Question: please answer both question with all parts! ill leave a good review You have gast been Hired as a financial analost for Lydex Conopanyi a

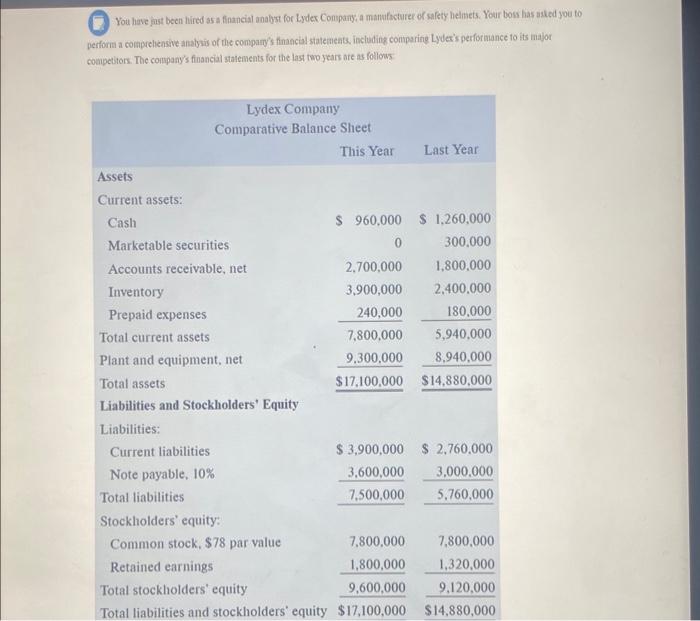

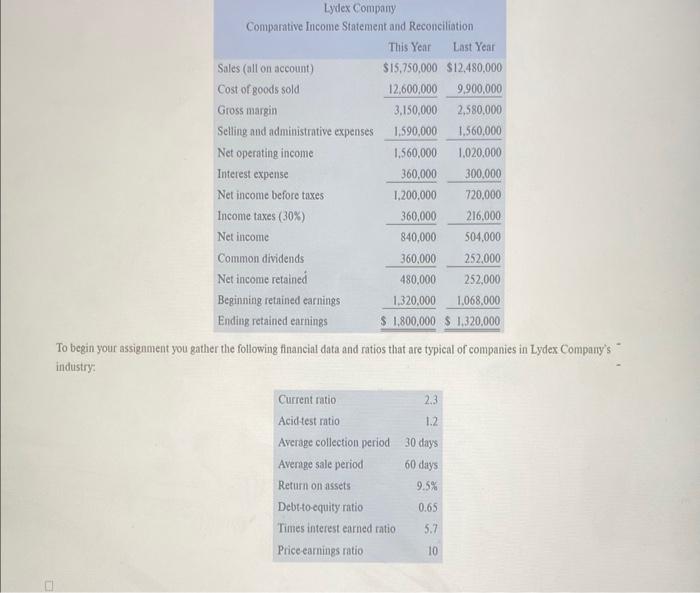

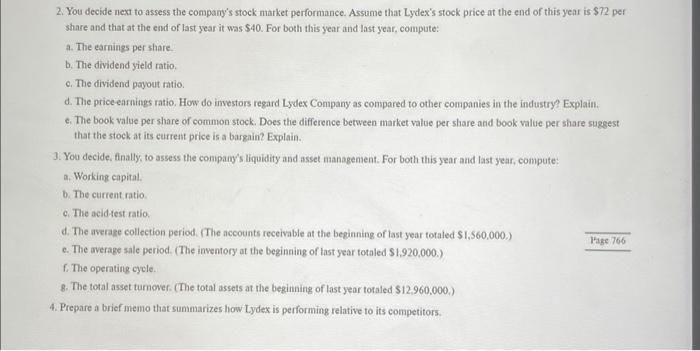

You have gast been Hired as a financial analost for Lydex Conopanyi a mannifacturer of safety helimets. Yoar boss has asked you to perform a compeclienshe anaby is of the compary's fimacial statemeab. iocluding comparing Lyder's performance fo its major coapetitors. The company's financial statements for the last tho years are as follows. To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: 2. You decide next to assess the company's stock market performance. Assume that Lydex's stock price at the end of this year is $72 per share and that at the end of last year it was $40. For both this year and last year, compute: a. The earnings pershare. b. The dividend yield ratio. c. The dividend payout ratio. . The price earnings ratio. How do imvestors regard Lydex Company as compared to other companies in the industry? Explain. c. The book value per share of common stock. Does the difference between market value per share and book value per share suggest that the stock at its current price is a bargain? Explain. 3. You decide, finally, to assess the company's liquidity and asset managenent. For both this year and last year, compute: a. Working capital. b. The current ratio c. The acidetest ratio. d. The average collection period. (The accounts receivable at the beginning of last year totaled $1,560,000.) e. The average sale period. (The inventory at the beginaing of last year totaled $1,920,000.) f. The operating cycle. 8. The total asset turnover. (The total assets at the beginning of last year toraled $12,960,000,) 4. Prepare a brief memo that summarizes how Lydex is performing relative to its competitors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts