Question: please answer b. Construct the statement of stockholders' equity for the year ending Decensber 31, 2021, and the 2021 statement of cash flows. Hint: The

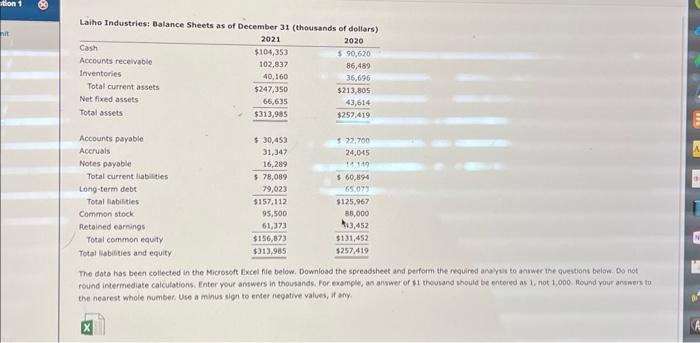

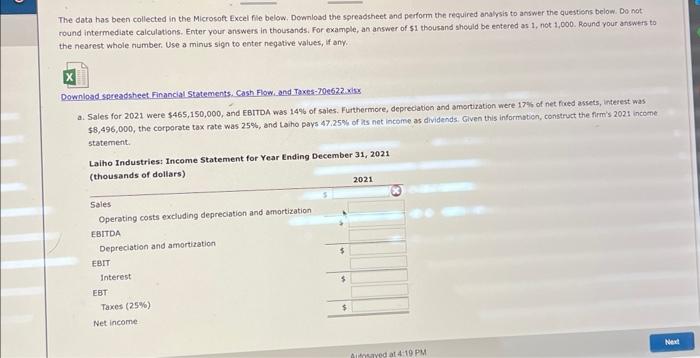

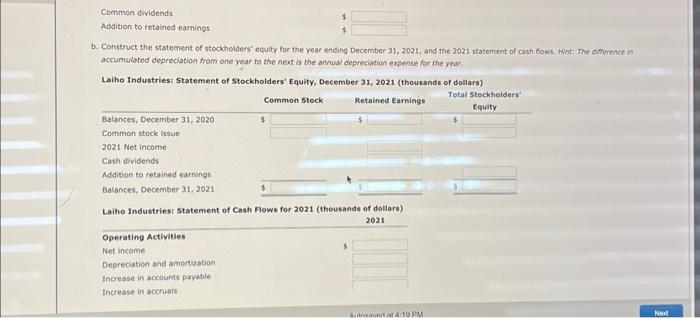

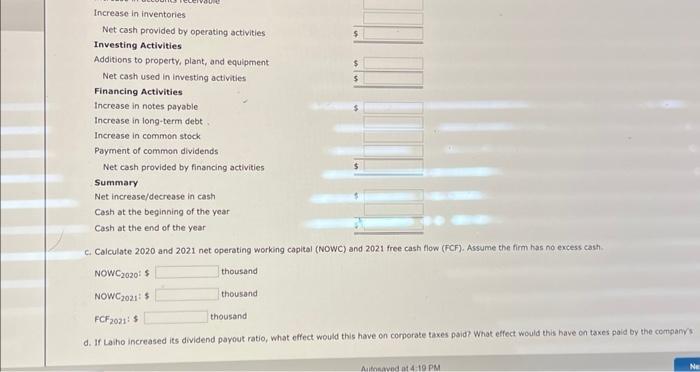

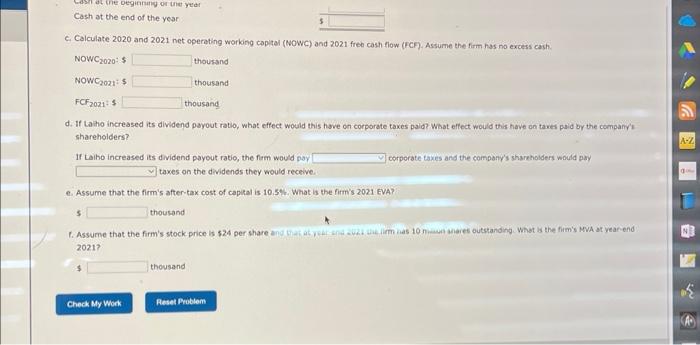

b. Construct the statement of stockholders' equity for the year ending Decensber 31, 2021, and the 2021 statement of cash flows. Hint: The diference ith accumulated depreciation from ane year to the next is the annual deprediation expense for the year. Laiho Industries: Balance Sheets as of December 31 (thousands of dellers) The dato has been collected in the Microsoft Excel file below, Download the spereadsheet and perform the required anavas to ansiner ine questions belan. Oo not round intermediate calcutations. Enter your answers in thousands, for example, an anwer of it theviand vhould be entered as 1 , not 1,000 , Round vour answers to the nearest whole number. Use a minus sign to enter negative values, if any. c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC 2020 is thousand NOWC 2021:5 thousand FCF 2021:5 thousand d. If Laho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the comp The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the recuired analrsis to answer the questiens below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand sheald be entered as 1 , not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any. Download spreadshest Financial Statements, Cash Flow, and Texes-70e622.xiss a. Sales for 2021 were $46$,150,000, and EBITDA was 1496 of saies. Furthermoce, depreciation and amortization were 17% of net foned assets, interest was $8,496,000, the corporate tax rate was 25%, and Laiho pays 47.25% of 7 s net income as dividends. Given this information, construct the firm's 2021 income statement. C. Calculate 2020 and 2021 net opereting working capital (NOWC) and 2021 freb cash flow (FCF). Assume the firm has no excess cash. NowC 2020:5 thousand NOWC2021: 5 thousand FCF 2021:5 thousand d. If Laiho increased its dividend payout ratio, what effect would this hove on corporate taxes pald? What effect would this have on tawes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would par corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10,5%. What is the firm's 2021 EVA? 5 thousand 2021 ? $ thousand b. Construct the statement of stockholders' equity for the year ending Decensber 31, 2021, and the 2021 statement of cash flows. Hint: The diference ith accumulated depreciation from ane year to the next is the annual deprediation expense for the year. Laiho Industries: Balance Sheets as of December 31 (thousands of dellers) The dato has been collected in the Microsoft Excel file below, Download the spereadsheet and perform the required anavas to ansiner ine questions belan. Oo not round intermediate calcutations. Enter your answers in thousands, for example, an anwer of it theviand vhould be entered as 1 , not 1,000 , Round vour answers to the nearest whole number. Use a minus sign to enter negative values, if any. c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC 2020 is thousand NOWC 2021:5 thousand FCF 2021:5 thousand d. If Laho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the comp The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the recuired analrsis to answer the questiens below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand sheald be entered as 1 , not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any. Download spreadshest Financial Statements, Cash Flow, and Texes-70e622.xiss a. Sales for 2021 were $46$,150,000, and EBITDA was 1496 of saies. Furthermoce, depreciation and amortization were 17% of net foned assets, interest was $8,496,000, the corporate tax rate was 25%, and Laiho pays 47.25% of 7 s net income as dividends. Given this information, construct the firm's 2021 income statement. C. Calculate 2020 and 2021 net opereting working capital (NOWC) and 2021 freb cash flow (FCF). Assume the firm has no excess cash. NowC 2020:5 thousand NOWC2021: 5 thousand FCF 2021:5 thousand d. If Laiho increased its dividend payout ratio, what effect would this hove on corporate taxes pald? What effect would this have on tawes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would par corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10,5%. What is the firm's 2021 EVA? 5 thousand 2021 ? $ thousand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts