Question: Please answer B, C,D 2.10 The capital asset pricing model (CAPM) is an important model in the field of finance. It explains variations in the

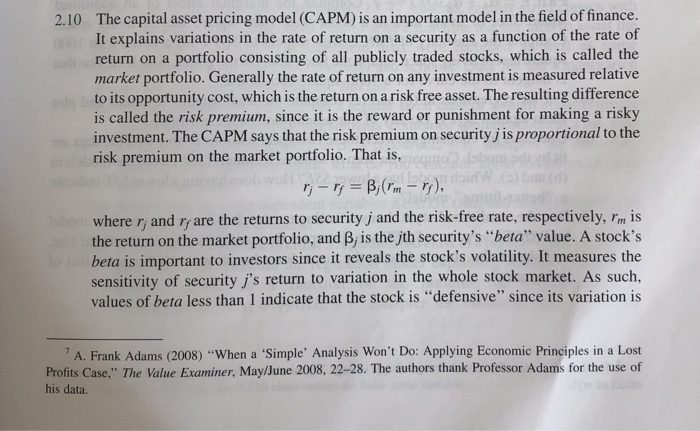

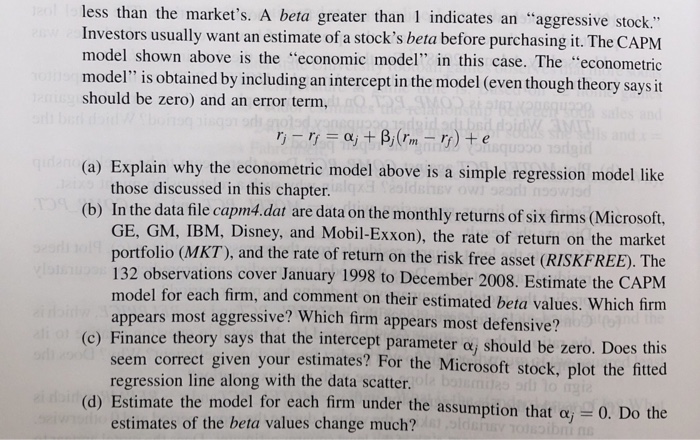

2.10 The capital asset pricing model (CAPM) is an important model in the field of finance. It explains variations in the rate of return on a security as a function of the rate of return on a portfolio consisting of all publicly traded stocks, which is called the market portfolio. Generally the rate of return on any investment is measured relative to its opportunity cost, which is the return on a risk free asset. The resulting difference is called the risk premium, since it is the reward or punishment for making a risky investment. The CAPM says that the risk premium on security jis proportional to the risk premium on the market portfolio. That is, where r, and r are the returns to security j and the risk-free rate, respectively, Im is the return on the market portfolio, and B, is the jth security's "beta" value. A stock's beta is important to investors since it reveals the stock's volatility. It measures the sensitivity of security j's return to variation in the whole stock market. As such, values of beta less than 1 indicate that the stock is "defensive" since its variation is 7 A. Frank Adams (2008) When a Simple, Analysis won't Do: Applying Economic Principles in a Lost Profits Case," The Value Examiner, May/June 2008, 22-28. The authors thank Professor Adams for the use of his data. 2.10 The capital asset pricing model (CAPM) is an important model in the field of finance. It explains variations in the rate of return on a security as a function of the rate of return on a portfolio consisting of all publicly traded stocks, which is called the market portfolio. Generally the rate of return on any investment is measured relative to its opportunity cost, which is the return on a risk free asset. The resulting difference is called the risk premium, since it is the reward or punishment for making a risky investment. The CAPM says that the risk premium on security jis proportional to the risk premium on the market portfolio. That is, where r, and r are the returns to security j and the risk-free rate, respectively, Im is the return on the market portfolio, and B, is the jth security's "beta" value. A stock's beta is important to investors since it reveals the stock's volatility. It measures the sensitivity of security j's return to variation in the whole stock market. As such, values of beta less than 1 indicate that the stock is "defensive" since its variation is 7 A. Frank Adams (2008) When a Simple, Analysis won't Do: Applying Economic Principles in a Lost Profits Case," The Value Examiner, May/June 2008, 22-28. The authors thank Professor Adams for the use of his data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts