Question: please answer both a & b, shows steps and formula of calculation, thank you Suppose you purchase a 10-year bond with 6.3% annual coupons. You

please answer both a & b, shows steps and formula of calculation, thank you

please answer both a & b, shows steps and formula of calculation, thank you

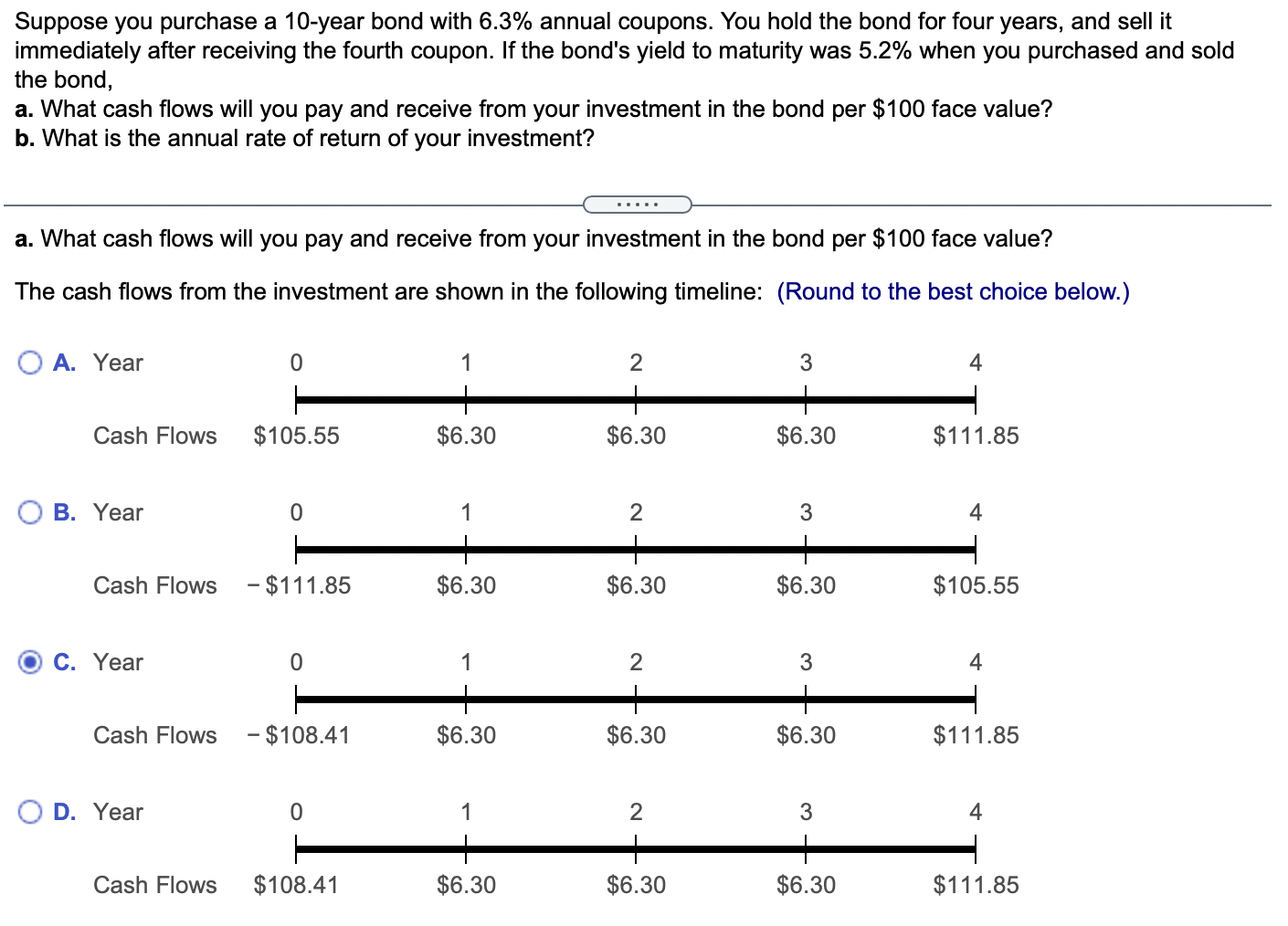

Suppose you purchase a 10-year bond with 6.3% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 5.2% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the annual rate of return of your investment? a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below.) O A. Year 0 1 2 3 4 Cash Flows $105.55 $6.30 $6.30 $6.30 $111.85 OB. Year 0 1 2 3 4 Cash Flows - $111.85 $6.30 $6.30 $6.30 $105.55 C. Year 0 1 2 3 4 Cash Flows - $108.41 $6.30 $6.30 $6.30 $111.85 D. Year 0 1 2 3 4 Cash Flows $108.41 $6.30 $6.30 $6.30 $111.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts