Question: PLEASE ANSWER B,C,D AND I WILL LEAVE THUMBS UP IF CORRECT! THANK YOUU Your company has earnings per share of $6. It has 1 million

PLEASE ANSWER B,C,D AND I WILL LEAVE THUMBS UP IF CORRECT! THANK YOUU

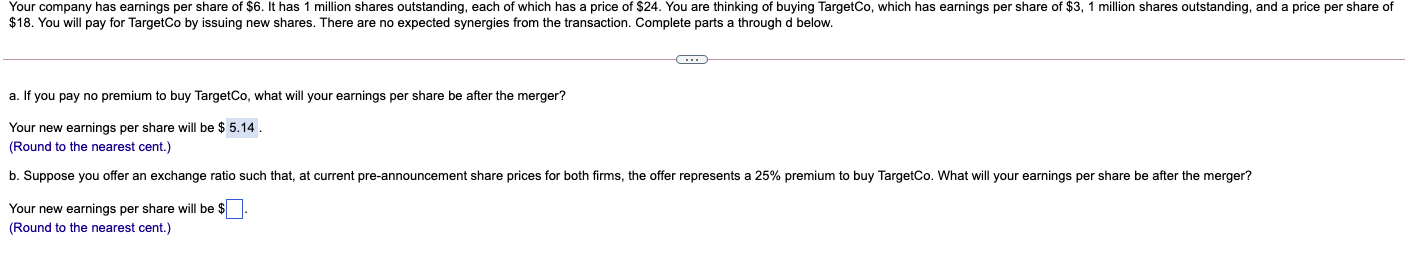

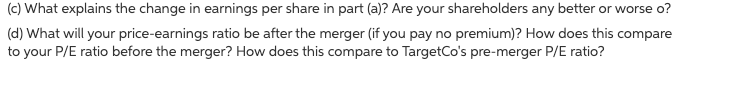

Your company has earnings per share of $6. It has 1 million shares outstanding, each of which has a price of $24. You are thinking of buying TargetCo, which has earnings per share of $3, 1 million shares outstanding, and a price per share of $18. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. Complete parts a through d below. .. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? Your new earnings per share will be $ 5.14. (Round to the nearest cent.) b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 25% premium to buy TargetCo. What will your earnings per share be after the merger? Your new earnings per share will be $- (Round to the nearest cent.) (c) What explains the change in earnings per share in part (a)? Are your shareholders any better or worse o? (d) What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare to TargetCo's pre-merger P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts