Question: please answer both Q Q2 asap please all questions I really appreciate it At the beginning of the year, Learer Company's manager estimated total direct

please answer both Q

Q2

asap please all questions I really appreciate it

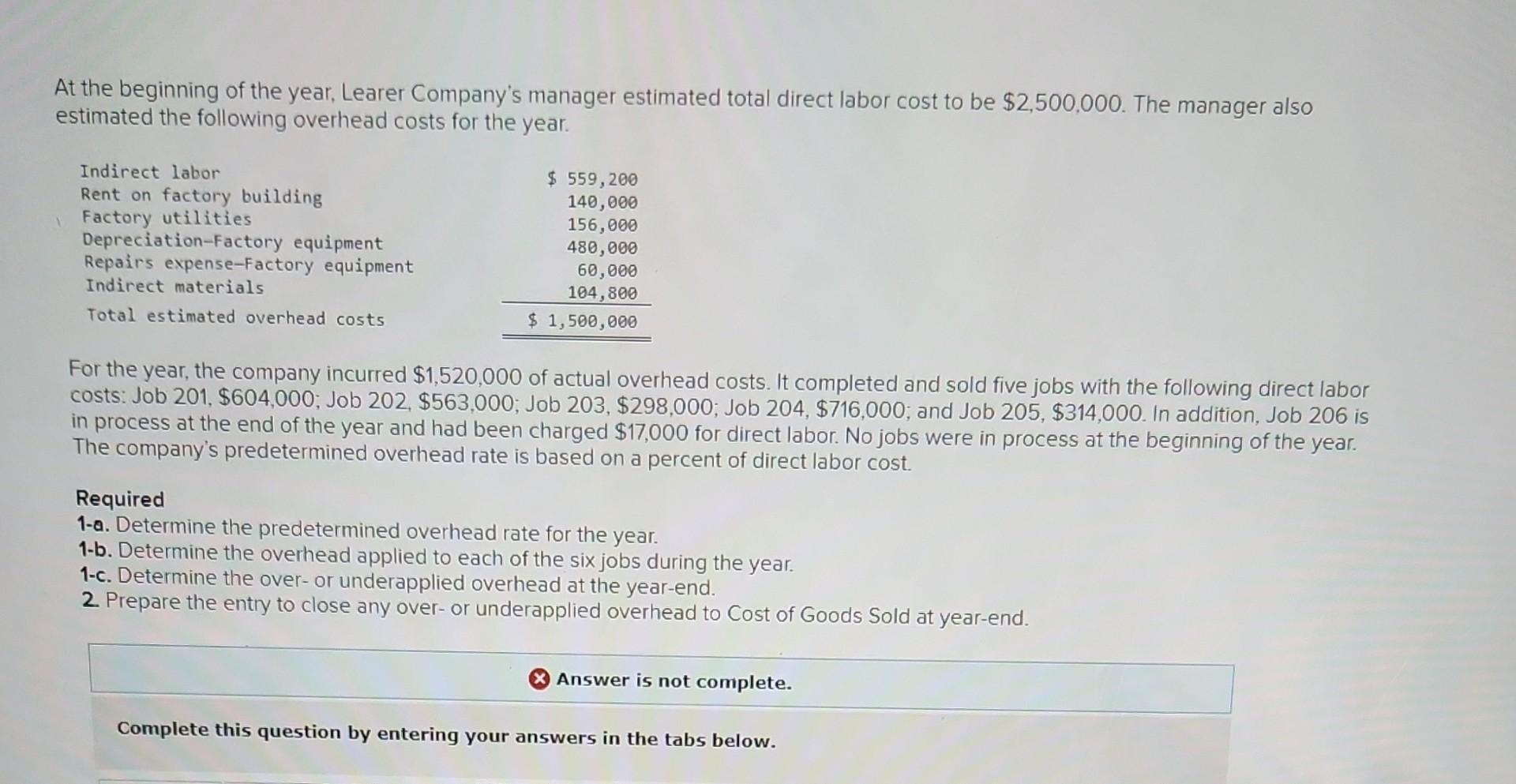

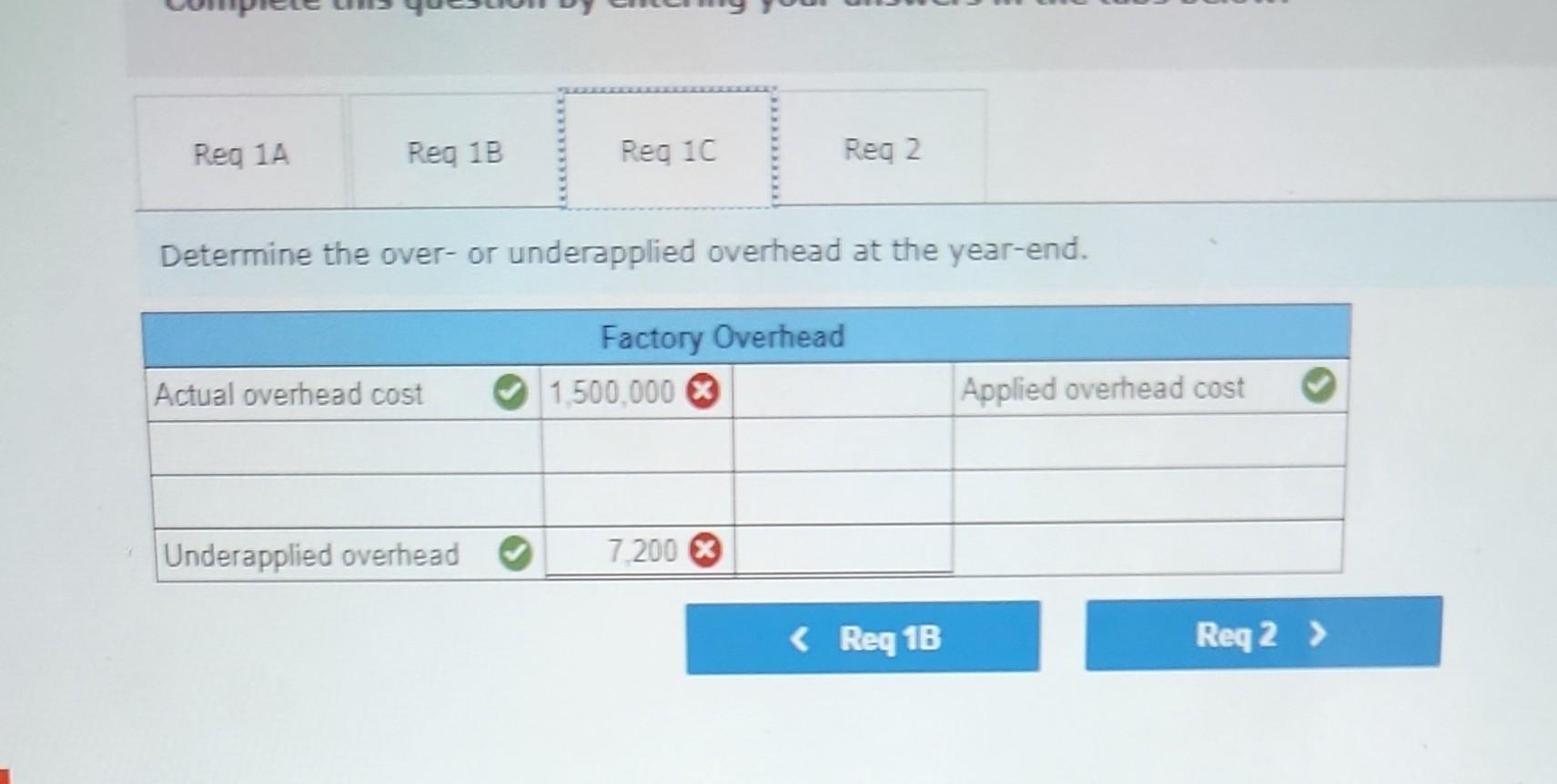

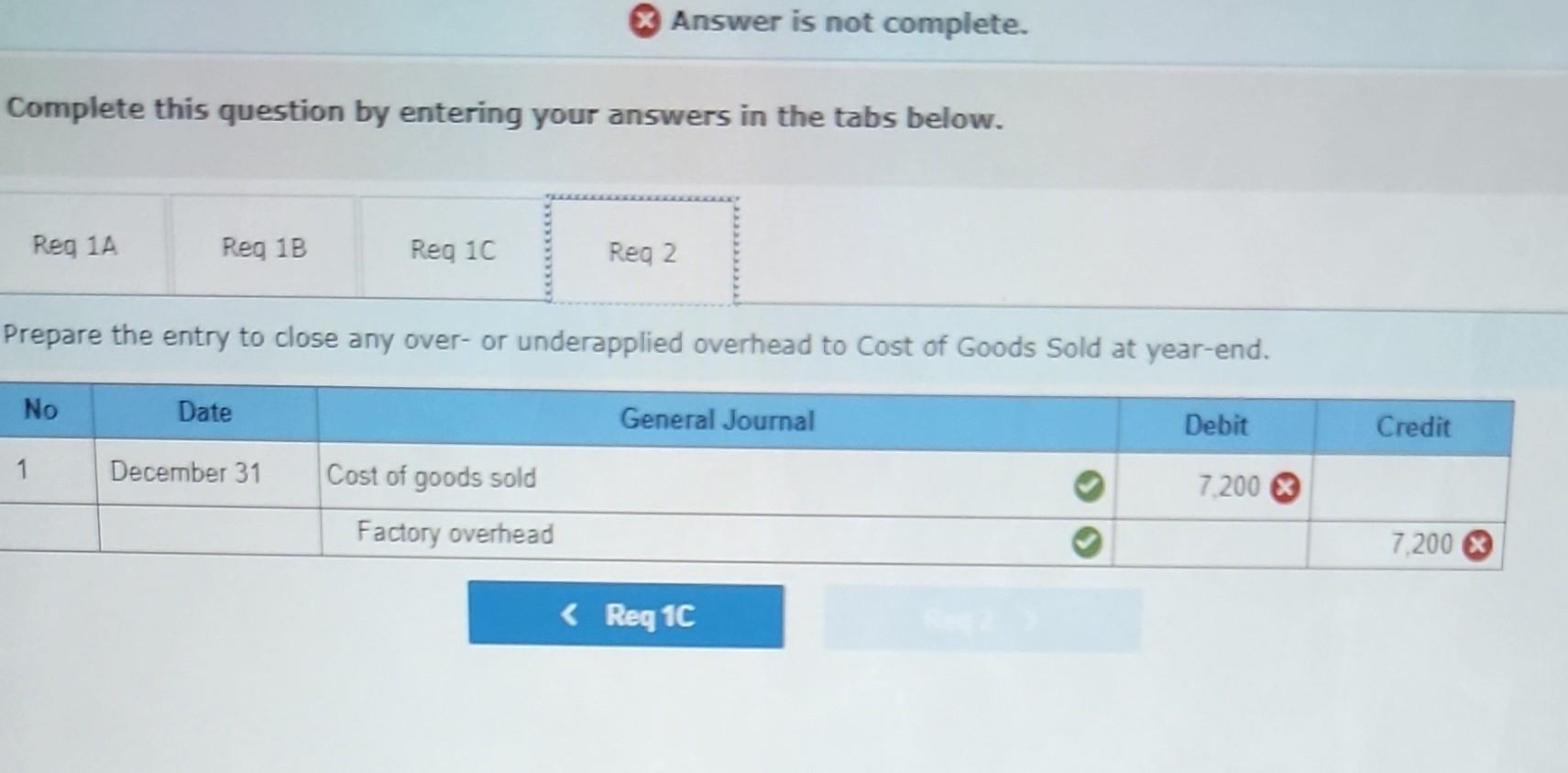

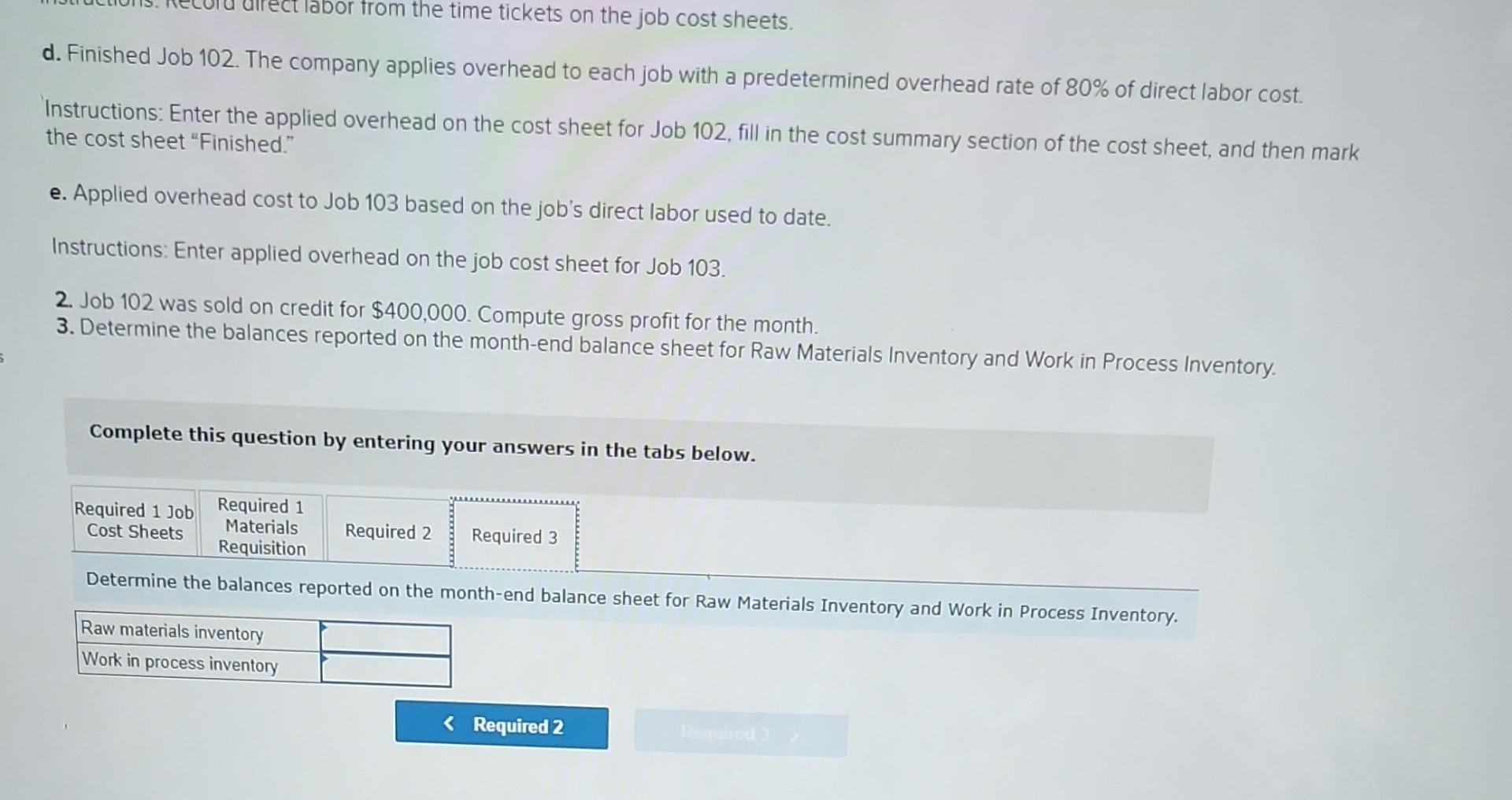

