Question: please explain well how you derive to this Answer questions 13 and 14 based on the following information: A company manufactures and sells four products.

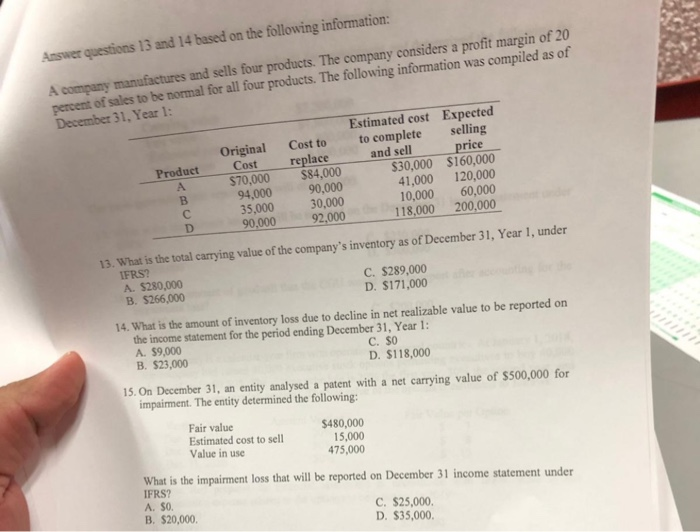

Answer questions 13 and 14 based on the following information: A company manufactures and sells four products. The company considers a profit margin of 20 percent of sales to be normal for all four products. The following information was compiled as of December 31, Year 1: Product Original Cost $70,000 94.000 35,000 90,000 Cost to replace $84,000 90.000 30,000 92,000 Estimated cost Expected to complete selling and sell price $30,000 $160,000 41,000 120,000 10,000 60,000 118.000 200.000 13. What is the total carrying value of the company's inventory as of December 31, Year 1, under IFRS? A. $280,000 C. $289,000 B. $266,000 D. $171,000 14. What is the amount of inventory loss due to decline in net realizable value to be reported on the income statement for the period ending December 31, Year 1: A $9,000 C. $0 B. $23,000 D. $118,000 15. On December 31, an entity analysed a patent with a net carrying value of $500,000 for impairment. The entity determined the following: Fair value $480,000 Estimated cost to sell 15,000 Value in use 475,000 What is the impairment loss that will be reported on December 31 income statement under IFRS? A. SO. C. $25,000 B. $20,000 D. $35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts