Question: Please answer both questions correctly. thanks so much in advance. Suppose Rocky Brands has earnings per share of $2.47 and EBITDA of $30.9 million. The

Please answer both questions correctly.

thanks so much in advance.

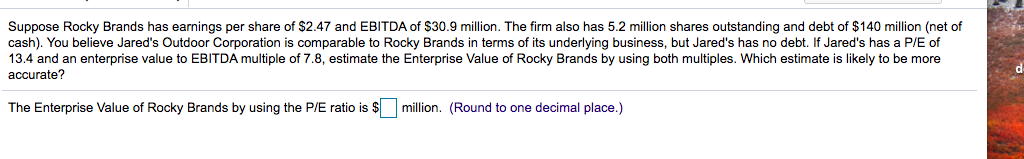

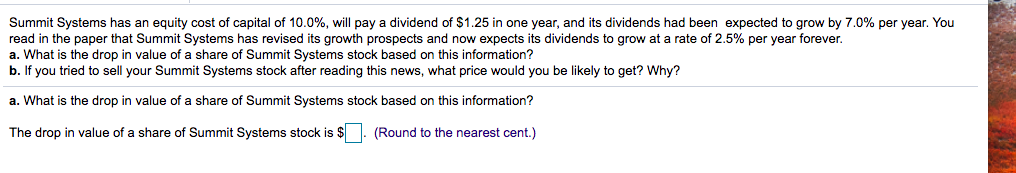

Suppose Rocky Brands has earnings per share of $2.47 and EBITDA of $30.9 million. The firm also has 5.2 million shares outstanding and debt of $140 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.4 and an enterprise value to EBITDA multiple of 7.8, estimate the Enterprise Value of Rocky Brands by using both multiples. Which estimate is likely to be more accurate? The Enterprise Value of Rocky Brands by using the P/E ratio is $ million. (Round to one decimal place.) Summit Systems has an equity cost of capital of 10.0%, will pay a dividend of $1.25 in one year, and its dividends had been expected to grow by 7.0% per year. You read in the paper that Summit Systems has revised its growth prospects and now expects its dividends to grow at a rate of 2.5% per year forever. a. What is the drop in value of a share of Summit Systems stock based on this information? b. If you tried to sell your Summit Systems stock after reading this news, what price would you be likely to get? Why? a. What is the drop in value of a share of Summit Systems stock based on this information? The drop in value of a share of Summit Systems stock is $. (Round to the nearest cent.) Suppose Rocky Brands has earnings per share of $2.47 and EBITDA of $30.9 million. The firm also has 5.2 million shares outstanding and debt of $140 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.4 and an enterprise value to EBITDA multiple of 7.8, estimate the Enterprise Value of Rocky Brands by using both multiples. Which estimate is likely to be more accurate? The Enterprise Value of Rocky Brands by using the P/E ratio is $ million. (Round to one decimal place.) Summit Systems has an equity cost of capital of 10.0%, will pay a dividend of $1.25 in one year, and its dividends had been expected to grow by 7.0% per year. You read in the paper that Summit Systems has revised its growth prospects and now expects its dividends to grow at a rate of 2.5% per year forever. a. What is the drop in value of a share of Summit Systems stock based on this information? b. If you tried to sell your Summit Systems stock after reading this news, what price would you be likely to get? Why? a. What is the drop in value of a share of Summit Systems stock based on this information? The drop in value of a share of Summit Systems stock is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts