Question: please answer both questions, thank you!!! Calls A and B have an exercise price of $50. The current price of the underlying stock is $52

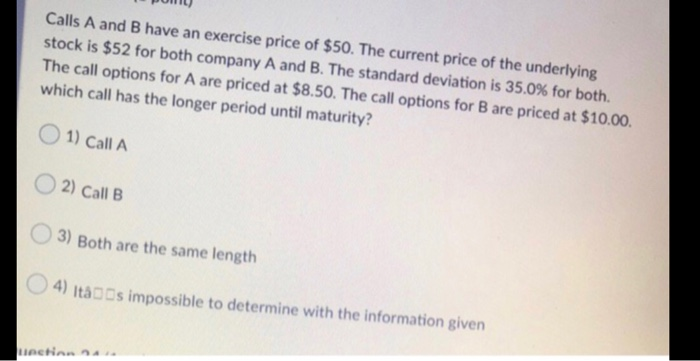

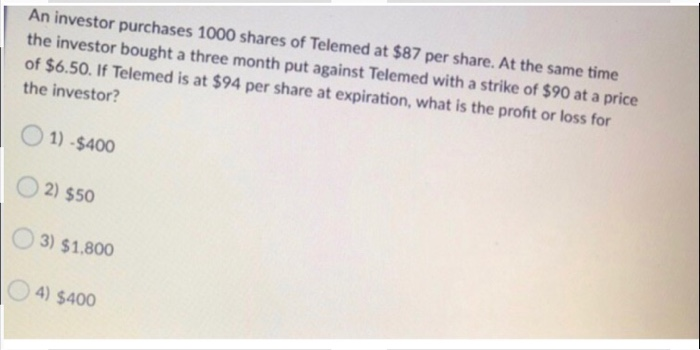

Calls A and B have an exercise price of $50. The current price of the underlying stock is $52 for both company A and B. The standard deviation is 35.0% for both. The call options for A are priced at $8.50. The call options for B are priced at $10.00. which call has the longer period until maturity? 1) Call A 2) Call B 3) Both are the same length 4) Itats impossible to determine with the information given An investor purchases 1000 shares of Telemed at $87 per share. At the same time the investor bought a three month put against Telemed with a strike of $90 at a price of $6.50. If Telemed is at $94 per share at expiration, what is the profit or loss for the investor? 1)-9400 2) $50 3) $1,800 14) $400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts