Question: Please answer both Part E FastTrack Corporation manufactures batons. FastTrack can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed

Please answer both

Please answer both

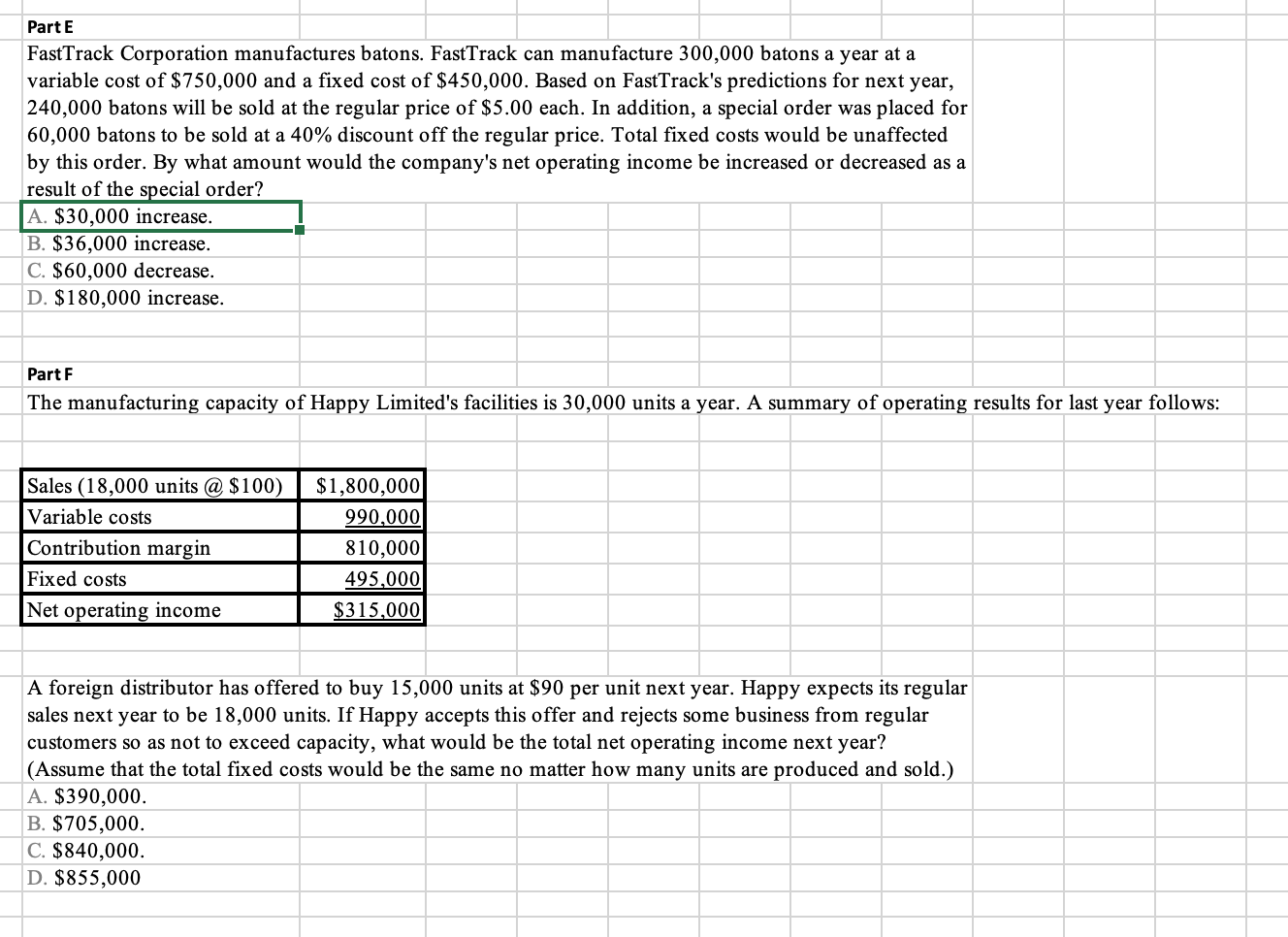

Part E FastTrack Corporation manufactures batons. FastTrack can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000. Based on FastTrack's predictions for next year, 240,000 batons will be sold at the regular price of $5.00 each. In addition, a special order was placed for 60,000 batons to be sold at a 40% discount off the regular price. Total fixed costs would be unaffected by this order. By what amount would the company's net operating income be increased or decreased as a result of the special order? A. $30,000 increase. B. $36,000 increase. C. $60,000 decrease. D. $180,000 increase. Part F The manufacturing capacity of Happy Limited's facilities is 30,000 units a year. A summary of operating results for last year follows: Sales (18,000 units @ $100) Variable costs Contribution margin Fixed costs Net operating income $1,800,000 990,000 810,000 495,000 $315,000 A foreign distributor has offered to buy 15,000 units at $90 per unit next year. Happy expects its regular sales next year to be 18,000 units. If Happy accepts this offer and rejects some business from regular customers so as not to exceed capacity, what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold.) A. $390,000. B. $705,000. C. $840,000. D. $855,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts