Question: please answer both parts 9. A and B can borrow for a 5-yrear term at the following rates: (20%) Rating Fixed rate borrowing cost Floating

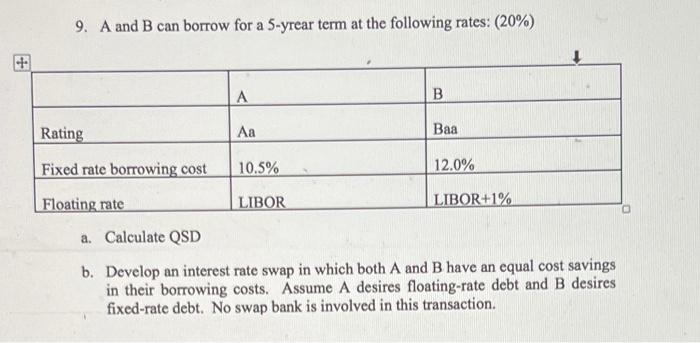

9. A and B can borrow for a 5-yrear term at the following rates: (20%) Rating Fixed rate borrowing cost Floating rate A Aa 10.5% LIBOR B Baa 12.0% LIBOR+1% a. Calculate QSD b. Develop an interest rate swap in which both A and B have an equal cost savings in their borrowing costs. Assume A desires floating-rate debt and B desires fixed-rate debt. No swap bank is involved in this transaction

Step by Step Solution

There are 3 Steps involved in it

To solve this problem lets address both parts step by step a Calculate QSD Quality Spread Differenti... View full answer

Get step-by-step solutions from verified subject matter experts