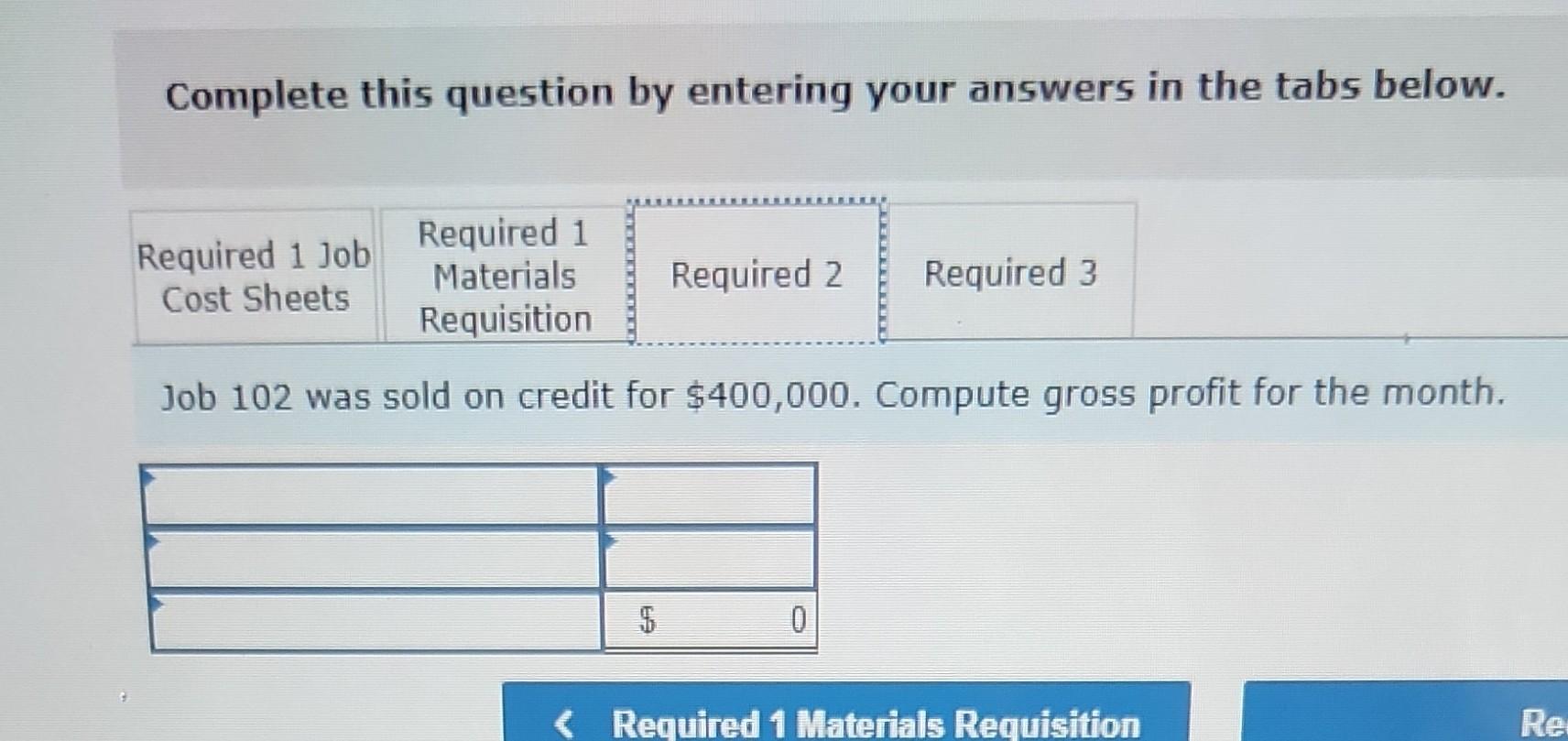

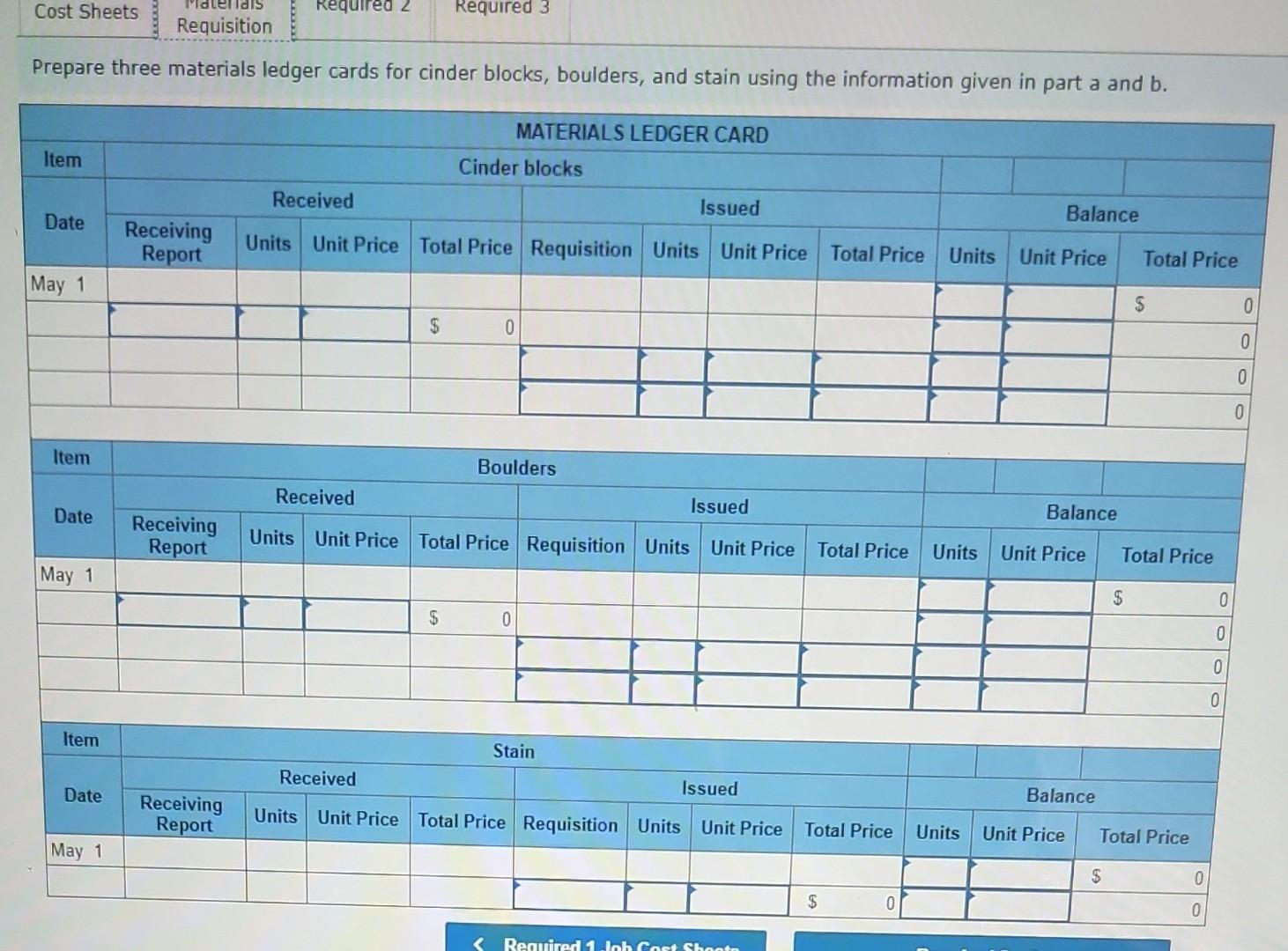

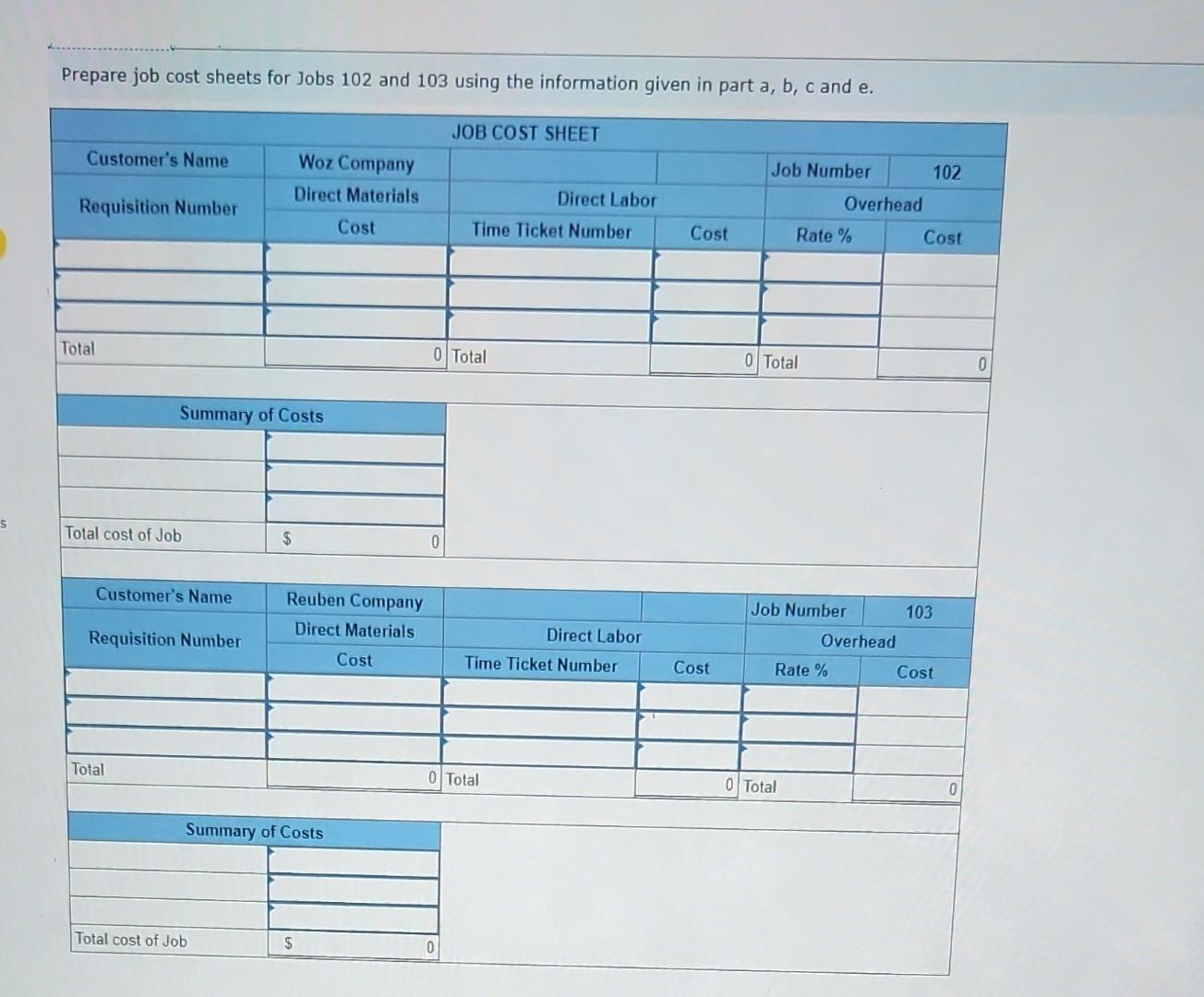

At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,500,000. The manager also estimated the following overhead costs for the year. Indirect labor Rent on factory building Factory utilities Depreciation-Factory equipment Repairs expense-Factory equipment Indirect materials Total estimated overhead costs $ 559,200 140,000 156,000 480,000 60,000 104,800 $1,500,000 For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000; Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Actual overhead cost Req 1C Determine the over- or underapplied overhead at the year-end. Factory Overhead Underapplied overhead 1,500,000 X Req 2 7.200 X Complete this question by entering your answers in the tabs below. Reg 1A No 1 Reg 1B Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Date Req 1C December 31 Answer is not complete. Cost of goods sold Factory overhead Req 2 General Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts