Question: please answer both questions Problem 1. Selected accounts from the ledger of Hughes Company appear below. For each account, indicate the following: (a) In the

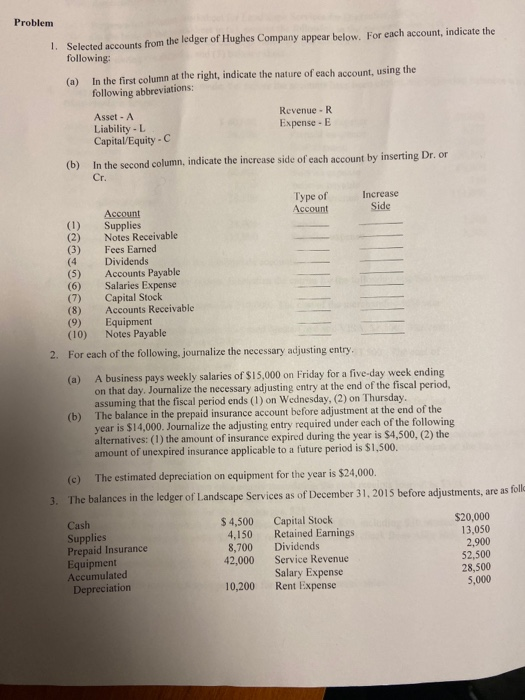

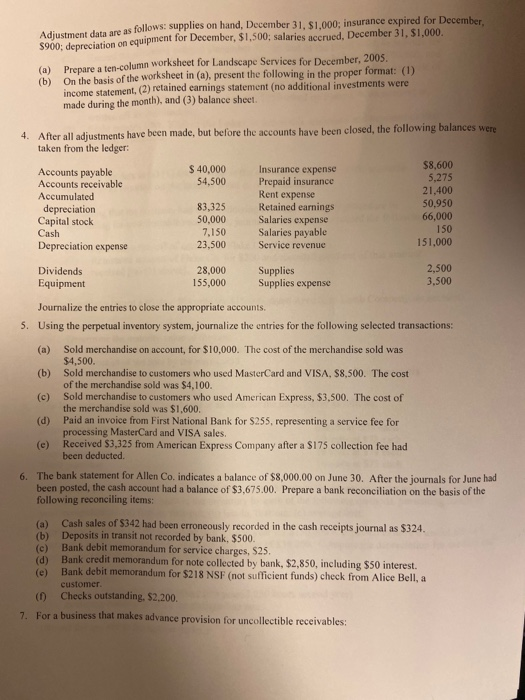

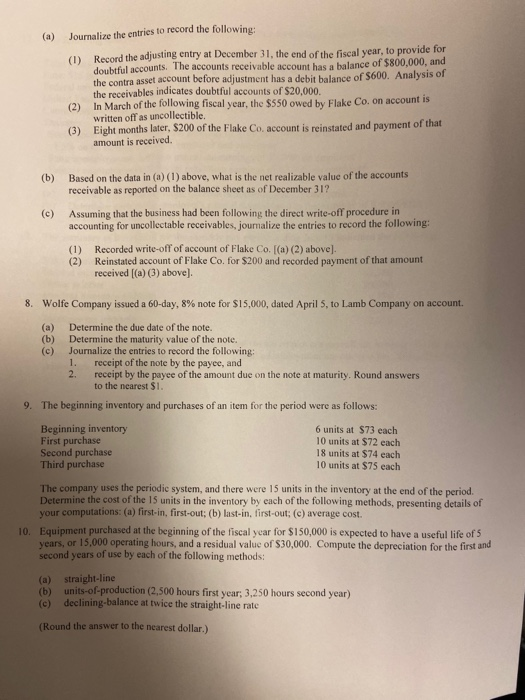

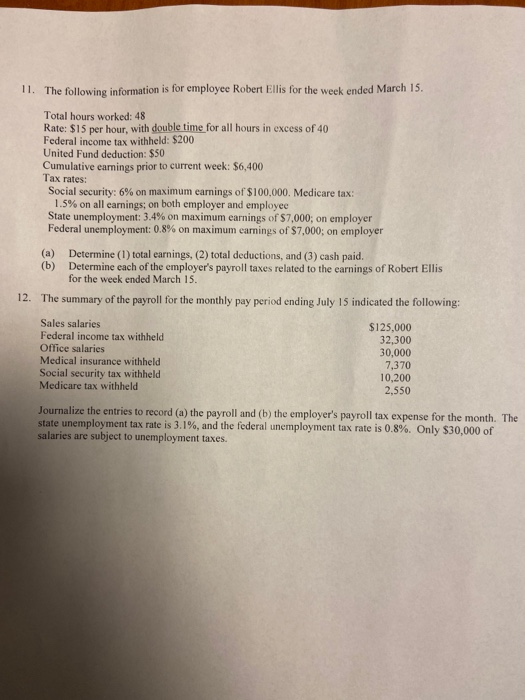

Problem 1. Selected accounts from the ledger of Hughes Company appear below. For each account, indicate the following: (a) In the first column at the right, indicate the nature of each account, using the following abbreviations: Revenue - R Asset - A Liability - L Expense - E Capital/Equity- In the second column, indicate the increase side of each account by inserting Dr. or Cr. (b) Increase Side Type of Account Account Supplies (2) Notes Receivable Fees Earned Dividends Accounts Payable (6) Salaries Expense (7) Capital Stock (8) Accounts Receivable (9) Equipment (10) Notes Payable For each of the following, journalize the necessary adjusting entry. 2. (a) (b) A business pays weekly salaries of $15,000 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the fiscal period, assuming that the fiscal period ends (1) on Wednesday, (2) on Thursday. The balance in the prepaid insurance account before adjustment at the end of the year is $14,000. Journalize the adjusting entry required under each of the following alternatives: (1) the amount of insurance expired during the year is $4,500, (2) the amount of unexpired insurance applicable to a future period is $1.500. (c) The estimated depreciation on equipment for the year is $24,000. The balances in the ledger of Landscape Services as of December 31, 2015 before adjustments, are as folk 3. Cash Supplies Prepaid Insurance Equipment Accumulated Depreciation $4,500 4,150 8,700 42,000 Capital Stock Retained Earnings Dividends Service Revenue Salary Expense Rent Expense $20,000 13,050 2,900 52,500 28,500 5,000 10,200 Adjustment data are as fol are as follows: supplies on hand, December 31, $1.000; insurance expired for December $900: depreciation on equipment for December, S1,500; salaries accrued, December 31, $1,000. (a) (b) Prepare a ten-column worksheet for Landscape Services for December, 2005. On the basis of the worksheet in (a), present the following in the proper format: (1) income statement, (2) retained earnings statement (no additional investments were made during the month), and (3) balance sheet. 4. After all adjustments have been made, but before the accounts have been closed, the following balances were taken from the ledger: Accounts payable $ 40,000 Insurance expense $8,600 Accounts receivable 54,500 Prepaid insurance 5,275 Accumulated Rent expense 21,400 depreciation 83,325 Retained earnings 50.950 Capital stock 50,000 Salaries expense 66,000 Cash 7.150 Salaries payable 150 Depreciation expense 23,500 Service revenue 151,000 Dividends Equipment 28,000 155,000 Supplies Supplies expense 2.500 3.500 Journalize the entries to close the appropriate accounts. 5. Using the perpetual inventory system, journalize the entries for the following selected transactions (a) (b) Sold merchandise on account, for $10,000. The cost of the merchandise sold was $4,500. Sold merchandise to customers who used MasterCard and VISA, $8,500. The cost of the merchandise sold was $4,100. Sold merchandise to customers who used American Express, $3,500. The cost of the merchandise sold was $1,600. Paid an invoice from First National Bank for $255, representing a service fee for processing MasterCard and VISA sales. Received $3,325 from American Express Company after a $175 collection fee had been deducted. (d) (e) 6. The bank statement for Allen Co. indicates a balance of $8,000.00 on June 30. After the journals for June had been posted, the cash account had a balance of $3,675.00. Prepare a bank reconciliation on the basis of the following reconciling items: (a) Cash sales of $342 had been erroneously recorded in the cash receipts journal as $324. (b) Deposits in transit not recorded by bank, $500. (e) Bank debit memorandum for service charges, $25. (d) Bank credit memorandum for note collected by bank, $2,850, including $50 interest. (e) Bank debit memorandum for $218 NSF (not sufficient funds) check from Alice Bell, a customer. (1) Checks outstanding. $2,200. 7. For a business that makes advance provision for uncollectible receivables: (a) Journalize the entries to record the following: (1) (2) Record the adjusting entry at December 31, the end of the fiscal year, to provide for doubtful accounts. The accounts receivable account has a balance of $800,000, and the contra asset account before adjustment has a debit balance of $600. Analysis of the receivables indicates doubtful accounts of $20,000. In March of the following fiscal year, the $550 owed by Flake Co. on account is written off as uncollectible. Eight months later, $200 of the Flake Co, account is reinstated and payment of that amount is received (3) (b) Based on the data in (a) (1) above, what is the net realizable value of the accounts receivable as reported on the balance sheet as of December 31? Assuming that the business had been following the direct write-off procedure in accounting for uncollectable receivables, journalize the entries to record the following: (1) (2) Recorded write-off of account of Flake Co. (a) (2) above). Reinstated account of Flake Co. for $200 and recorded payment of that amount received [(a) (3) above). 8. Wolfe Company issued a 60-day, 8% note for $15,000, dated April 5, to Lamb Company on account (a) Determine the due date of the note. (b) Determine the maturity value of the note. (c) Journalize the entries to record the following: 1. receipt of the note by the payee, and 2. receipt by the payee of the amount due on the note at maturity. Round answers to the nearest $1. 9. The beginning inventory and purchases of an item for the period were as follows: Beginning inventory First purchase Second purchase Third purchase 6 units at $73 each 10 units at $72 each 18 units at $74 each 10 units at $75 each The company uses the periodic system, and there were 15 units in the inventory at the end of the period Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (e) average cost. 10. Equipment purchased at the beginning of the fiscal year for $150,000 is expected to have a useful life of 5 years, or 15,000 operating hours, and a residual value of $30,000. Compute the depreciation for the first and second years of use by each of the following methods: (a) (b) (c) straight-line units-of-production (2,500 hours first year: 3.250 hours second year) declining-balance at twice the straight-line rate (Round the answer to the nearest dollar.) 11. The following information is for employee Robert Ellis for the week ended March 15. Total hours worked: 48 Rate: $15 per hour, with double time for all hours in excess of 40 Federal income tax withheld: $200 United Fund deduction: $50 Cumulative earnings prior to current week: $6,400 Tax rates: Social security: 6% on maximum earnings of $100.000. Medicare tax: 1.5% on all earnings, on both employer and employee State unemployment: 3.4% on maximum earnings of $7,000; on employer Federal unemployment: 0.8% on maximum earnings of $7,000; on employer (a) Determine (1) total earnings, (2) total deductions, and (3) cash paid. (b) Determine each of the employer's payroll taxes related to the earnings of Robert Ellis for the week ended March 15. 12. The summary of the payroll for the monthly pay period ending July 15 indicated the following: Sales salaries Federal income tax withheld Office salaries Medical insurance withheld Social security tax withheld Medicare tax withheld $125,000 32,300 30,000 7,370 10,200 2,550 Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $30,000 of salaries are subject to unemployment taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts