matter experts