Question: Please Answer both D Question 2 1 pts Winnebagel Corp.currently sells 22,193 motor homes per year at $59,849 each, and 13,733 luxury motor coaches per

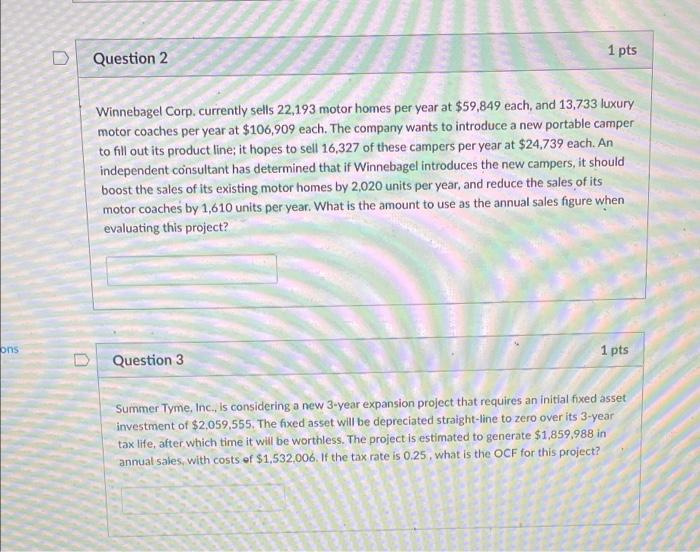

D Question 2 1 pts Winnebagel Corp.currently sells 22,193 motor homes per year at $59,849 each, and 13,733 luxury motor coaches per year at $106,909 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 16,327 of these campers per year at $24,739 each. An independent consultant has determined that if Winnebagel introduces the new campers, it should boost the sales of its existing motor homes by 2,020 units per year, and reduce the sales of its motor coaches by 1,610 units per year. What is the amount to use as the annual sales figure when evaluating this project? ons 1 pts D Question 3 Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $2,059,555. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will be worthless. The project is estimated to generate $1,859,988 in annual sales, with costs of $1,532,006. If the tax rate is 0.25, what is the OCF for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts