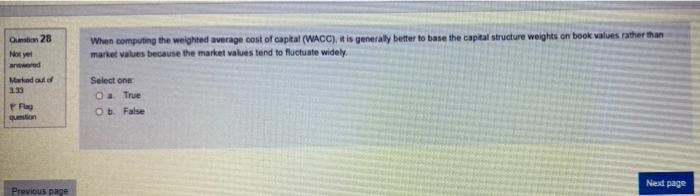

Question: When computing the weighted average cost of captal (WACC), it is generally better to base the capital structure weights on book values rather than market

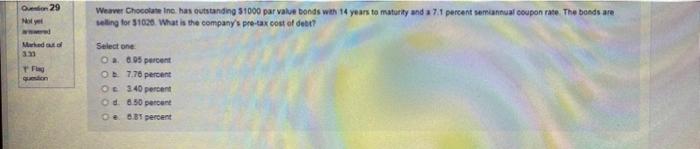

When computing the weighted average cost of captal (WACC), it is generally better to base the capital structure weights on book values rather than market values because the market values tend to fluctuate widely Qui 28 Not yet arred Marked out of 123 Select one O True Ot False Plag Question Nead page Previous page 29 Noel Weaver Chocolate Inc. has outstanding 51000 par value bonds with 14 years to maturity and a 71 percent semiannual coupon rate. The bands are seling for 51020 What is the company's pre-tax cost of det? Marked out of F Select one O 0.05 percent OD 7.70 percent 340 percent Od 650 percent 6.39 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock