Question: please answer the questions and show your work 11 5.00% $5,000.00 12 For questions 1 - 4 use a required nominal annual return: 13 1.

please answer the questions and show your work

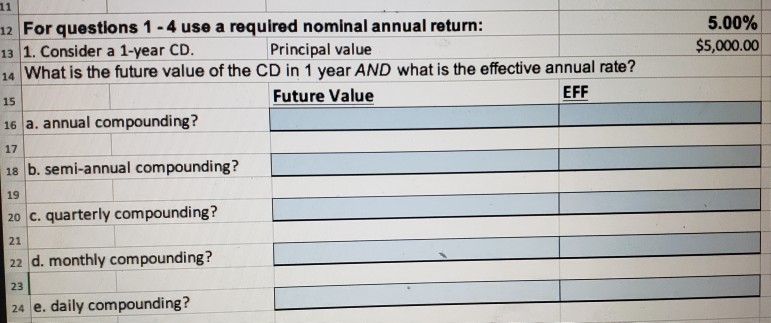

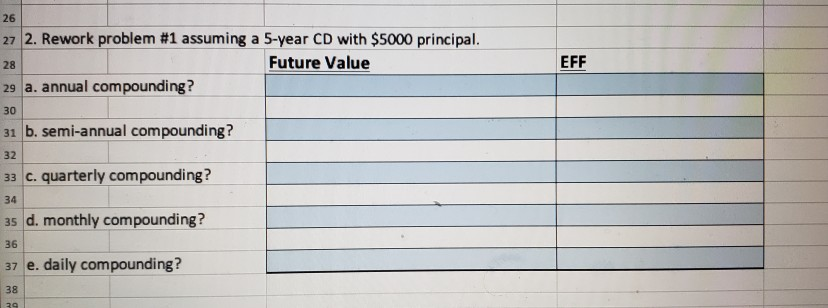

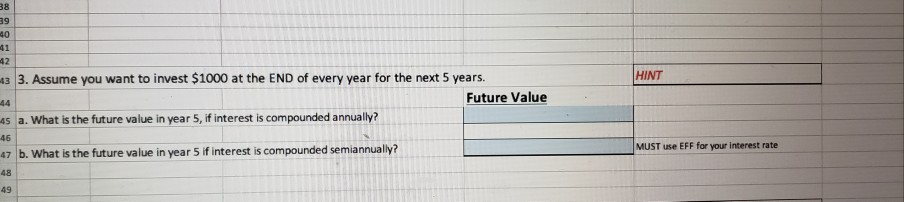

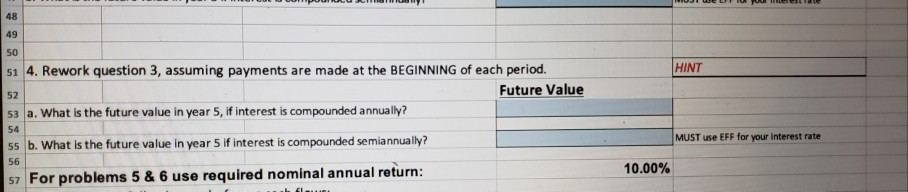

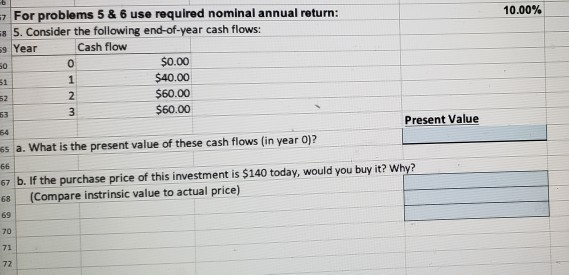

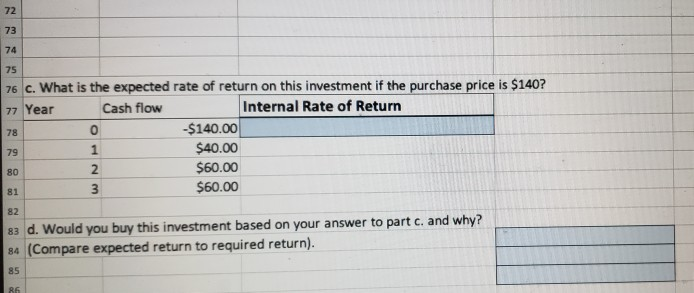

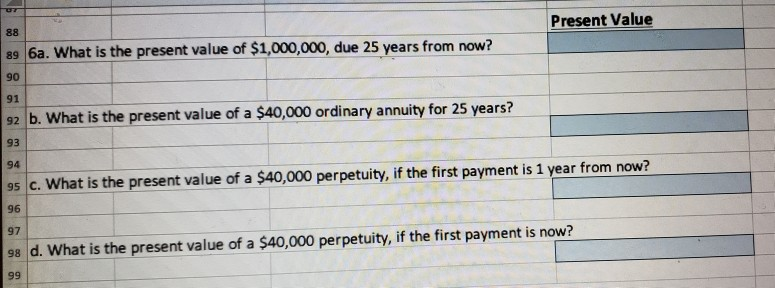

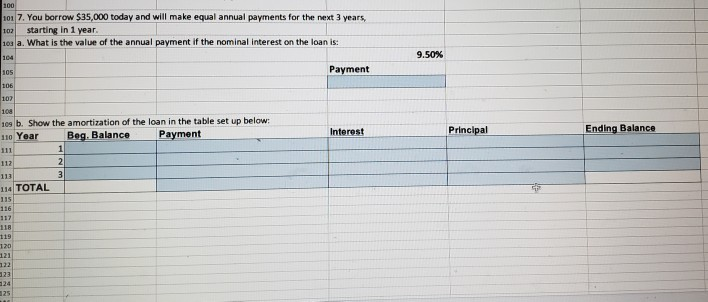

11 5.00% $5,000.00 12 For questions 1 - 4 use a required nominal annual return: 13 1. Consider a 1-year CD. Principal value 14 What is the future value of the CD in 1 year AND what is the effective annual rate? Future Value EFF 16 a. annual compounding? 17 18 b. semi-annual compounding? 15 19 20 C. quarterly compounding? 21 22 d. monthly compounding? 23 24 e. daily compounding? 26 28 27 2. Rework problem #1 assuming a 5-year CD with $5000 principal. Future Value 29 a. annual compounding? EFF 30 31 b. semi-annual compounding? 32 33 c. quarterly compounding? 34 35 d. monthly compounding? 36 37 e. daily compounding? 38 39 38 39 40 41 42 HINT 43 3. Assume you want to invest $1000 at the END of every year for the next 5 years. Future Value 45 a. What is the future value in year 5, if interest is compounded annually? 44 46 MUST use EFF for your interest rate 47 b. What is the future value in year 5 If interest is compounded semiannually? 49 48 49 SO HINT 52 51 4. Rework question 3, assuming payments are made at the BEGINNING of each period. Future Value 53 a. What is the future value in year 5, if interest is compounded annually? 55 b. What is the future value in year 5 if interest is compounded semiannually? 54 MUST use EFF for your interest rate 56 10.00% 57 For problems 5 & 6 use required nominal annual return: 10.00% = For problems 5 & 6 use required nominal annual return: 8 5. Consider the following end-of-year cash flows: 59 Year Cash flow 50 0 $0.00 51 1 $40.00 52 2 $60.00 53 3 $60.00 Present Value 54 65 a. What is the present value of these cash flows (in year O)? 66 67 b. If the purchase price of this investment is $140 today, would you buy it? Why? (Compare instrinsic value to actual price) 68 69 71 72 72 73 74 77 Year 75 76 C. What is the expected rate of return on this investment if the purchase price is $140? Cash flow Internal Rate of Return 78 0 $140.00 79 1 $40.00 2 $60.00 3 $60.00 80 81 82 83 d. Would you buy this investment based on your answer to part c. and why? 84 (Compare expected return to required return). 85 86 Present Value 88 89 6a. What is the present value of $1,000,000, due 25 years from now? 90 91 92 b. What is the present value of a $40,000 ordinary annuity for 25 years? 93 94 95 c. What is the present value of a $40,000 perpetuity, if the first payment is 1 year from now? 96 97 98 d. What is the present value of a $40,000 perpetuity, if the first payment is now? 99 100 101 7. You borrow $35,000 today and will make equal annual payments for the next 3 years, 102 starting in 1 year 103 a. What is the value of the annual payment if the nominal interest on the loan is: 104 9.50% Payment Interest Principal Ending Balance 105 106 107 108 109 b. Show the amortization of the loan in the table set up below: 110 Year Beg. Balance Payment 1 112 2 3 114 TOTAL 115 116 117 118 119 120 121 122 23 113 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts