Question: please answer both parts to this question in a timely manner. thank you Question 3 The following costs were incurred by AstraZeneca Limited on the

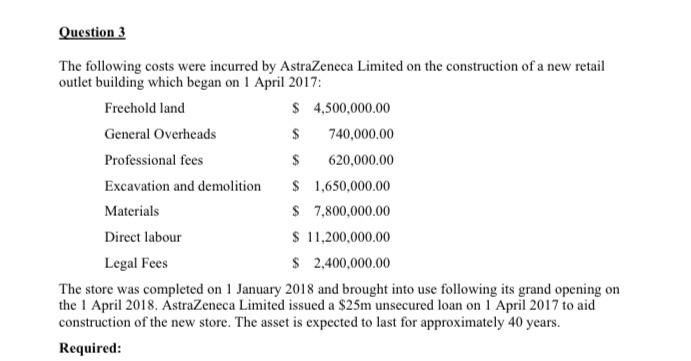

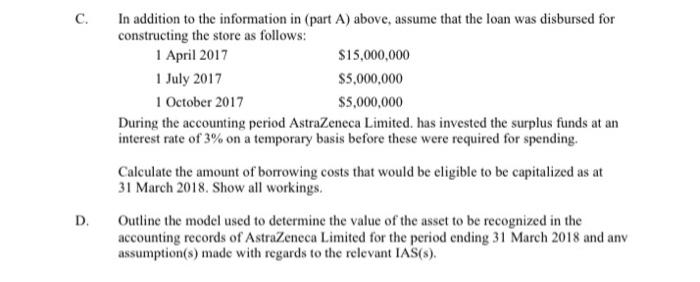

Question 3 The following costs were incurred by AstraZeneca Limited on the construction of a new retail outlet building which began on 1 April 2017: Freehold land $ 4,500,000.00 General Overheads $ 740,000.00 Professional fees $ 620,000.00 Excavation and demolition $ 1,650,000.00 Materials $ 7,800,000.00 Direct labour $ 11,200,000.00 Legal Fees $ 2,400,000.00 The store was completed on 1 January 2018 and brought into use following its grand opening on the 1 April 2018. AstraZeneca Limited issued a $25m unsecured loan on 1 April 2017 to aid construction of the new store. The asset is expected to last for approximately 40 years. Required: c. In addition to the information in (part A) above, assume that the loan was disbursed for constructing the store as follows: 1 April 2017 $15,000,000 1 July 2017 $5,000,000 1 October 2017 $5,000,000 During the accounting period AstraZeneca Limited, has invested the surplus funds at an interest rate of 3% on a temporary basis before these were required for spending. Calculate the amount of borrowing costs that would be eligible to be capitalized as at 31 March 2018. Show all workings. Outline the model used to determine the value of the asset to be recognized in the accounting records of AstraZeneca Limited for the period ending 31 March 2018 and any assumption(s) made with regards to the relevant IAS(s). D. Question 3 The following costs were incurred by AstraZeneca Limited on the construction of a new retail outlet building which began on 1 April 2017: Freehold land $ 4,500,000.00 General Overheads $ 740,000.00 Professional fees $ 620,000.00 Excavation and demolition $ 1,650,000.00 Materials $ 7,800,000.00 Direct labour $ 11,200,000.00 Legal Fees $ 2,400,000.00 The store was completed on 1 January 2018 and brought into use following its grand opening on the 1 April 2018. AstraZeneca Limited issued a $25m unsecured loan on 1 April 2017 to aid construction of the new store. The asset is expected to last for approximately 40 years. Required: c. In addition to the information in (part A) above, assume that the loan was disbursed for constructing the store as follows: 1 April 2017 $15,000,000 1 July 2017 $5,000,000 1 October 2017 $5,000,000 During the accounting period AstraZeneca Limited, has invested the surplus funds at an interest rate of 3% on a temporary basis before these were required for spending. Calculate the amount of borrowing costs that would be eligible to be capitalized as at 31 March 2018. Show all workings. Outline the model used to determine the value of the asset to be recognized in the accounting records of AstraZeneca Limited for the period ending 31 March 2018 and any assumption(s) made with regards to the relevant IAS(s). D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts