Question: Please answer both questions and show work!! I will appreciate it a lot!! ASAP Answer the following problems on your own paper. Present Value Tables

Please answer both questions and show work!!

I will appreciate it a lot!!

ASAP

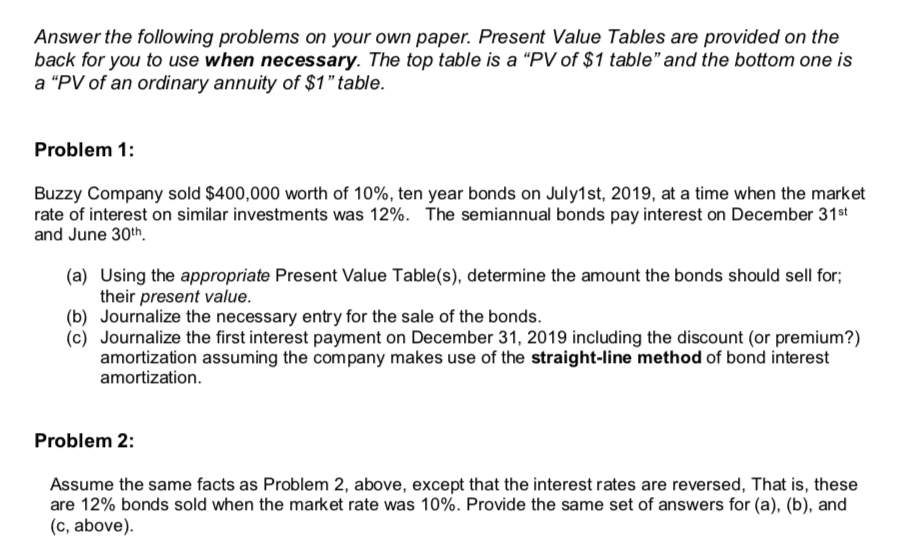

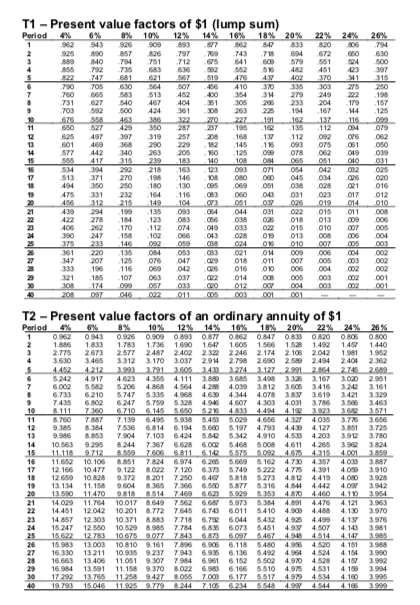

Answer the following problems on your own paper. Present Value Tables are provided on the back for you to use when necessary. The top table is a "PV of $1 table"and the bottom one is a "PV of an ordinary annuity of $1"table. Problem 1 Buzzy Company sold $400,000 worth of 10%, ten year bonds on July1 st, 2019, at a time when the market rate of interest on similar investments was 12%. The semiannual bonds pay interest on December 31st and June 30th. (a) Using the appropriate Present Value Table(s), determine the amount the bonds should sell for, their present value. (b) Journalize the necessary entry for the sale of the bonds. (c) Journalize the first interest payment on December 31, 2019 including the discount (or premium?) amortization assuming the company makes use of the straight-line method of bond interest amortization Problem 2: Assume the same facts as Problem 2, above, except that the interest rates are reversed, That is, these are 12% bonds sold when the market rate was 10%. Provide the same set of answers for (a), (b), and (c, above) T1 - Present value factors of $1 (lump sum) 925 890 857 826 797 9 743 718 694 672 650 630 889 840 794751 712 5 641 60 579 551 24 00 855 792 735 683 636 2 5&2 5 482 451 423 397 790 705 630 564 507 456 410 31 335 303 275 250 760 665 583 513 452 400 354 3 279 249 22 198 731 703 592 500 424 361 308 263 225 194 167 44 125 627 540 467 404 351 305 285 233 204 179 157 650 527 429 350 287 237 625 497 397 319 257 z8 168 137 601 469 368 290 229182 145 577 442 340 263 205 0 125 090 078 06.2 04.9 039 95 12 112 79 12 1 09.3 075 001 050 513 371 270 198 146 103080 045 034 020 494 350 250 180 475 331 232 164 116 083 060 043 031 023 017 012 130 060 001 038 028 021 016 21 439 294 199 422 278 184 123 083 056 038 025 018 013 09 06 135 083 4 044 031 022 015 011 170 112 074 049 033 012 015 010 7 5 390 247 158102 066 03 028 019 013 008 006 04 347 207 125 076 047 018 011 007 5 3 002 333 196 116 069 042 0 016 010 006 004 002 02 321 185 107 3 037 Q2 014 005 3 2 001 T2 -Present value factors of an ordinary annuity of $1 0.962 0943 926 9 0.893 0877 0862 0847 0833 0820 0 805 0.800 1833 1783 1736 1690 1647 1605 1.566 1528 1492 145 1440 2775 2673 2577 2487 2402 2322 2246 2174 2.105 2042 1981 1952 3630 3465 3312 3170 3037 2914 2798 2690 25M 2494 2401 2362 5242 4917 4623 4355 4111 38 3685 3498 3326 3167 3020 2951 6.002 5582 5206 4868 4564 4288 4039 3812 3605 3416 3242 3.161 6.733 6210 5747 5335 4968 469 4344 4078 38 3619 3421 3.329 7435 6.802 6247 759 5328 4945 4607 4303 4031 3.786 3.585 3.463 11 8760 7887 7139 64955938 54535029 4656 4327 4035 37 3656 12 9385 8384 7536 6814 194 5660 5.197 4.793 4439 4127 3.851 3 725 13 9 986 8853 7904 7.103 6424 5842 5342 4910 4.53 4 203 3912 3 780 14 105639195 824473676628600254685 4611 42653923824 16 1652 10.106 8851 7824 6974 6285 5669 5162 4.730 4 357 4033 3 887 17 12 166 10477-9 122 8022 7120 6373 5749 5222 4775 4391 40 3910 18 12659 10.828 9372 8201 7250 6467 5818 5273 4.812 4419 4080 3 928 19 13134 11158 9604 8365 7366 65 5877 5316 4844 4442 40W 3942 21 64 10017 8649 7562 668 5973 5384 4891 4476 4121 3963 22 14 451 12042 10201 8772 7645 6743 6011 5410 4 4488 4130 3970 23 14857 12303 10.371 8883 7718 6.72 6044 5432 4 925 4499 41 3 976 24 15 247 12550 10529 898 7784 6835 6073 5451 4937 4507 4143 3981 14 029 26 15 983 13003 10810 9161 7896 66118 5480 4986 4520 4151 3 27 16 330 13211 10.935 9237 7943 6933 6.136 5492 4964 4 524 4.154 3 980 28 16663 13406 11051 9307 7984 6901 6152 5502 49 4528 4157 3992 29 16 984 13 591 1115893708022661665510 494531 41 3994 517 4979 4534 4100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts