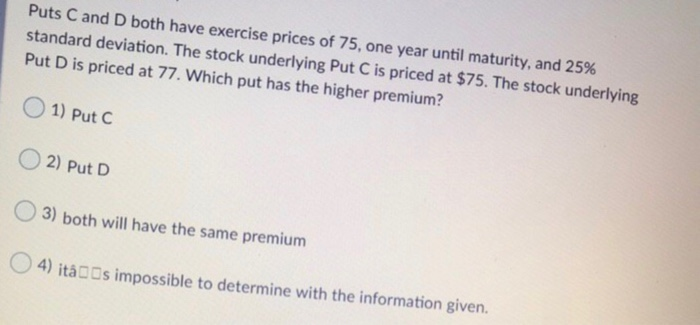

Question: please answer both questions , Thank you!!! Puts C and D both have exercise prices of 75, one year until maturity, and 25% standard deviation.

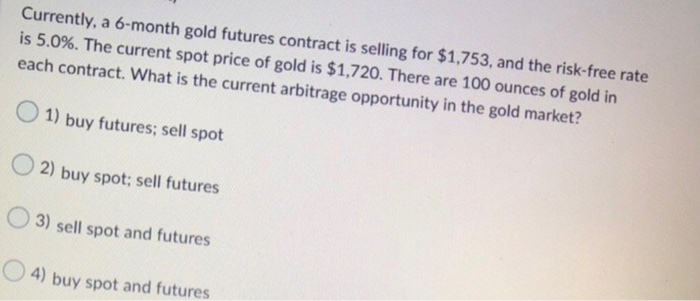

Puts C and D both have exercise prices of 75, one year until maturity, and 25% standard deviation. The stock underlying Put C is priced at $75. The stock underlying Put D is priced at 77. Which put has the higher premium? 1) Put 2) Put D 3) both will have the same premium 0 4) ita Os impossible to determine with the information given. Currently, a 6-month gold futures contract is selling for $1,753, and the risk-free rate is 5.0%. The current spot price of gold is $1,720. There are 100 ounces of gold in each contract. What is the current arbitrage opportunity in the gold market? 1) buy futures; sell spot 2) buy spot; sell futures 3) sell spot and futures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts