Question: Please answer both problems and show work in detail. I appreciate your help. Joon.com is considering two projects given below: If the two projects have

Please answer both problems and show work in detail. I appreciate your help.

Please answer both problems and show work in detail. I appreciate your help.

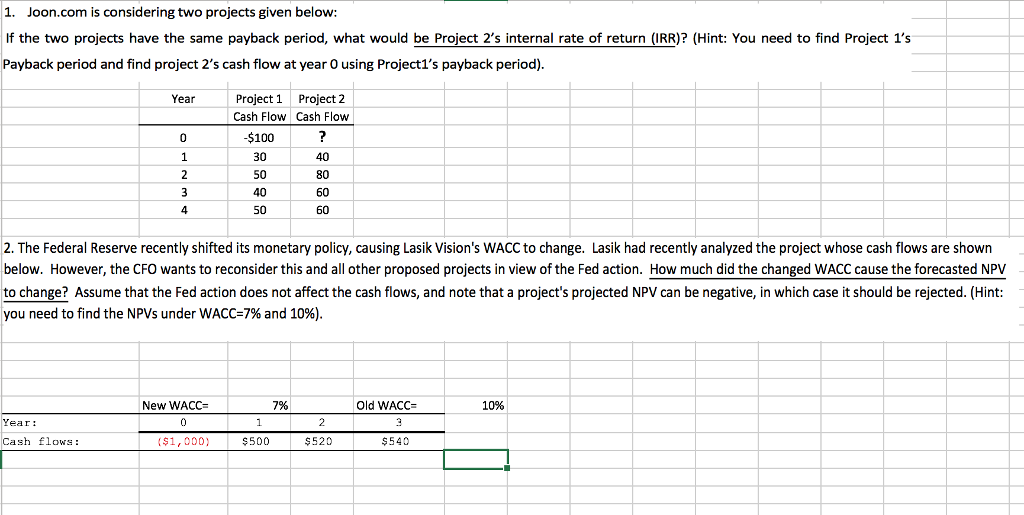

Joon.com is considering two projects given below: If the two projects have the same payback period, what would be Project 2's internal rate of return (IRR)? The Federal Reserve recently shifted its monetary policy, causing Lasik Vision's WACC to change. Lasik had recently analyzed the project whose cash flows are shown below. However, the CFO wants to reconsider this and all other proposed projects in view of the Fed action. How much did the changed WACC cause the forecasted NPV to change? Assume that the Fed action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts