Question: Please answer both questions!! Will give thumbs up Jaws Inc. currently sells 40,000 dental tools to its regular customers but it has a capacity to

Please answer both questions!! Will give thumbs up

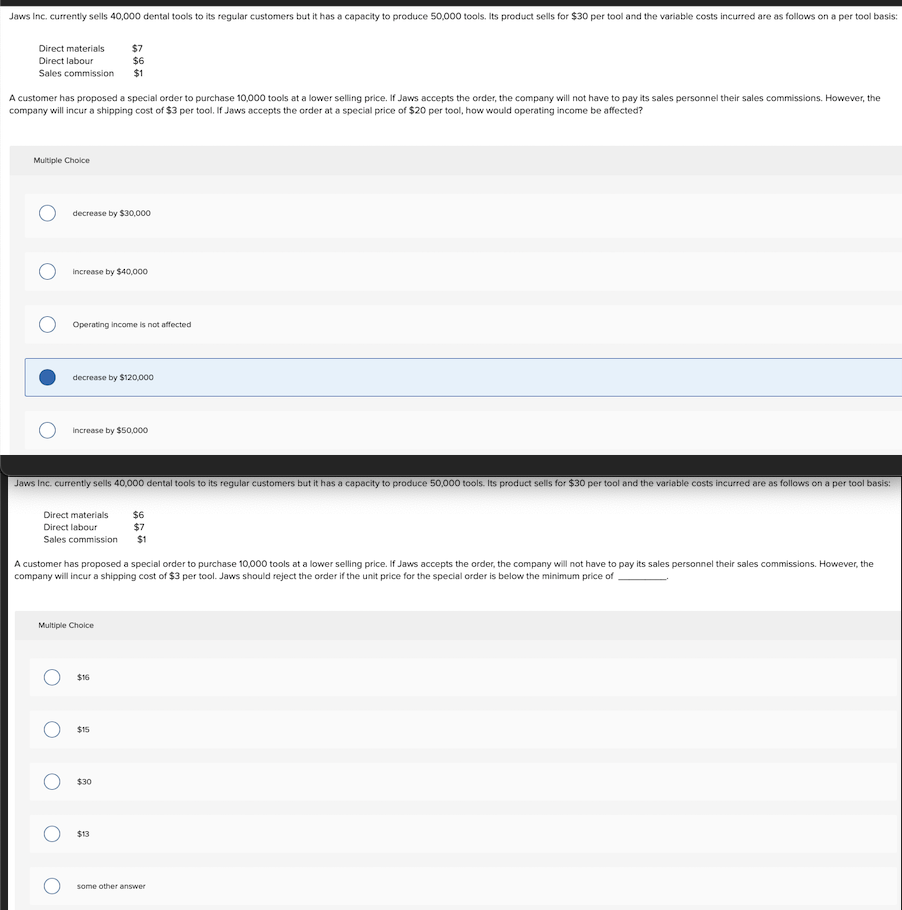

Jaws Inc. currently sells 40,000 dental tools to its regular customers but it has a capacity to produce 50,000 tools. Its product sells for $30 per tool and the variable costs incurred are as follows on a per tool basis: Direct materials $7 Direct labour $6 Sales commission $1 A customer has proposed a special order to purchase 10,000 tools at a lower selling price. If Jaws accepts the order, the company will not have to pay its sales personnel their sales commissions. However, the company will incur a shipping cost of $3 per tool. If Jaws accepts the order at a special price of $20 per tool, how would operating income be affected? Multiple Choice decrease by $30,000 increase by $40,000 Operating income is not affected decrease by $120,000 Increase by $50,000 Jaws Inc. Currently sells 40,000 dental tools to its regular customers but it has a capacity to produce 50,000 tools. Its product sells for $30 per tool and the variable costs incurred are as follows on a per tool basis: Direct materials $6 Direct labour $7 Sales commission $1 A customer has proposed a special order to purchase 10,000 tools at a lower selling price. If Jaws accepts the order, the company will not have to pay its sales personnel their sales commissions. However, the company will incur a shipping cost of $3 per tool. Jaws should reject the order if the unit price for the special order is below the minimum price of Multiple Choice O $16 O $15 O $30 0 $13 some other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts