Question: please answer both questions, thanks! Question 3 1 pts Rainy Day needs an initial amount of Net Working Capital of $188,544 in time consisting of

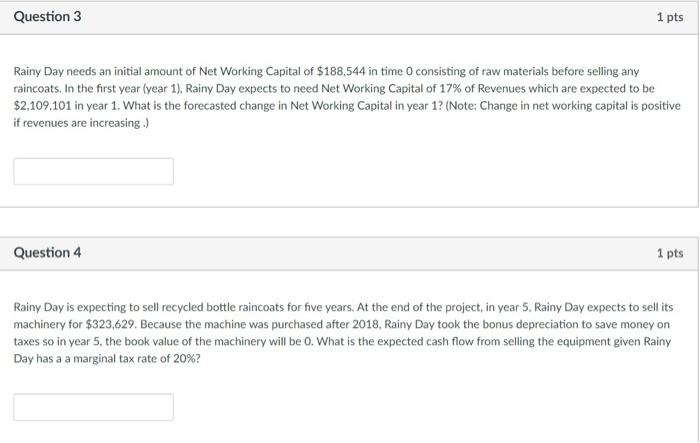

Question 3 1 pts Rainy Day needs an initial amount of Net Working Capital of $188,544 in time consisting of raw materials before selling any raincoats. In the first year (year 1), Rainy Day expects to need Net Working Capital of 17% of Revenues which are expected to be $2,109,101 in year 1. What is the forecasted change in Net Working Capital in year 12 (Note: Change in net working capital is positive if revenues are increasing.) Question 4 1 pts Rainy Day is expecting to sell recycled bottle raincoats for five years. At the end of the project, in year 5. Rainy Day expects to sell its machinery for $323,629. Because the machine was purchased after 2018, Rainy Day took the bonus depreciation to save money on taxes so in year 5, the book value of the machinery will be 0. What is the expected cash flow from selling the equipment given Rainy Day has a a marginal tax rate of 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts